Growth in South Asia is projected between 1.8 and 2.8 percent this year, down from 6.3 percent projected six months ago.

Growth in South Asia is projected between 1.8 and 2.8 percent this year, down from 6.3 percent projected six months ago.

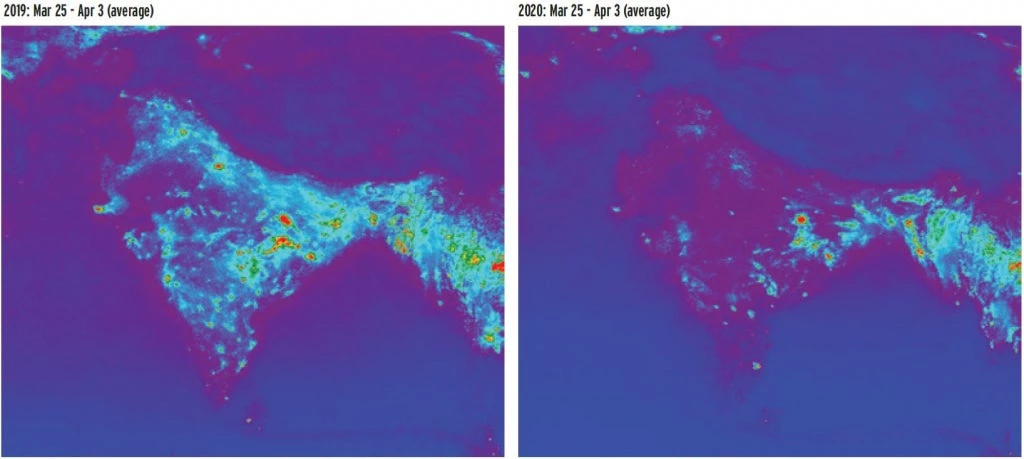

Source: Based on Sentinel-5P NRTI NO2: Near Real-Time Nitrogen Dioxide satellite data (https://sentinel.esa.int/web/sentinel/user-guides/sentinel-5p-tropomi) and processed with Google Earth Engine.

The region is already at a standstill as countries try to contain the virus, and the rapid drop in emissions has quickly become visible in satellite images.

While cleaner air is a welcome respite for one of the world’s most polluted regions, this decline also signals the startling halt in economic activity. The sudden disappearance of mostly informal urban service sector jobs and a rise in food prices have created economic hardship, especially for poor and vulnerable people.

The economic outlook for the region is dire

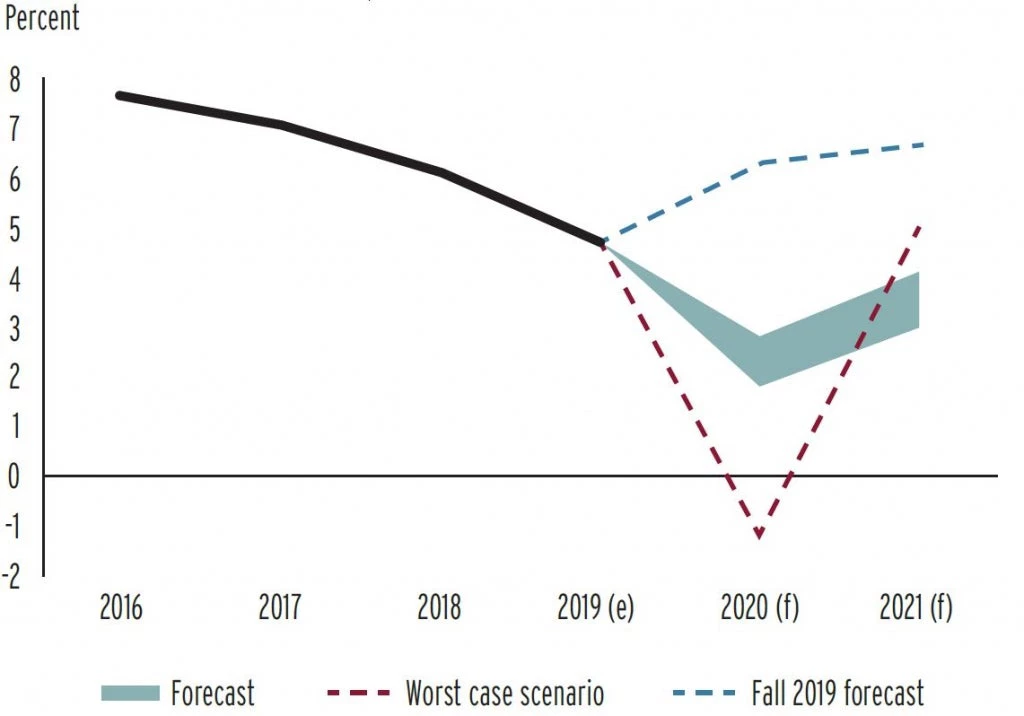

South Asia real GDP growth forecast

Source: World Bank and staff calculations.

According to our latest South Asia Economic Focus, growth in the region is projected between 1.8 and 2.8 percent this year, down from 6.3 percent projected six months ago and potentially the lowest in four decades. In a worst-case scenario, shown by the dotted red line above, South Asia’s economy could even shrink.

Economic policies should aim at flattening the recession curve and jump-starting growth . The immediate response has been rightly focused on mitigating the spread of COVID-19, but it is also important to simultaneously create the conditions needed to revive the economies around the region, once countries emerge from the immediate health crisis. A combination of temporary work programs, liquidity provision, and a moratorium on some obligations, such as debt servicing and rent payments, could help prepare for the restart of the economies.

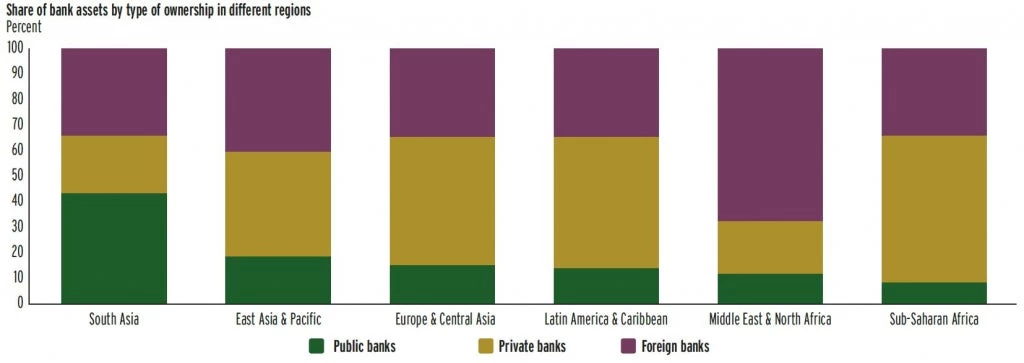

Sources: Reserve Bank of India, World Bank, South Asia Spatial Database, and staff calculations.

State-owned banks are much more common in South Asia than in other regions , as indicated by the green band in the above chart.

Public banks play both a negative and positive role in economic development. On the negative side, these banks suffer from inefficiency and are likely to reduce competition by slowing innovation. They also face severe agency problems, leading to political interventions that can result in an inappropriate use of public money.

These negative characteristics are a root cause of the rise in non-performing assets in recent years. But on the positive side, lending by these banks can be countercyclical. They are also more likely than private banks to provide services to the poor and those living in remote areas.

While the pandemic will exacerbate the weaknesses of public banks, these institutions can also be part of the solution by lending more and reaching out to vulnerable groups.

Join the Conversation