Kyzyl-Korgon village Alay region Kyrgyz Republic

Kyzyl-Korgon village Alay region Kyrgyz Republic

Globally, countries are accelerating efforts to save the planet. The World Bank’s mission statement, “End extreme poverty and boost shared prosperity” now has the words “on a livable planet” added on. Starting July 1, 2023, all of the World Bank’s operations have aligned with the Paris Agreement. Other multilateral development banks (MDBs) have done the same, with MDB financing increasingly supporting the urgent transition to a low-carbon, climate-resilient future.

This in turn impacts the financial sectors in developing countries. For the Kyrgyz Republic, it means that—to attract external financing including concessional financing from MDBs—its financial sector must be aligned with the reduction targets the country submitted in 2021 to the Paris Agreement. For this, the country’s banks and central bank (National Bank of Kyrgyz Republic) should be aware of the targets and actively manage the transition while dealing with the physical risks stemming from climate change.

Indeed, climate adaptation to build resilience to climate change is contingent on availability of sufficient financing, both from domestic and external sources. While the Kyrgyz Republic’s current contribution to greenhouse gases emissions is low, compared to other countries, it does not mean that the problem is non-existent. Factors such as the use of coal for heating in winter, for example, make Bishkek one of the worst cities in terms of air quality.

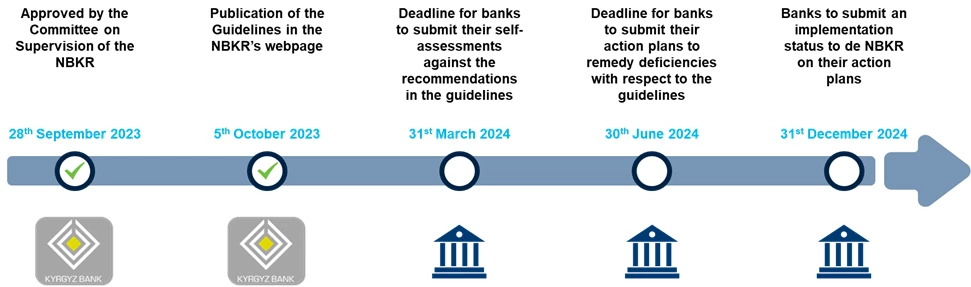

The National Bank of Kyrgyz Republic, in October, 2023, issued Environmental, Social, and Governance (ESG) Guidelines for the banking sector to adequately manage the risks from the transition process. The Guidelines specify minimum standards that banks should meet for the sound management of ESG risks within the current prudential framework and recommends how banks can integrate ESG into their business planning and environment, organizational structures, internal governance, and risk-management frameworks.

Key contents of the guidelines

The Guidelines are based on international best practices—they follow the Basel Committee on Banking Supervision’s Principles for the effective management and supervision of climate-related financial risks but have also considered standards issued by other central banks. They contain mechanisms for quick and effective compliance, requiring banks to perform self-assessments by March 2024 and prepare action plans by June 2024. At the same time, it is crucial that NBKR continues to build capacity, including training and developing tools so that the central bank’s staff can effectively challenge banks’ compliance.

Even as the Guidelines seek to upgrade banks’ ESG governance and risk-management practices, they can catalyze the development of a sustainable lending market. For this, banks will need to redesign their credit-risk practices to obtain data on the carbon intensities resulting from the activities of their large corporate clients and develop new green loans to facilitate client transitions towards less carbon-intensive activities. The integration of sustainability into the credit-risk practices of the banking sector is particularly important, as most of the financial intermediation in the Kyrgyz Republic flows through the banking sector.

Other initiatives are also underway in the Kyrgyz Republic to create an enabling environment for sustainable finance. The Kyrgyz Stock Exchange (KSE) has already joined the Sustainable Stock Exchange Initiative in 2021 and issued Sustainable Reporting Guidelines applicable to listed companies. Financial institutions are building up capacity in ESG. The Union of Banks, as a member of the Sustainable Finance and Banking Network (SBFN), has developed knowledge-sharing and capacity-building programs for member banks on ESG risks assessment, sustainable finance, disclosure and reporting with international partners and donors. Meanwhile, two ESG bonds were issued under the KSE Sustainable Development Sector initiative—the Bank of Asia issued a social bond in 2022 and Dos-Credobank issued a green bond in 2023.

As more initiatives are launched, policy coordination among relevant government agencies and financial sector regulatory authorities will become important. This is a good time to coordinate and intensify the banking sector’s path to climate and sustainable finance to keep up with a rapidly changing global financing landscape that is moving towards a sustainable future.

Join the Conversation