While discussing a cash transfer program, a senior government official in Nicaragua spoke for many when she worried that “husbands were waiting for wives to return in order to take the money and spend it on alcohol” [

Moore 2009]. This concern around cash transfer programs comes up again and again. For at least some of the poor, some will say, “Isn’t that how they became poor in the first place?”

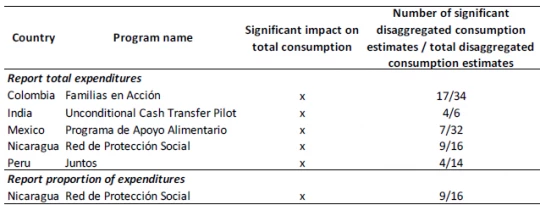

In a recent paper, we examined all the evidence we could find on whether this actually happens. While few papers are specifically focused on whether the poor spend transfers on alcohol and other, similar goods, many evaluations of cash transfer programs examine consumption by categories. We winnowed through over 4,000 papers to identify 19 papers from around the world that examine the impact of participation in a cash transfer program on overall consumption (from any income, not just transfer income) of a range of goods. We focused on alcohol and tobacco because these are commonly grouped together and consumption of these is the most frequently measured among such goods, although the occasional paper examined the impact on consumption of doughnuts [ Aker 2013] or Chinese food [ Dasso and Fernandez 2013].

What would we expect to find? Many people enjoy alcohol, and there is some evidence from the US [ Decker and Schwartz 2000] and the UK [ Banks, Blundell and Lewbel 1997] that alcohol is a normal good: In other words, when people get more money (at least up to a point), they spend more on alcohol. So this - the income effect - could lead alcohol expenditures to increase as these households get richer. If one found this to be the case, it wouldn’t mean that recipients are blowing all the transfers on alcohol: It could just mean they buy a little bit more of lots of things they enjoy: Education, health, doughnuts, and some alcohol, too.

But there are other effects! With conditional cash transfers, there can be a substitution effect: If households have to incur additional costs to achieve the conditions (such as minimum school attendance and health clinic visits), then they are likely to increase education and health expenditures (for example) relative to all other goods (including alcohol).

Most cash transfer programs come with strong messaging. With both conditional and unconditional transfer programs, respondents can technically spend the money however they see fit; in the case of CCTs, this is conditional on satisfying the program conditions. In practice, program staff tell recipients very clearly that they shouldn’t “‘waste’ the cash on drinks and other unproductive items” (Zimbabwe - Román 2010) and that they should “buy goods and services which improve the nutritional, educational and health status” of their families (Nicaragua - Adato and Roopnaraine 2004). In the context of other programs, the flypaper effect has been demonstrated, where local governments ( Hines and Thaler 1995) and households ( Jacoby 2002) often use resources for what they are intended, even when they aren’t strictly obligated to do so.

Many cash transfer programs are targeted at women, especially in Latin America. There is mixed (but leaning positive) evidence that shifting resources into the hands of women means more spending on children (and therefore potentially less spending on alcohol). The positive evidence is from Côte d’Ivoire, Mexico, Brazil, and Macedonia. Evidence from Burkina Faso and Morocco, on the other hand, shows insignificant differences. So it may be that shifting resources into the hands of women decreases spending on alcohol and tobacco, a household bargaining effect.

So we have the income effect pushing expenditures on alcohol and tobacco up, and the substitution effect, the flypaper effect, and the household bargaining effect potentially pushing expenditures down. In the absence of some very strong assumptions, the net effect is unclear.

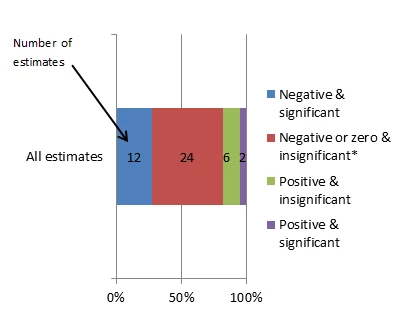

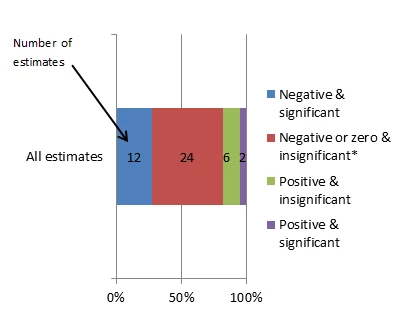

Well, do they waste the money on alcohol and cigarettes or not? They do not. When we examine 44 estimates of spending on alcohol and tobacco across 19 studies and 13 interventions (i.e., Oportunidades/PROGRESA is very well studied), we find that the vast majority of estimates (82%) are negative. More than a quarter are negative and significant, and only 2 are positive and significant. With both of the positive and significant estimates, estimates within the study are discordant (i.e., one positive and one negative).

