Despite hard times at home, emerging market multinationals (EMMs) continue their impressive rise in the global marketplace. In 2014, outward foreign direct investment (FDI) by developing and emerging economies increased by 23 percent, reaching a record level of $468 billion or 35 percent of global FDI flows (

UNCTAD, 2015). In little more than a decade, emerging market firms like India’s Tata Group, South Africa’s SABMiller, and China’s Haier, have established operations around the world, becoming global leaders in their respective products.

Yet, the fast and far-reaching geographic spread of these global giants is not the norm among this particular brand of multinationals. Our recent book “ New Voices in Investment” where we surveyed over 700 firms from four emerging economies – Brazil, India, Korea, and South Africa—shows that, in fact, a large majority of EMMs look primarily within their regions when deciding where to invest. Although 40 percent of respondents claimed that market size and business opportunities were the main factors influencing their location decisions, their revealed preference seems to be for closer destinations.

How does geography affect the investment decisions of emerging market multinationals? To what extent is distance –not only physical, but also cultural and social, a barrier to investment that can offset the attractiveness of a larger market? To test this empirically, we used a modified version of a gravity model, estimating the importance of distance as well as of various country and firm level factors on the investment decisions of EMMs. [1]

Our findings confirm that firms face a trade-off between market size attractiveness, and the transaction costs associated with entry into distant and culturally dissimilar markets. Income per capita and population levels of the host country, capturing the “size” attractiveness of markets, emerge as significant determinants both of the probability of investing in a particular destination, and of the number of investments there. Physical distance between two markets, in turn, reduces the probability of investments. Similarly, other factors capturing physical and cultural distance between two countries, such as contiguity, a common language, and colonial history, are, jointly, significant determinants both of the probability of investing, and of the number of investments in a given market. This suggests that geographical or culturally related transaction and information costs matter in investment decisions.

How can countries reduce transaction and informational costs associated with physical and cultural distance so as to attract more FDI from EMMs? First of all, through investment promotion services aimed at reducing informational barriers for prospective investors.

But, in addition, our analysis reveals there are other policies that governments can implement to mitigate the costs of physical and cultural distance. In particular, our results show that the existence of bilateral investment treaties (BITs) between two countries increases the likelihood of investment in a significant manner. This is consistent with the literature. BITs generally contain commitments to protect investors of one country in the territory of the host country. These protections are accompanied by a powerful international arbitration mechanism that allows investors to bring claims directly against the host state.

More interestingly, our results show that bilateral investment treaties reduce the cost of distance for investors. By providing clear and stable rules, BITs reduce to some extent the costs of investing in markets that are rather unfamiliar for investors.

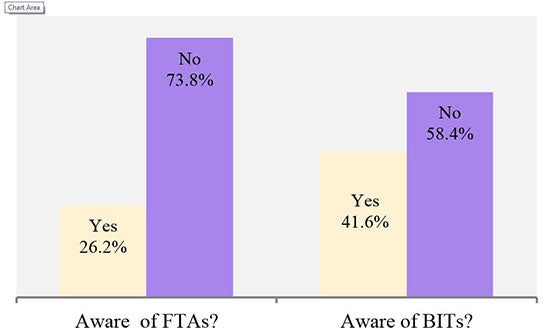

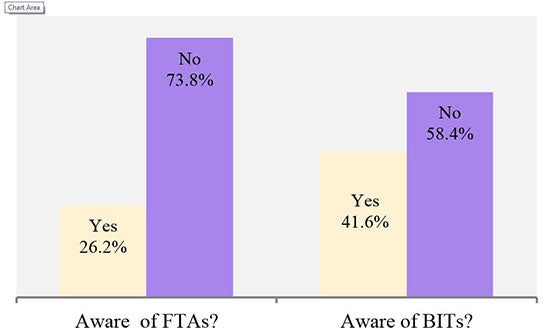

As important as it is to ratify and enforce these treaties, it is also crucial to effectively communicate their reach. Information dissemination about these treaties is key. Not just about investment and market opportunities but also about the BITs and other international agreements. Evidence suggests that firms tend to be largely unaware of the agreements that potential and actual host markets sign (Figure 1). Policymakers should take these elements into account when designing investment promotion strategies.

Figure 1. Are you aware of any FTAs or BITs to which your host country is signatory?

Source: Data from the Potential Investors Survey

Yet, the fast and far-reaching geographic spread of these global giants is not the norm among this particular brand of multinationals. Our recent book “ New Voices in Investment” where we surveyed over 700 firms from four emerging economies – Brazil, India, Korea, and South Africa—shows that, in fact, a large majority of EMMs look primarily within their regions when deciding where to invest. Although 40 percent of respondents claimed that market size and business opportunities were the main factors influencing their location decisions, their revealed preference seems to be for closer destinations.

How does geography affect the investment decisions of emerging market multinationals? To what extent is distance –not only physical, but also cultural and social, a barrier to investment that can offset the attractiveness of a larger market? To test this empirically, we used a modified version of a gravity model, estimating the importance of distance as well as of various country and firm level factors on the investment decisions of EMMs. [1]

Our findings confirm that firms face a trade-off between market size attractiveness, and the transaction costs associated with entry into distant and culturally dissimilar markets. Income per capita and population levels of the host country, capturing the “size” attractiveness of markets, emerge as significant determinants both of the probability of investing in a particular destination, and of the number of investments there. Physical distance between two markets, in turn, reduces the probability of investments. Similarly, other factors capturing physical and cultural distance between two countries, such as contiguity, a common language, and colonial history, are, jointly, significant determinants both of the probability of investing, and of the number of investments in a given market. This suggests that geographical or culturally related transaction and information costs matter in investment decisions.

How can countries reduce transaction and informational costs associated with physical and cultural distance so as to attract more FDI from EMMs? First of all, through investment promotion services aimed at reducing informational barriers for prospective investors.

But, in addition, our analysis reveals there are other policies that governments can implement to mitigate the costs of physical and cultural distance. In particular, our results show that the existence of bilateral investment treaties (BITs) between two countries increases the likelihood of investment in a significant manner. This is consistent with the literature. BITs generally contain commitments to protect investors of one country in the territory of the host country. These protections are accompanied by a powerful international arbitration mechanism that allows investors to bring claims directly against the host state.

More interestingly, our results show that bilateral investment treaties reduce the cost of distance for investors. By providing clear and stable rules, BITs reduce to some extent the costs of investing in markets that are rather unfamiliar for investors.

As important as it is to ratify and enforce these treaties, it is also crucial to effectively communicate their reach. Information dissemination about these treaties is key. Not just about investment and market opportunities but also about the BITs and other international agreements. Evidence suggests that firms tend to be largely unaware of the agreements that potential and actual host markets sign (Figure 1). Policymakers should take these elements into account when designing investment promotion strategies.

Figure 1. Are you aware of any FTAs or BITs to which your host country is signatory?

Source: Data from the Potential Investors Survey

[1] We estimated count models in which the unit of observation is the triplet “country of origin ‘i’ – country of destination ‘j’ – sector ‘s’”, and the dependent variable is the number of investors from country i in country j and in sector ‘s.’[1] Specifically, we used a two-step hurdle model: first, a logit to estimate the likelihood that the count is positive, and second, a zero-truncated negative binomial to determine the drivers of the positive count of investments. Both models are assumed to follow the same specification.

Join the Conversation