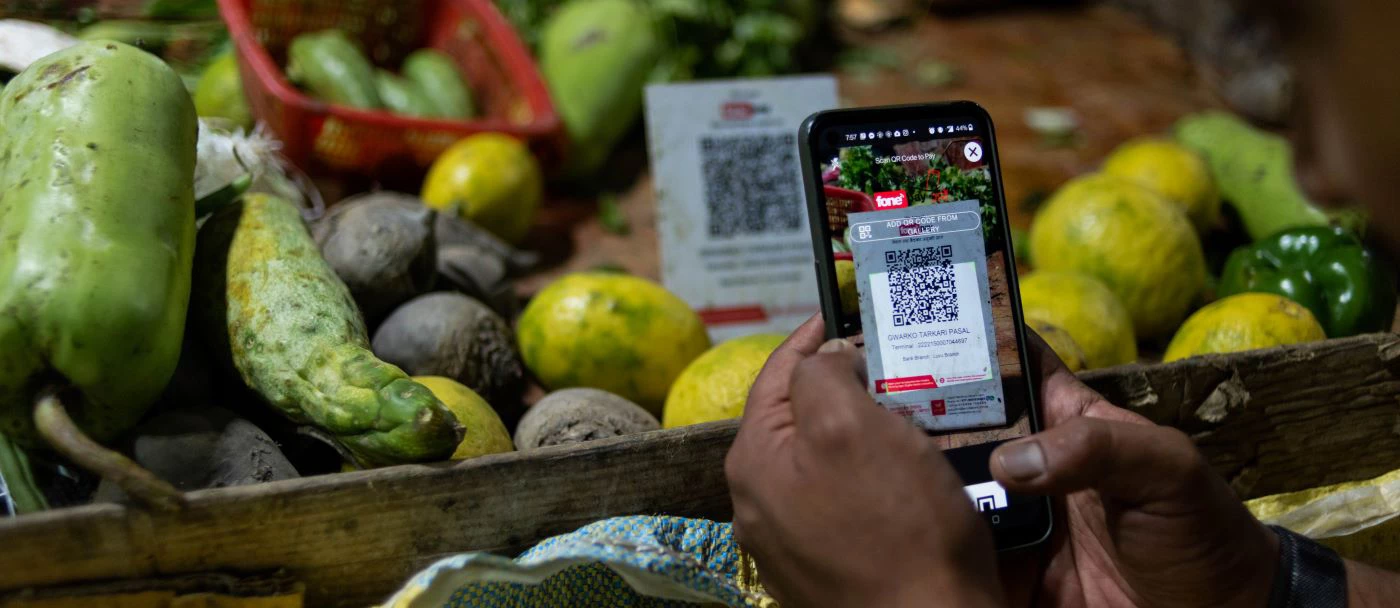

Use of QR code in a vegetable market in Nepal

Use of QR code in a vegetable market in Nepal

As the COVID-19 pandemic dragged the world to a colossal slowdown in early 2020, 17-year-old Nabina Yadav, in Kathmandu took a decision.

Sitting behind heaps of cabbages, tomatoes, potatoes, and onions at her small vegetable stall in Kathmandu’s Naxal Vegetable Market, she decided to use her mobile phone to keep her business running and maybe grow her pool of customers.

For many in Kathmandu, paralyzed by the fear of the virus, this decision came as a blessing. Nabina took orders on the messaging app Viber, packed the vegetables, and loaded them in the trunk of customers’ cars as they stopped briefly next to her stall.

All payments were done through digital wallets, which had been introduced in Nepal in 2010, but saw a spike in use during the pandemic. As ill-prepared small businesses and shops collapsed under the pressure of mobility restrictions, Nabina used her phone to grow her business further.

Nine months into the pandemic, in December 2020, the Governor of Nepal Rastra Bank (NRB), Nepal’s central bank, launched a campaign to promote the use of digital payment systems by businesses as per the policy of the NRB to promote cashless transactions.

The campaign was inaugurated at Naxal Vegetable Market by the Governor by purchasing vegetables through a Quick Response (QR) code. Innovators such as Nabina now represented a larger trend of digital adoption, even by the smallest of businesses.

Most people in Nepal and across South Asia live in areas covered by mobile broadband networks. This forms a large consumer base with access to information, services, and markets, including digital financial services and online marketplaces. However, while Nabina tapped into the fruits of digitization, many women in the region are yet to fully utilize these opportunities.

Nabina’s story illustrates how digital technologies can stimulate simple yet innovative business models to ensure resilient delivery of services during crises.

Women across South Asia are 36 percent less likely to use mobile internet than men.

The sector is mired by uneven gender participation in the digital economy including unequal digital literacy and skills, gaps in affordable and reliable access to devices and services, and increased risks of misinformation and online violence.

To effectively participate in the fast-digitizing economy, women would need improved access to technology, basic and intermediate skills, and access to digital financial services.

In Nepal, only 3 percent of women have used the internet or a mobile phone to access bank accounts while only 15 percent (vs. 23% male) have made or received digital payments. To identify and address the barriers to the growth of Nepal's digital economy, the World Bank is supporting the Government in implementing its digital economy strategy. That strategy aims to connect people and businesses to information, services, and domestic and global markets, while helping improve public service delivery, and create an innovative and inclusive digital economy.

To this end, the World Bank-financed Digital Nepal Acceleration Project supports digital literacy among women and other vulnerable groups, including on emerging areas such as online safety and cybersecurity.

The Project also aims to build advanced skills among women to boost their employment in the growing IT industry and in the startup ecosystem, which will also position them as producers—and not only passive consumers—in the digital economy.

The IFC’s engagement on digital financial services further helped make the QR codes interoperable across banks, driving the increased use of those payment services, benefiting businesses like Nabina’s.

Fast forward to 2023, Nabina continues to use digital platforms to innovate and expand her business. Nabina now also uses her digital access and skills to help her lesser tech-savvy fellow vendors and connect them with customers.

Digital platforms across the world are opening new markets or are vastly broadening existing ones.

Nabina’s story illustrates how digital technologies can stimulate simple yet innovative business models to ensure resilient delivery of services during crises.

Join the Conversation