Image courtesy of UPU

In October 2012, when the first version of the Global Panorama was published, several news agencies and papers wrote: “UN urges increase in role of financial services across global postal sector” or “Posts must exploit untapped potential for financial inclusion”. The surprise was not in the titles but in the interest generated by reports on the postal sector. The intersection between two things which the general public does not automatically associate: the Post and financial services, especially for the poor, seemed to spark interest.

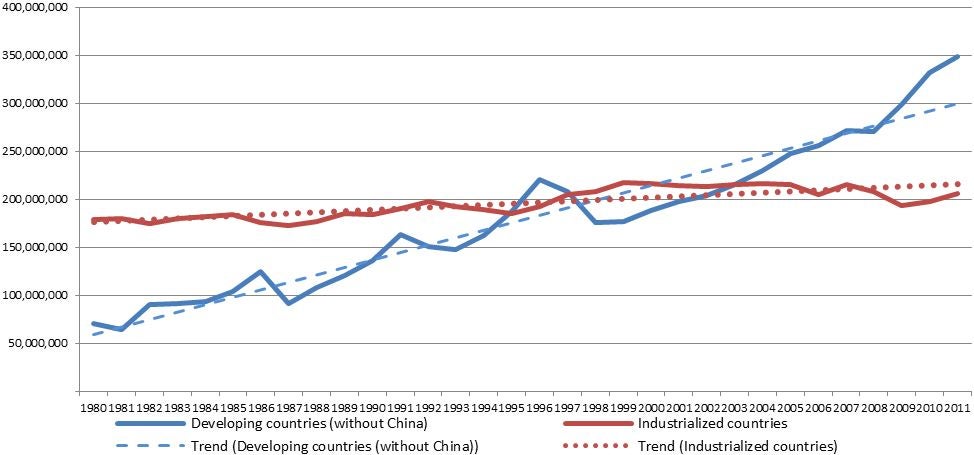

In reality, what many people ignore is that for more than a century now, the postal sector has been a key player in offering services to the unbanked all around the world. Some observers would like to think that the Post belongs to a bygone era and has lost its raison d’être in a digital world. However, if we look at trends, in the developing world, excluding China, savings and current accounts in the postal sector have shown very strong growth over the last 10 years, and even exponential growth were we to include China. This seems to demonstrate the exact opposite: the postal sector is alive and postal financial inclusion is enjoying a boom phase. After banks, postal operators and their postal financial subsidiaries are the second biggest worldwide contributor to financial inclusion, far ahead of microfinance institutions, money-transfer organizations, cooperatives, insurance companies, mobile money operators and other financial services providers. In 2010, 51 postal operators held 1.6 billion savings and deposit accounts for a billion people and more than 1.5 billion customers accessed basic transactional services through the Post.

Figure 1 : Postal savings accounts worldwide

The information gap

Unfortunately, there is a crucial information gap in today’s financial inclusion space due to the lack of recognition of this sector. This is not a recent feature; indeed, back in 2004, the World Bank identified this awareness issue and mentioned in its publication on reforming the postal sector in developing countries that “Post offices play a significant and, often, unrecognized role in access to basic financial services (payments, remittances, savings, giro)”. In an era where financial inclusion has become a major policy goal for the G20 and developing countries alike, it is critical for decision makers and practitioners to have a proper vision of this sector. This is exactly what the newly released Global Panorama on Postal Financial Inclusion tries to address. Here are some of its key findings.

Defining Postal financial inclusion

Postal financial inclusion is the process whereby people excluded from the formal financial sector find a way into the financial system, using the postal network as a gateway.

Business models

Postal financial services have become a multifaceted concept reflecting different realities around the world. One of the objectives of the UPU Global Panorama was to analyze that diversity and build a typology to facilitate our understanding of the postal financial inclusion reality and enable us to take advantage of its potential.

There are six main business models (BMs) used by postal operators to participate in financial inclusion:

BM 1 – Cash merchant for government and financial services providers (present in 83% of countries);

BM 2 – Proprietary electronic remittances and transactional financial services (present in 63% of countries);

BM 3 – Partnership with a financial service provider (present in 24% of countries);

BM 4 – Unlicensed postal financial services, including account-based services (present in 24% of countries); and

BM 5 – Licensed postal financial services (present in 9% of countries).

An additional business model, which is referred to as BM 0, given the total lack of involvement of the Post, is when the postal operator rents space to a financial service provider to sell its services.

Countries can adopt one or more business models. A table has been prepared at the end of the report to present the global panorama of business models of Posts for 139 countries around the world. For each country, the table shows the business models used.

