There is little evidence on the impact of the pandemic on firms in Fragile, Conflict and Violence (FCV) affected situations. Getting information about firms operating in these environments is challenging even during normal times due to weaker institutions and a lack of political commitment, and the paucity of credible data on businesses in FCV environments limits evidence-backed response, especially during times such as the COVID-19 pandemic.

Unlike previous global shocks, the crisis has affected most countries simultaneously through multiple transmission channels, leaving policymakers with an acute lack of data. To fill this gap, the World Bank implemented the COVID-19 Business Pulse Surveys (BPS), partnering primarily with national statistical offices, alongside COVID-19 follow-ups of Enterprise Surveys. The first round of firm-level data collection took place during May-September 2020 in 51 countries, covering all regions and including 16 FCV countries. So far, 6 of the FCV countries have also completed a second round of data collection.

Findings from COVID-19 Business Pulse Surveys

Using the BPS data, we estimate the effects of COVID-19 on firms for FCV and non-FCV countries. By accounting for differences in the country context, severity of the pandemic, lockdown conditions, timing of the survey and sector-specific idiosyncrasies, we document four key findings:

1. The pandemic has more protracted and persistent effects in FCV countries. Firms are recovering from the COVID-19 crisis, but they remain far from the pre-pandemic level. We may be experiencing a U-shaped recovery, which is slower in FCV countries. For example, immediately after the pandemic shock, sales in non-FCV locations fell by 39% compared with 47% in FCV countries. In the latest round of the BPS data sales still remain 36% below their 2019 pre-pandemic levels in FCV countries compared with 27% in non-FCV countries (Figure 1). Overall, the recovery of firms in the group of FCV countries is much more sluggish than in other countries.

2. Firms in non-FCV countries adjust largely by reducing hours worked, wages and salaries, but are less likely to lay off workers. By comparison, firms in FCV countries more often resort to layoffs in response to the pandemic. At the onset of the crisis, firms in FCV countries had an average of five weeks of cash to cover operating expenses compared with 11 weeks for an average firm in a non-FCV country. The extent of business uncertainty measured with BPS data is also higher in FCV countries. In response, firms in FCV countries are adjusting by shedding jobs. This also means that some of the intangible firm-worker relationships may have been lost in FCV countries and these will be hard to rebuild post pandemic.

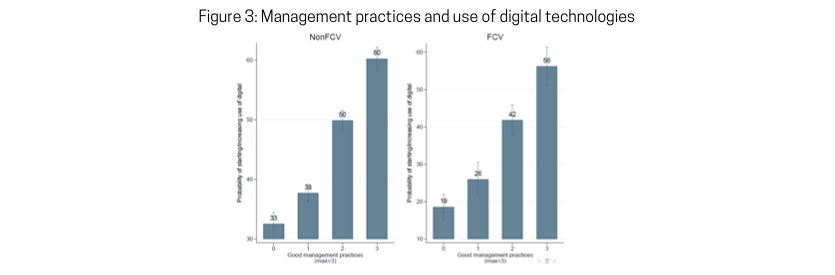

3. Firms in FCV countries are narrowing the digital adoption gap with non-FCV countries. The likelihood of starting or increasing the use of digital platforms in FCV countries grew from 16% to 39% between the first and latest round of BPS (Figure 2a). Although the FCV countries start from a very low level of usage, this improvement is impressive. However, when it comes to making new investments in digital solutions, firms in FCV countries severely lag behind. This may point to a lack of access to credit or firms’ assessment of their needs to upgrade capabilities. Notably, firms with structured management practices in FCV countries are also comparably likely to adopt digital solutions and invest in digitalization as much as their counterparts in non-FCV locations (Figure 3).

4. The probability of receiving public support for firms in FCV countries remains low at 22%. This likelihood has barely increased since the initial phase of the crisis. By comparison, for firms in non-FCV locations, the probability of accessing public support increased from 31% to 41% as the pandemic evolved (Figure 4). Public support to firms has the potential to address gaps in management practices, access to credit and to upgrade other capabilities.

Policy lessons from Business Pulse Surveys

The first and foremost lesson is that the BPS initiative was successful in collecting meaningful data in fragile contexts within a short time span. An initiative such as the BPS may be particularly appropriate for FCV countries due to ease of data collection (phone surveys vis-à-vis face to face) with a relatively quick turnaround time (an average of 15-20 minutes) and comes at a much lower cost (ranging from $10-$40 per survey). Thus, data gaps that are binding in normal circumstances can be overcome with such efforts, to inform evidence backed interventions.

Second, based on the analysis of BPS data comparing FCV with non-FCV countries and other research using the global BPS data, we recommend that public support to firms should facilitate three Cs:

1. Capabilities of firms such as management practices and technological readiness. This matters for firms’ response to the crisis, especially as the analysis from BPS data shows that management practices are equally important in FCV as in non-FCV countries.

2. Capital or access to credit to invest in digitization or upgrading. This is important for firms to cope with the crisis and recover from it, given that FCVs lag in digital investments.

3. Connections with other firms. Recent work using BPS data on globally engaged firms suggests that firms with such a network recover faster.

Tailoring these recommendations further will require an in-depth understanding of each FCV context. Notably, firms in fragile contexts face multiple constraints. To this end, support should alleviate multiple constraints, for instance by using a funneling approach to filter out the most promising firms. Moreover, given the low institutional capacity in FCV situations, support should be simple. Some examples include encouraging the adoption of basic management practices – such as keeping track of performance and targets or modernizing record-keeping – or the use of digital platforms for sales, using social media for marketing and so on. In sum, support firms in FCV situations require that the modality of support, the kind of activities backed, and the type of firms targeted be tailored as per the context of fragility.

Join the Conversation