The funding needs of developing countries are immense. By one estimate, they need $4 trillion annually to meet the Sustainable Development Goals, a figure significantly exceeding the financial resources available to governments or development finance institutions.

This situation hinders job creation and economic growth in developing countries.

The global insurance industry is expected to expand its revenue by as much as $9.8 trillion by 2027; however, emerging markets currently account for less than a quarter of the market size. The gap presents an opportunity for insurance companies, as they target high quality long-term development finance assets in emerging markets.

But what can insurance companies do to expand their businesses in these markets? Moreover, how can multilateral development banks (MDBs) facilitate the connection between insurance companies’ credit capacity and development impact, with a return on investment?

First, there are hurdles to overcome. An array of factors contributes to insurers’ low exposure in developing countries, including high risk, tenor mismatch, limited market depth, regulatory constraints, and a lack of access to viable investment opportunities.

But the low exposure, coupled with higher expected growth relative to developed markets, presents substantial business opportunities. Many insurers are seeking to rebalance their businesses and diversify portfolios from traditional product offerings—such as life, health, auto and property insurance—to more bank-like products that promise a return on the principal.

In recent years, insuring loans originated by MDBs has emerged as a new asset class for many credit insurers. It can increase insurers’ operations in emerging markets while offering a high-yield, market-based return on their capital that isn't correlated with their traditional lines of business.

What will it take to boost insurance lending in developing countries?

Insurance companies can insure a portion of MDB loans in emerging markets, thereby enabling the banks to lend larger amounts.

Insurers can leverage their underwriting skills of selling credit insurance to financial institutions by extending it to cover lending by MDBs to projects with a development impact. Private credit’s defensive qualities form a sound basis to add this asset class to insurance portfolios. In the event of payment default, the insurer compensates the holder of credit insurance with a pro rata coverage payout, thereby freeing up billions of dollars to bolster the lending capacity of MDBs.

At IFC, we created the Managed Co-Lending Portfolio Program for Financial Institutions (MCPP FIG), a unique financing solution connecting insurers to development finance assets. This program enables insurers to expand insurance coverage to development assets in new markets and deliver positive social, economic, and environmental impact.

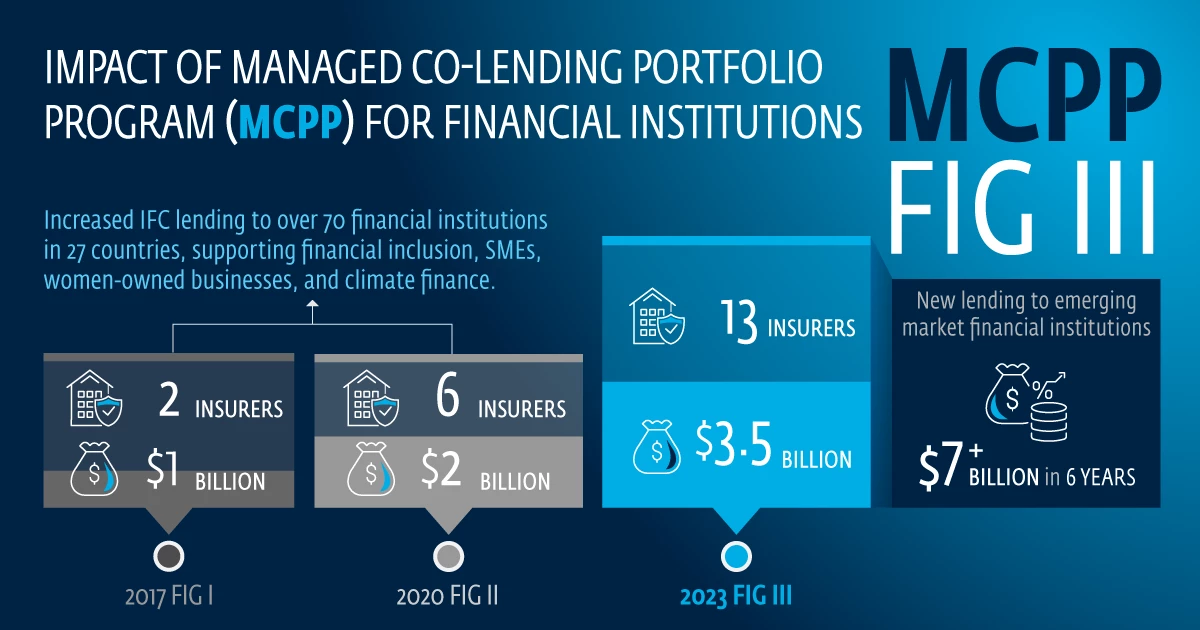

In September 2023, IFC mobilized $3.5 billion of credit insurance capacity from 13 global insurance companies through this facility—unlocking more than $7 billion of IFC’s own lending to financial institutions over the next six years.

The facility builds on two earlier programs launched in 2017 and 2020. These programs enabled IFC’s increased lending to over 70 financial institutions, both banks and nonbank, supporting financial inclusion, small and medium-sized enterprises, women-owned businesses, and climate finance in 27 countries, with 24 projects focused on some of the world’s poorest and most fragile countries.

Building strong partnerships between insurers and development financiers

Underwriting development lending in tough markets requires building strong partnerships between insurers and MDBs. These partnerships multiply the development impact, diversify insurers product offerings, unlock greater private sector investment, and enable MDBs to increase their lending to projects in challenging markets by sharing the risk with other participants.

For insurers, the incentive is not only to make a return on investment but also to underwrite private credit that enables development. Through facilities such as MCPP FIG, leading global insurers can access IFC’s diversified pipeline of emerging market assets, including projects aligned with the Paris Climate Accords, and deliver on their own commitments to sustainability.

By boosting lending operations in emerging markets, insurers expand their credit insurance businesses, while helping to improve people’s lives on a more sustainable, resilient, and livable planet.

To learn more about IFC’s MCPP, please visit our website.

Join the Conversation