Policymakers often associate competitiveness with real exchange rates. Not too long ago, firms in Southern European countries attributed their difficulties to compete in global markets with a strong Euro. Worldwide, a lot has been discussed on the implications of an undervalued yuan on the chances of competing with Chinese firms. Also a few years back, Brazil’s finance minister argued that an ‘international currency war’ had broken out, as governments around the globe competed to lower their exchange rates to boost competitiveness. In practice,

how much can real exchange rates affect exports and competitiveness?

For example, when the Chinese yuan depreciates against the dollar, newspaper headlines warn about increased challenges to competing with Chinese products. In principle this makes sense. A depreciation of the yuan means, all else equal, that goods produced in China become cheaper relative to American ones, when expressed in the same currency, leading to an expenditure switching from American to Chinese goods.

In practice, are real depreciations effective in boosting export growth, and if so, does their effectiveness decline with global value chains (GVCs) participation? The World Bank Group recently unveiled new firm level evidence on the link between real exchange rates and export performance in a recent paper focusing on Poland that suggests the answer to both questions may be “yes…but with nuances.”

A bit of background…

Competitively valued exchange rates are crucial to promote exports, say Freund and Pierola (2012). Export surges are associated with large real depreciations. The effect is larger in developing countries – where market failures preventing reallocation into tradables are more pervasive, and it operates mostly through the extensive margin: more entry into new markets or products.

More recently, a decline in the effect of real exchange rates on export performance has been documented. This has been linked with the emergence of GVCs through three mechanisms:

The case of Polish firms is relevant because (i) Poland’s productive transformation over the last 20 years has been grounded on integration into the global marketplace, with accession to the EU single market playing a crucial role, and (ii) because that integration was on the back of active participation in German-led production networks, thus increasing the cross-border production linkages of Polish firms.

Our research resulted in several key findings:

What do we learn from these results?

Methodologically, in a world in which trade is driven by GVCs, we need to rely on estimates of real exchange rate effects on exports that take into account the portion of foreign value embedded in domestic production. In addition, we need to understand that different determinants of export performance operate through different channels: some may induce new firms to enter, some may increase shipments among existing exporters.

From a policy perspective, the competitiveness agenda is very much linked with encouraging firms’ productivity growth. Productivity remains the main driver of export growth among existing exporters. Yet, competitively valued currencies still matter for entry into exporting, and may have smaller beggar-the-neighbor effects. This is because, in a world of GVCs, a depreciation that makes a firm more competitive in global markets will also increase demand for foreign value added upstream.

Last but not least, the deepening of financial markets so that competitively priced hedging instruments are available for firms, in particular to SMEs is important to facilitate the internationalization of small firms.

Related Reading:

For more background on this topic, please see the following sources:

For example, when the Chinese yuan depreciates against the dollar, newspaper headlines warn about increased challenges to competing with Chinese products. In principle this makes sense. A depreciation of the yuan means, all else equal, that goods produced in China become cheaper relative to American ones, when expressed in the same currency, leading to an expenditure switching from American to Chinese goods.

In practice, are real depreciations effective in boosting export growth, and if so, does their effectiveness decline with global value chains (GVCs) participation? The World Bank Group recently unveiled new firm level evidence on the link between real exchange rates and export performance in a recent paper focusing on Poland that suggests the answer to both questions may be “yes…but with nuances.”

A bit of background…

Competitively valued exchange rates are crucial to promote exports, say Freund and Pierola (2012). Export surges are associated with large real depreciations. The effect is larger in developing countries – where market failures preventing reallocation into tradables are more pervasive, and it operates mostly through the extensive margin: more entry into new markets or products.

More recently, a decline in the effect of real exchange rates on export performance has been documented. This has been linked with the emergence of GVCs through three mechanisms:

- Firms need to import to be able to export, therefore their exports contain not just domestic but also foreign value added.

- Stable supplier-buyer links are valuable, so the costs of switching suppliers in case of a real exchange rate change in a given partners’ country becomes non-negligible.

- Large leading firms account for an increasingly larger portion of world trade, and these firms may find it easier to hedge against real exchange rate changes along their production network.

The case of Polish firms is relevant because (i) Poland’s productive transformation over the last 20 years has been grounded on integration into the global marketplace, with accession to the EU single market playing a crucial role, and (ii) because that integration was on the back of active participation in German-led production networks, thus increasing the cross-border production linkages of Polish firms.

