Sugar-Sweetened Beverage. Photo: Shutterstock

Sugar-Sweetened Beverage. Photo: Shutterstock

Sugar-Sweetened Beverages (SSB)[i] are a well-recognized adversary in the fight against obesity and the quest for better public health. Interest in discouraging consumption through higher taxes is growing as more jurisdictions impose them and as we learn more from their experiences. [Pop-up box 2} Sugar-sweetened beverage taxes are one of three taxes for health highlighted in a recently published report by the Task Force on Fiscal Policy for Health.

Many are asking: are taxes on sugar-sweetened beverages are really a sweet deal? Does such a tax enable policy makers to improve health outcomes by reducing unhealthy consumption? And does it help generate additional tax revenue for more spending on human capital?

These taxes have sceptics. Some oppose the sugar-sweetened beverage taxes in principal, saying that the government is playing nanny state. Other critics question these taxes’ effectiveness as a policy tool, arguing that people are likely to substitute other sugary foods, such as ice cream, for the sugary beverages. People may also just shop for their sugary fix in lower-tax jurisdictions across borders, canceling out most health and revenue effects. Finally, some are convinced that such taxes are unfairly regressive, meaning they tax the poor more than rich.

These and other questions were recently discussed at a World Bank event in Washington, D.C., hosted by the Governance Global Practice and the global tax team. Here are seven lessons that I drew from the discussion:

-

Sugar-sweetened beverage taxes can enhance welfare across society as a whole by incentivizing individuals to reduce unhealthy consumption and lower public health costs to society. In the case of sugar-sweetened beverages, harm to society is related to public budgets and the public health costs of treating obesity, diabetes and cardiovascular disease. Economists call these negative externalities. The field of behavioral economics offers another welfare-enhancing opportunity for individuals, which is linked to the concept of internalities. People may not be correctly internalizing the costs, due to imperfect nutrition knowledge, lack of self-control or we may simply incorrectly discount the effects on our future health.

-

These taxes are not necessarily regressive. A common concern voiced in opposition to increasing sugary-beverages taxes is that they will fall heaviest on the poor. If poor people are consuming these products more, it is certain that they would pay more of the taxes if their consumption level stays the same. But to evaluate the overall distributional impact of the taxes, one must also consider the benefits from reduced consumption resulting from the price increase. According to a recent National Bureau of Economic Research working paper, internalities are largest for lower-income individuals who “have systematically less nutrition knowledge and likely to self-report they consume more sugary beverages than they think they should... Low-income households reduce consumption much more than high-income households when prices rise.” They conclude these benefits would be progressive. World Bank Research shows that tobacco taxes are progressive when second-order effects (reduced medical expenditures, and additional years of productive life) are considered.

-

Revenue increases from sugar-sweetened beverage taxes are a small fraction of the overall tax revenue, but are not trivial. Sugary beverages are thought to be unlike tobacco and alcohol, for which people tend to sustain consumption even as prices rise. Economists call this characteristic price-inelastic--meaning that consumption falls but less than the amount of the price increase. Demand for sugary beverages is more elastic, meaning people are more likely to reduce consumption as prices rise. In theory, this makes sugar taxes less effective at raising revenue over time. Still, sugar-sweetened beverage taxes are relatively new, and evidence of their revenue-enhancing benefits is still emerging. Early implementers show some consistent revenue gains following the implementation of these taxes. In Mexico, for instance, the sugar-sweetened beverage tax revenue averaged around 0.1 percent of GDP annually since they were instituted in 2014.

-

Soft earmarking can help increase public awareness and support for sugar-sweetened beverage taxes. The Philippines’ experience is a good example where soft earmarked revenue is linked to the country’s universal health coverage. In other jurisdictions links have been made to programs benefiting the community and children. Hard earmarks are not recommended: public expenditure management experts discourage earmarking for specific purposes because it can limit the ability to prioritize spending based on current needs. Reviewing empirical evidence, Cashin, Sparkes, Bloom (2017) conclude that “in most cases earmarking is unlikely to bring a significant and sustained increase in the priority placed on health in overall government spending.” They find that “earmarking has been more effective when practices come closer to standard budget processes – that is, softer earmarks with broader expenditure purposes and more flexible revenue–expenditure links.”