In a recent paper, we examined all the evidence we could find on whether this actually happens. While few papers are specifically focused on whether the poor spend transfers on alcohol and other, similar goods, many evaluations of cash transfer programs examine consumption by categories. We winnowed through over 4,000 papers to identify 19 papers from around the world that examine the impact of participation in a cash transfer program on overall consumption (from any income, not just transfer income) of a range of goods. We focused on alcohol and tobacco because these are commonly grouped together and consumption of these is the most frequently measured among such goods, although the occasional paper examined the impact on consumption of doughnuts [ Aker 2013] or Chinese food [ Dasso and Fernandez 2013].

What would we expect to find? Many people enjoy alcohol, and there is some evidence from the US [ Decker and Schwartz 2000] and the UK [ Banks, Blundell and Lewbel 1997] that alcohol is a normal good: In other words, when people get more money (at least up to a point), they spend more on alcohol. So this - the income effect - could lead alcohol expenditures to increase as these households get richer. If one found this to be the case, it wouldn’t mean that recipients are blowing all the transfers on alcohol: It could just mean they buy a little bit more of lots of things they enjoy: Education, health, doughnuts, and some alcohol, too.

But there are other effects! With conditional cash transfers, there can be a substitution effect: If households have to incur additional costs to achieve the conditions (such as minimum school attendance and health clinic visits), then they are likely to increase education and health expenditures (for example) relative to all other goods (including alcohol).

Most cash transfer programs come with strong messaging. With both conditional and unconditional transfer programs, respondents can technically spend the money however they see fit; in the case of CCTs, this is conditional on satisfying the program conditions. In practice, program staff tell recipients very clearly that they shouldn’t “‘waste’ the cash on drinks and other unproductive items” (Zimbabwe - Román 2010) and that they should “buy goods and services which improve the nutritional, educational and health status” of their families (Nicaragua - Adato and Roopnaraine 2004). In the context of other programs, the flypaper effect has been demonstrated, where local governments ( Hines and Thaler 1995) and households ( Jacoby 2002) often use resources for what they are intended, even when they aren’t strictly obligated to do so.

Many cash transfer programs are targeted at women, especially in Latin America. There is mixed (but leaning positive) evidence that shifting resources into the hands of women means more spending on children (and therefore potentially less spending on alcohol). The positive evidence is from Côte d’Ivoire, Mexico, Brazil, and Macedonia. Evidence from Burkina Faso and Morocco, on the other hand, shows insignificant differences. So it may be that shifting resources into the hands of women decreases spending on alcohol and tobacco, a household bargaining effect.

So we have the income effect pushing expenditures on alcohol and tobacco up, and the substitution effect, the flypaper effect, and the household bargaining effect potentially pushing expenditures down. In the absence of some very strong assumptions, the net effect is unclear.

Well, do they waste the money on alcohol and cigarettes or not? They do not. When we examine 44 estimates of spending on alcohol and tobacco across 19 studies and 13 interventions (i.e., Oportunidades/PROGRESA is very well studied), we find that the vast majority of estimates (82%) are negative. More than a quarter are negative and significant, and only 2 are positive and significant. With both of the positive and significant estimates, estimates within the study are discordant (i.e., one positive and one negative).

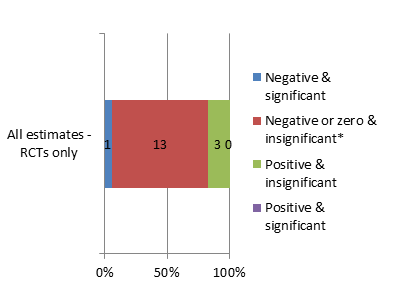

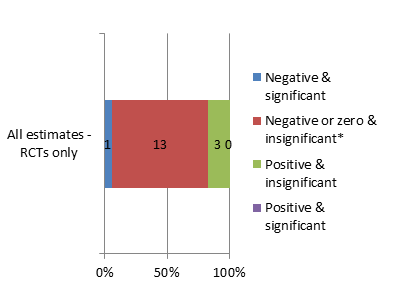

Of course, not all estimates are created equal. If we restrict the analysis to randomized trials, we find that again, more than 80% of estimates are negative, albeit now most are statistically insignificant. Note that no randomized trial finds a statistically significant increase in expenditures on alcohol and tobacco.

This evidence is from Latin America, Africa, and Asia. It includes conditional and unconditional cash transfer programs. The pattern looks very similar across these sub-groups (which is unsurprising, since there isn’t much heterogeneity to start with). There just isn’t any evidence that people are spending their transfers on these products.