Our research resulted in several key findings:

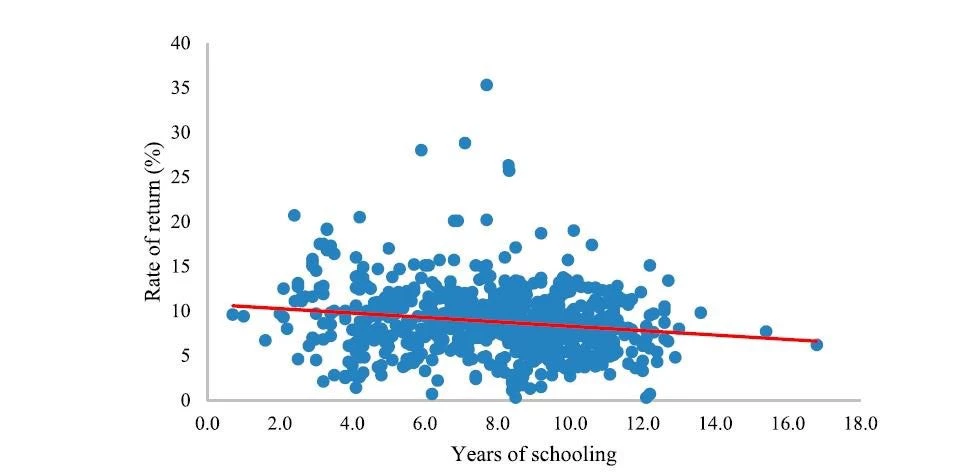

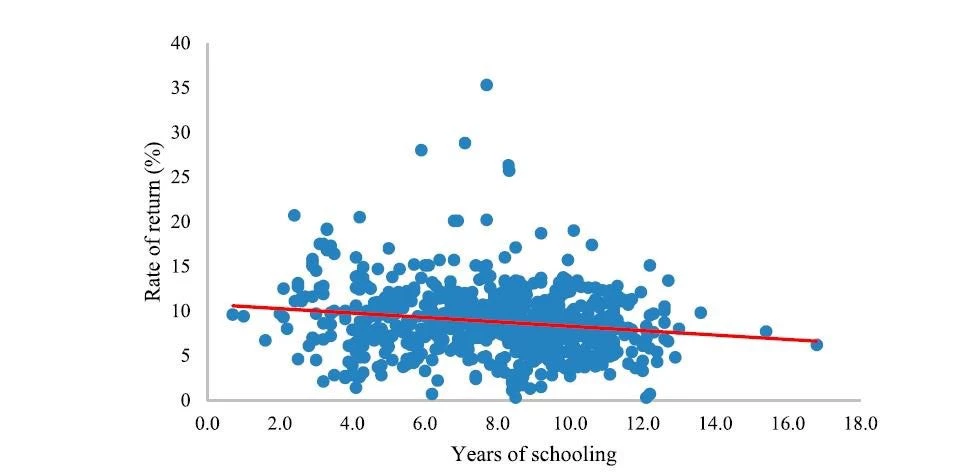

- Real exchange rate depreciations stimulate entry into exporting, rather than larger shipments for existing exporters. Export intensity is instead systematically affected by other factors, in particular, firms’ productivity: as firms become more productive, they tend to export greater volumes.

- The effect of real exchange rates on export participation depends on how much a firm participates in GVCs. More specifically, the effect is conditional on how much a firm relies on imported intermediates. The more foreign value added is embedded in their exports, the less ‘vulnerable’ (better hedged) firms are to real exchange rate fluctuations.

- When firms’ share of imported intermediates is greater than 30 percent, the effect of real exchange rates on export participation fades.

- Real exchange rate volatility negatively affects export decisions, especially for small firms. Large firms are both naturally hedged - through higher shares of imported intermediates and credit in foreign currency - and financially hedged – through the use of derivative instruments.

Percentage of real exchange rate-vulnerable firms in Poland, by sector

What do we learn from these results?

Methodologically, in a world in which trade is driven by GVCs, we need to rely on estimates of real exchange rate effects on exports that take into account the portion of foreign value embedded in domestic production. In addition, we need to understand that different determinants of export performance operate through different channels: some may induce new firms to enter, some may increase shipments among existing exporters.

From a policy perspective, the competitiveness agenda is very much linked with encouraging firms’ productivity growth. Productivity remains the main driver of export growth among existing exporters. Yet, competitively valued currencies still matter for entry into exporting, and may have smaller beggar-the-neighbor effects. This is because, in a world of GVCs, a depreciation that makes a firm more competitive in global markets will also increase demand for foreign value added upstream.

Last but not least, the deepening of financial markets so that competitively priced hedging instruments are available for firms, in particular to SMEs is important to facilitate the internationalization of small firms.

Related Reading:

For more background on this topic, please see the following sources:

- Exchange rates still matter for trade, by Cheng, K., G. Hong, D. Seneviratne and R. van Elkan (2016)

- Depreciations without exports, by Ahmed, S., M. Appendino and M. Ruta (2015)

- Importers, Exporters, and Exchange Rate Disconnect, by Amiti, M. O. Itskhoki and J. Konings (2012)

- Export surges, by Freund, C. and M. Pierola (2012)

- Why some firms export, by Bernard, A. and B. Jensen (2001)

Join the Conversation