When the tuxedo-clad and mustached attendants of the First International Thrift Congress in Milan in 1924 declared October 31st World Thrift Day, they associated savings with hand-written numbers in savings books, duly signed by clerks who would receive bank notes from customers over the wooden counter. If these gentlemen were to take a trip 95 years into the future, they would be surprised to see not only that a rapidly rising share of financial transactions are made on little electric handheld machines, but also that savings are increasingly channeled through institutions that are not banks.

The financial services industry is rife for disruption. Estimates of the per-unit cost of financial intermediation by Thomas Philippon show that the overall efficiency of the industry has not improved much in a century. Relative average wages in finance have risen fast since the 1980s, but the financial services industry still only reaches and benefits a relatively wealthy and urban share of the global population due to a combination of market failures and high transaction costs. According to the latest Findex survey, even though 1.2bn adults have obtained access to a bank account since 2011, 1.7bn continue to be unbanked in 2017, virtually all of them living in the developing world. Philippon summarizes the situation candidly: “If one steps back, it is difficult not to see finance as an industry with excessive rents and poor overall efficiency.”

Technological innovation in general and digital transformation in particular promise to improve this situation. New research by the World Bank "Financial Inclusion Beyond Payments: Policy Considerations for Digital Savings" finds that digital savings products are on the rise in Asia and Africa. New firms compete or partner with existing banks to offer low-cost access to savings accounts, slashing minimum requirements and maintenance fees, and making deposits and withdrawals easier for underserved populations, especially lower income and rural households. They often rely on agent networks rather than bank branches, and they customize digital savings products to mimic traditional forms of savings, such as rural savings groups.

Figure 1: Three common digital savings account delivery models

Importantly, many innovators in digital savings are not banks. In Nepal for example, eSewa and HelloPaisa operate as tech platforms that link customers to multiple banks, introducing a healthy dose of innovation and competition among the incumbents. In Kenya, M-Shwari offers deposit accounts through the M-Pesa mobile payment network. And in India, mobile network operator Airtel is among a dozen firms that offer digital savings accounts, along with other financial services. Yet, many newcomers ultimately link to traditional savings accounts at banking institutions .

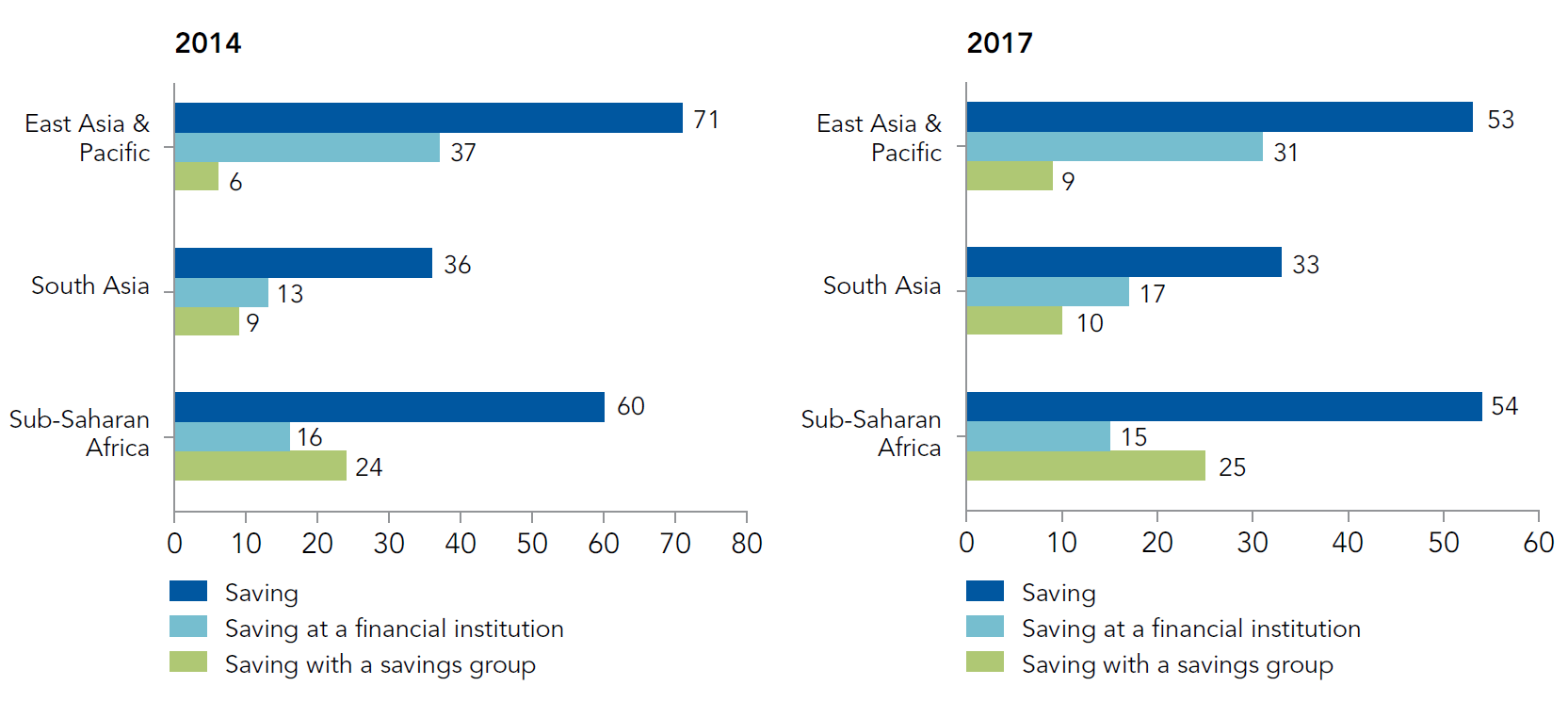

This is good news for the millions of adults across the developing world who accumulate savings every year but don’t deposit their cash in formal institutions. According to the report, 54% of households in Sub-Saharan Africa report savings, but only 15% choose to save at a financial institution. In East Asia, the numbers are 53% and 31%, respectively. The perception that savings are too low to merit opening an account, high maintenance costs and physical distance are the chief reasons why households don’t deposit their savings in a financial institution, according to Global Findex. Others are concerned with the safety of their deposits. This highlights the importance of regulatory certainty and customer funds protection, no matter whether their bank of choice is digital or not.

Figure 2: Savings patterns across focus regions (% age 15+) (excluding high-income countries)

The Payment Aspects of Financial Inclusion (PAFI) framework, developed by the Committee for Payments and Market Infrastructures (CPMI) and the World Bank Group in 2016, thus emphasizes access to an account with which individuals can make transactions and safely store value. The PAFI Framework also forms the foundation of the World Bank Group’s Universal Financial Access by 2020 (UFA 2020) initiative.

Back in 1924, the members of the International Thrift Congress stated that savings is “a virtue and a practice which are essential to the civil progress of each individual, of every nation, and of the whole of humanity!” Thanks to digital disruption, innovation by non-banks, and the ongoing expansion of financial services to lower-income and rural savers around the world, the financial services industry may finally be able to help households around the world turn that aspiration into reality.

Related:

Universal Financial Access by 2020

World Bank Financial Inclusion

Financial Inclusion Support Framework (FISF)

Payment Aspects of Financial Inclusion (PAFI)

Join the Conversation