-

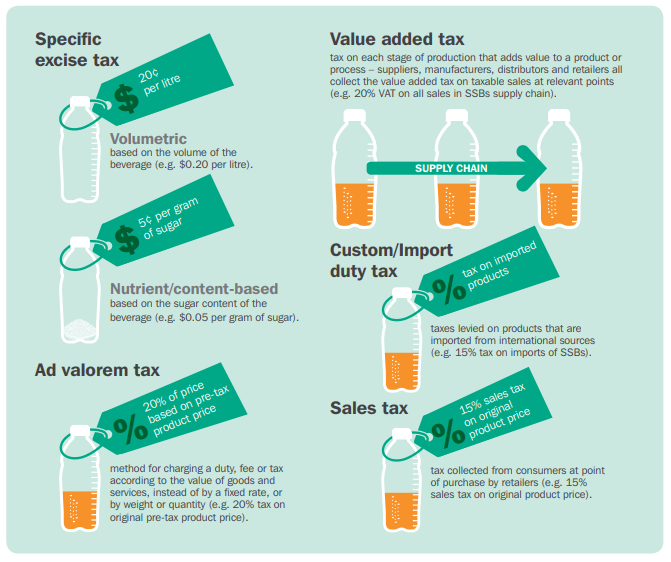

Tax policy design and administration’s capacity matter. Authorities need to consider which tax type and tax rate structure work best for the policy purpose. Excise taxes are the most commonly used form for sugar-sweetened beverage taxation. Specific taxes can reduce price gaps between different brands, decreasing the probability that consumers will switch to cheaper brands when taxes increase. However, specific taxes need to be increased regularly to keep up with inflation and income growth. From a public-health perspective taxing sugar content (rather than per-ounce tax) is most effective. When focusing on sugar content, however, the tax administration’s capacity to implement and the resources of the country to assess sugar content in these beverages are factors. Countries considering sugar-sweetened beverage taxes should also complement the tax policy with necessary legislation on consumer protection and product labeling.

-

Reformulation (reducing sugar content) in soft drinks is desirable for public health, but budget officials must prepare to cope with lower-than-expected revenue. The UK Government introduced a Soft Drinks Industry Levy (SDIL) in April 2018 to tackle childhood obesity by encouraging manufacturers to reduce the sugar content in the soft drinks. The levy is a tiered system that impose a higher volumetric tax for drinks with higher sugar content. The soft drinks manufacturers were given two years and encouraged to reformulate products and bring their sugar content below the taxable thresholds. About 50 percent did. The tax authority had to revise early revenue forecasts by half.

-

Tax reforms are political. It may sound obvious, but it is crucial for reformers to study the political economy landscape, to prepare for public debates and to set the pace of reforms accordingly. For instance, I learned that these taxes hardly faced any resistance in Samoa and Tonga, because soft drinks were mostly imported. In Thailand on the other hand, the legislative process was much fraught and slow as the beverage industry mobilized a strong opposing block jointly with the local sugar cane farmers.

Are you interested in learning more about any of these seven points? Let us start a conversation here and we will use the next blogs to deepen each topic with your help. I look forward to your comments.

For other related content, make sure to check out these blogs:

- The seven salvos of sin (taxes)

- Sugar-Sweetened Beverages and Snack Taxes: All Eyes on Mexico (and Hungary)

[i] A sugar-sweetened beverage is any drink with caloric sweeteners, including carbonated soft drinks, sports drinks, energy drinks, fruit drinks, chocolate (or otherwise sweetened) milk, and sweetened coffee and tea, but not including 100 percent fruit juice or “diet” drink alternatives with non-caloric sweeteners. The beverage categories included in sugary drink taxes depend both on political calculations and judgment calls by public health experts. (As defined in Allcott, Lockwood, Taubinsky, (2019)) For a definition of caloric and non-caloric sweeteners read this handout.

[Sources for Chart/Table]

Join the Conversation