Exchange of dollar to Sri Lankan rupee in Sri Lankan money currency exchange.

Exchange of dollar to Sri Lankan rupee in Sri Lankan money currency exchange.

South Asia has a rich history of informal foreign exchange markets such as the well-known Hundi and Hawala. These informal networks play a significant role in traditional societies and informal economies——for one, they help overseas migrant workers send money home without going through the cumbersome formal banking system. On the downside, these informal mechanisms lead to lowering official foreign exchange reserves that countries use to pay imports and settle cross-country transactions. More recently, many South Asian countries imposed restrictions on the use of official foreign exchange, as they scrambled to preserve scarce foreign reserves. However, these restrictions have backfired, and have only served to increase activities in the informal Hundi and Hawala markets, thereby further reducing official reserves. This blog discusses how these informal markets work across South Asia and how restrictive policies can backfire, and calls for a more comprehensive understanding of the system before establishing policies that work.

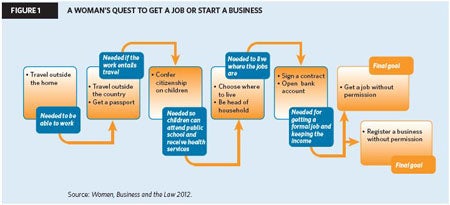

Informal trade in South Asia was 50 percent of formal trade between 1993 and 2005

Imagine you are Tania, a small-scale importer from Bangladesh. Rather than encounter cumbersome procedures and compliances at the border, Tania is looking for alternative ways to import. The impact of non-tariff barriers to trade in South Asia can be as high as 214 percent of the tariff equivalent, according to our calculation using ESCAP – World Bank trade cost database. This is beyond what small importers like Tania can afford. So, Tania decides to import informally, and purchases foreign exchange from local Hundi agents, even though it comes at a higher cost. Instead of providing foreign exchange to Tania directly, Hundi agents use the overseas network to settle the payment with exporters in neighboring countries.

Tania is not alone in her plight. Informal trade in South Asia was 50 percent of formal trade between 1993 and 2005 . India’s informal trade with Nepal was as large as the formal trade, while it accounted for around 30 percent of its trade with Sri Lanka. In Bhutan, informal trade was almost three times the formal trade and more recent studies show that informal trade between India and Pakistan was double the value of formal trade in 2012-13. This demand for informal trade drives the need for systems like Hundi and Hawala. What makes Hundi and Hawala even more attractive to small importers like Tania is the long-term relationship they build with their agents, who offer them short-term working capital loans—hard to come by from commercial banks—to help people like Tania cope with the uncertain business climate.

With governments imposing import and capital controls in the past year, small importers like Tania can become more reliant on Hundi and Hawala agents for import financing. Tania’s imports may not be on the government’s priority list, which means she cannot get foreign exchange from commercial banks to finance her imports. The commercial banks also require 100 percent advance payment to issue import credit letters, which is difficult for small importers like Tania. In this case, even if Hundi and Hawala charge higher exchange rates, they are still the only source of foreign exchanges for many importers.

Such increased demand for foreign exchange in the informal market in turn leads to a wider spread between the official and informal—or parallel—exchange rates. This happens as Hundi agents charge a premium to the traders who turn to the informal market to seek foreign exchange. As the analysis in the recent South Asia Economic Focus shows, between 2021 and early 2022, the informal exchange rate premium in Pakistan was only about 2 percent. But after the introduction of a temporary import ban of 694 items in May 2022, the premium skyrocketed to 13 percent by January 2023. Similarly, in Bangladesh, the premium had been hovering around 2 percent before July 2022 when a new regulation was introduced, requiring a 100 percent advance payment for letter of credits for non-essential items. After that, the premium surged to 12 percent by August 2022.

The informal rate premium in turn diverts remittance and other foreign exchange flows into the informal market. Our analysis shows that a 1 percent deviation between official and informal foreign exchange in Bangladesh shifts 3.6 percent of remittance from the formal to the informal channel.

Take the case of Krishna, a Nepali migrant worker in Qatar who sends money back to his family through a Hundi agent. Krishna may prefer using the Hundi system because not only are the rates better than official ones, but the Hundi network is also more accessible in his village. Moreover, Hundi agents can assist his family during times of emergency with low-interest loans without any collateral, a service that is not available at commercial banks. Krishna only pays back when he receives his salary. Over the past year, despite the government's efforts to incentivize the use of formal banks for remittances, more importers are resorting to Hundi due to import restrictions, leading to a surge in the price of foreign currency in the Hundi market. As a result, Hundi agents can offer Krishna even better rates, which may convince him to continue using Hundi to remit money instead of switching to formal banking channels.

Countries need to ensure that supply and demand of foreign exchanges should be balanced at the fixed official exchange rates they choose

Implications for Policy

As a recent blog by former World Bank president, David Malpass points out, parallel exchange rates “are expensive, highly distortionary for all market participants, are associated with higher inflation, impede private sector development and foreign direct investment, and lead to lower growth.” So, what South Asian countries can do about it?

First, currency depreciation or fiscal incentives alone may not be enough to bring remittance back to the formal financial sector. Indeed, weaker local currencies or fiscal incentives in the short run might make the official rates more attractive to migrant workers overseas. However, as long as authorities cannot make the foreign exchange available to people like Tania at the official rate they set, they purchase foreign exchange via the informal market at an even more expensive exchange rate, which allows the Hundi or Hawala agents to offer a premium to the remitters above the official exchange rates. For example, our analysis has shown that the depreciation of the Bangladeshi Taka does not bring back the remittance to formal channel if the informal market premium remains the same.

Second, to eliminate such informal exchange rates, countries don’t have to move to a free-floating exchange rate. The Asian Financial Crisis has shown that a sound domestic financial system should be in place before fully opening up capital account. Instead, countries need to ensure that supply and demand of foreign exchanges should be balanced at the fixed official exchange rates they choose. This calls for making it relatively easy for individuals and firms to access foreign exchange for legitimate reasons. For instance, smaller countries with long-standing capital controls, such as Bhutan and Nepal, can start by allowing firms to use foreign exchange to set up trade offices overseas. For countries like Bangladesh that require government approval for import activities and outward investment, a more transparent and less arbitrary approval process can go a long way in building back confidence in formal institutions.

This blog is part of a series on the Spring 2023 South Asia Economic Focus - Expanding Opportunities: Toward Inclusive Growth

Join the Conversation