Key success factors

There are 10 common factors that have been proven to lead to success, but which can become challenges for Posts, particularly in developing countries. The factors to be considered when analyzing a postal operator’s degree of preparedness to become a spearhead of financial inclusion are: i) network; ii) staff; iii) financial capacity; iv) trust; v) automation and process integration; vi) willingness to foster financial inclusion; vii) governance between the Post and postal financial services; viii) legal and regulatory framework; ix) marketing; and x) flexibility. Each of these factors is developed in detail in the report and a success factor ranking has been created on this basis.

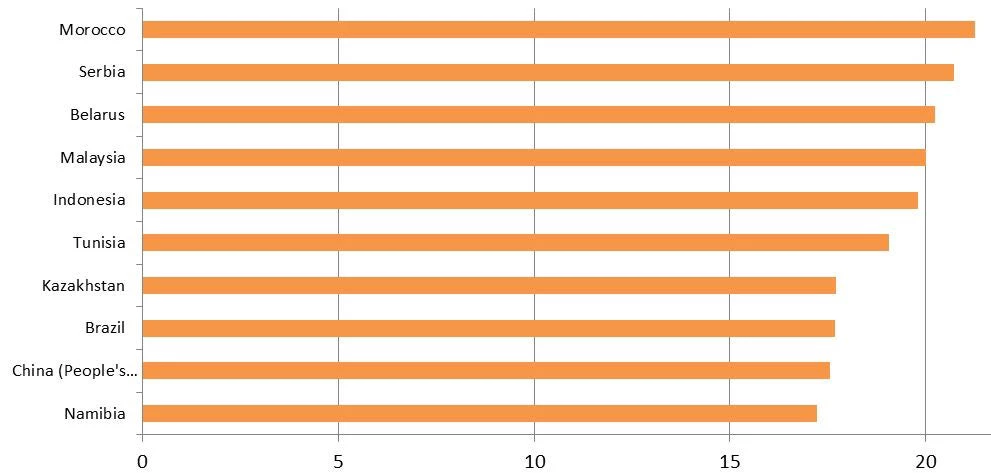

Figure 2: Top 10 developing countries in the global ranking of postal financial inclusion potential

Challenges

Despite its many positive features, it is important to be objective and acknowledge that everything is not rosy in the postal sector. Many years of under-investment have amounted to huge operational challenges which need to be addressed. First, the infrastructure is in a dire state in many developing countries. The Post may have a huge network, but it lacks maintenance and is not sufficiently connected. The second challenge lies within the staff – the unqualified ageing personnel with little customer service culture that can be found in some postal operators can be a major obstacle to the development of postal financial inclusion. Third, cash logistics and liquidity issues in post offices can make building a partnership with a Post a complicated story. Finally, governance issues between the Post and the postal financial services entity can sour even some of the best practices.

Solutions

There is no silver bullet in the realm of postal financial inclusion. Each country has to decide how to best use its postal network for financial inclusion. However, there are some guiding models and principles which countries can follow to take advantage of the postal infrastructure that already exists. These can be found in the Global Panorama. Resources are scarce, so if we want to be effective, we need to build on existing blocks.

Conclusions

Due to negative perceptions and a lack of awareness, Posts are often neglected in national and international financial inclusion strategies. However, at the global policy level, neglecting a key player can be a major obstacle to achieving results, since it may lead to resources being misallocated to certain market players, which could actually be put to better use in the postal sector. Posts and postal financial services are not a distorted competition to banks and other commercial microfinance institutions, but the government’s answer to a market failure which results in lack of access to financial services by poor, less educated and rural populations. As the World Bank’s Global Findex has recently shown, these segments remain mostly unbanked in the developing world. The policy recommendation is not necessarily for Posts to offer the service directly. In many cases, the optimal solution is for Posts to be allies with the banks and other financial service providers, to which they can offer their vast network. From a customer perspective, a future publication crossing UPU data and models with the Global Findex will give a better picture of how to tackle the financial inclusion challenge facing Posts.

It seems fair to end with a quote from H.R.H. Princess Máxima of the Netherlands, the United Nations Secretary-General’s Special Advocate for Inclusive Finance for Development, who wrote the foreword to the Global Panorama.

“In all these efforts, it is equally valuable to consider what has worked and also what has not worked, how successes can be taken to scale sustainably, and how experiences can be adapted to different local contexts. To this end, this Panorama and the related work of the Universal Postal Union is so valuable to help advance the financial inclusion agenda. […] I hope this publication will serve as the basis for many conversations on business models, partnership approaches, diverse financial products, and appropriate regulation for inclusive financial services provided by post offices and other institutions. And I hope that the Panorama will spark even more and continued efforts to share lessons learned and best practices to bring financial services to anyone who needs them and for the benefit of many.”

Alexandre can be reached at alexandre.BERTHAUD@upu.int.

Join the Conversation