With all this messaging, wouldn’t they just lie about their consumption? Of course, it’s possible that households are not being truthful. However, there are a few reasons this doesn’t worry us too much. First, these are consumption surveys with a long list of household items, in which alcohol and tobacco are not singled out. The enumerators for these consumption surveys are not the program administrators, so they aren’t infusing the questions with normative significance: “Yes, yes, you’re spending on rice, fine. But how much are you spending on booze?! Tell us!!” Second, transfer income is not asked about separately. Households are merely asked their total expenditures on each food category over a certain period of time. To game this simplistically, a household might report zero expenditures on alcohol and tobacco, but that’s not what we see. Households report a non-zero level at baseline and then again at follow-ups. For more sophisticated gaming and to deliver the mostly negative and insignificant results we observe, households would need to remember how much they reported at the last survey (often one year ago), and report a similar but slightly lower number. This seems unlikely.

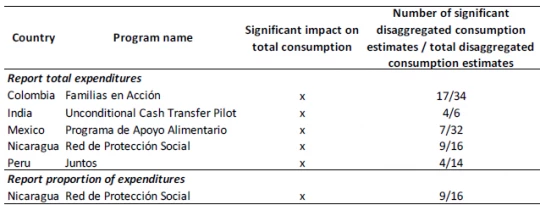

Maybe you just don’t have the statistical power to measure significant effects. For all the studies with positive but insignificant effects, we examine whether there are significant impacts of transfers on other consumption categories. We find that all of these studies identify significant impacts on several (and in some cases many) other categories, making it less likely that these studies are underpowered to pick up effects for smaller consumption categories like alcohol and tobacco. Rather, there is just no evidence that beneficiaries spend any significant proportion of their transfers on these goods.

With all this messaging, wouldn’t they just lie about their consumption? Of course, it’s possible that households are not being truthful. However, there are a few reasons this doesn’t worry us too much. First, these are consumption surveys with a long list of household items, in which alcohol and tobacco are not singled out. The enumerators for these consumption surveys are not the program administrators, so they aren’t infusing the questions with normative significance: “Yes, yes, you’re spending on rice, fine. But how much are you spending on booze?! Tell us!!” Second, transfer income is not asked about separately. Households are merely asked their total expenditures on each food category over a certain period of time. To game this simplistically, a household might report zero expenditures on alcohol and tobacco, but that’s not what we see. Households report a non-zero level at baseline and then again at follow-ups. For more sophisticated gaming and to deliver the mostly negative and insignificant results we observe, households would need to remember how much they reported at the last survey (often one year ago), and report a similar but slightly lower number. This seems unlikely.

Maybe you just don’t have the statistical power to measure significant effects. For all the studies with positive but insignificant effects, we examine whether there are significant impacts of transfers on other consumption categories. We find that all of these studies identify significant impacts on several (and in some cases many) other categories, making it less likely that these studies are underpowered to pick up effects for smaller consumption categories like alcohol and tobacco. Rather, there is just no evidence that beneficiaries spend any significant proportion of their transfers on these goods.

Why not just ask the poor? In addition to the 19 papers with estimates of impact on consumption, we identified an additional 11 papers that seek to measure directly how households use transfer income: Researchers ask households how much of the transfer income gets spent on alcohol and other, similar goods. This is problematic for at least a couple of reasons. First, by asking just one time and just about transfer income, it’s easier for households to game the answers: “Correct answer: ZERO!” Second, money is fungible. (Not

everything sticks to the flypaper!) So even without trying to game, a household could use this mental accounting: “I used to spend $100 on education. Now I get $50 through the transfer and spend all of it on education. Oh, and by the way, I now only spend $50 of regular income on education and use the other $50 on other things.” In this case, asking the household what they spend the transfer income on won’t tell us anything about how much more is actually spent on education, or on anything else. Nevertheless, households report almost no expenditures on alcohol and tobacco, which at least is consistent with the more reliable estimates discussed earlier.

The Take Away. Dasso and Fernandez (2013) have a nice paper comparing the consumption of CCT beneficiaries in Peru when they have the cash in hand versus later in the month, when most of the money is spent. They find that people with the cash transfer in hand buy more “candies, chocolates, soft drinks and meals in restaurants.” They also find no impact on alcohol consumption.

We should stop worrying that the poor are going to spend (or “waste”) their transfer income on alcohol and tobacco. They aren’t. They might buy some chocolate, though.

The Take Away. Dasso and Fernandez (2013) have a nice paper comparing the consumption of CCT beneficiaries in Peru when they have the cash in hand versus later in the month, when most of the money is spent. They find that people with the cash transfer in hand buy more “candies, chocolates, soft drinks and meals in restaurants.” They also find no impact on alcohol consumption.

We should stop worrying that the poor are going to spend (or “waste”) their transfer income on alcohol and tobacco. They aren’t. They might buy some chocolate, though.

Join the Conversation