At least one billion dollars is spent annually training at least 4 to 5 million potential and existing entrepreneurs in developing countries. In the majority of cases, including in many World Bank projects, this training is given by governments to firms for free or a nominal fee. There are arguments to be made both for making training free/cheap, as well as for charging more for it:

· Free training is often justified on the grounds that firms are too poor or credit-constrained to afford the costs of training, and that poorly managed firms may underestimate the benefits of improving their business practices.

· However, these programs use public money to provide private benefits for the participating firms. Charging a positive price may improve the financial sustainability of such programs, and enable governments to train more firms with a given budget. Higher prices may also help target training towards the firms that expect to benefit most from it. Finally, a sunk cost effect may operate, whereby paying for training causes firm owners to value it more, and exert more effort in learning from training.

In a new working paper (joint with Alessandro Maffioli of the IDB), we use two experiments in Jamaica to examine how the demand for business training varies with price, and to test whether charging a higher price results in business owners being more likely to attend training. In doing so, we experienced challenges in measuring willingness-to-pay, so thought we would discuss this, and then summarize the key results. A 2-page impact note is also available that focuses on the results and policy implications.

Using BDM and TIOLI with business training

We conducted pricing experiments in partnership with the Jamaica Business Development Corporation. The training course offered was a 40-hour course that had modules on improving business practices, and on personal initiative. The cost of providing the course was $150 per firm. This is expensive relative to many of the items that have been used in willingness-to-pay (WTP) experiments in developing countries (which are usually under $20), and relative to the incomes of the microenterprises (the full cost would be 3-5 months of profits for the median firm).

Our first experiment used the Becker-deGroot-Marschak (BDM) mechanism with 457 entrepreneurs. Under this method, firms are asked to state their maximum WTP for the training course. A price is then randomly drawn, and if the price is lower or equal to the maximum willingness to pay, the entrepreneur buys the course at the drawn price. For example, if the entrepreneur is willing to pay $50, they get the course for $30 if a price of $30 is drawn, but are not allowed to purchase the course if a price of $60 is drawn. This is done at the end of a demonstration session, where trainers present the content of the course and the BDM method is explained in detail to entrepreneurs: an example is conducted for a token object like a pen or notebook, so they could see how it works in practice. They are told that it is optimal for them to reveal their true willingness to pay for the course; since over-reporting the price would imply they might have to pay a higher amount than that they are really willing to pay, and under-reporting would reduce their chances of getting the course at a price they would be willing to pay.

However, business training has several aspects that makes it harder to sell than e.g. a solar kit or water filter. It shares the property of experience goods, that it can be difficult for consumers to assess quality without purchasing and consuming it. Since it is a service, if firm owners are dissatisfied with the purchase, they cannot return it or sell it to others. Our demonstration sessions aimed to partially reduce these problems. Entrepreneurs got examples of the course content, heard from other entrepreneurs that had been previously trained and got to visit the training venue. At the end of the session, firms were then offered the opportunity to purchase the course and were asked to sign a commitment document with the price they agreed to pay.

A second issue is that because the amount was sizeable relative to profits, JBDC did not want to require payment on the spot. This was for several reasons: for security (they did not want firm owners showing up with a large amount of cash to a group demonstration session, given high crime rates); and because it would be several weeks until the first session of the course, and they wanted to give owners time to collect together the money.

The result of these two issues was that we had a lot of people renege on their agreement to pay for the course (despite having signed the commitment to pay). Out of the 457 respondents who completed the BDM mechanism, 392 (86%) bought the course by reporting a WTP at least as high as the price they were randomly offered. In this group, 318 participants were assigned a positive price for the course, but only 46% of them paid the agreed amount for the course, while 50% paid at least part of the agreed amount.

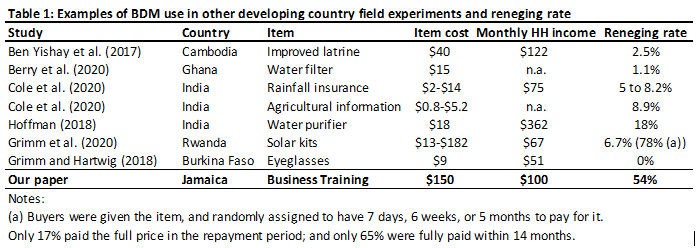

These reneging rates on BDM are larger than in most cases in the literature (Table 1), in which BDM has been used for cheap physical products. When credit is offered, another form of reneging is to take the item and then not pay the agreed amount, which is what happened to Grimm et al. (2020) with solar kits.

BDM would be much simpler to implement if the entrepreneurs had credit cards, since they could pre-authorize a transaction, which could then be automatically charged. But in general, with expensive items, BDM can be difficult to implement without some reneging in a developing country setting. It still does appear to have provided useful information, as we show below. Nevertheless, an alternative that is often used is the simpler take-it-or-leave-it-offer (TIOLI). We did this with a second sample of 374 entrepreneurs, Here, one of four prices (free, $37, $75, $112) was drawn, and the firm could decide whether or not to buy the course at this price.

What did we learn about the demand for business training?

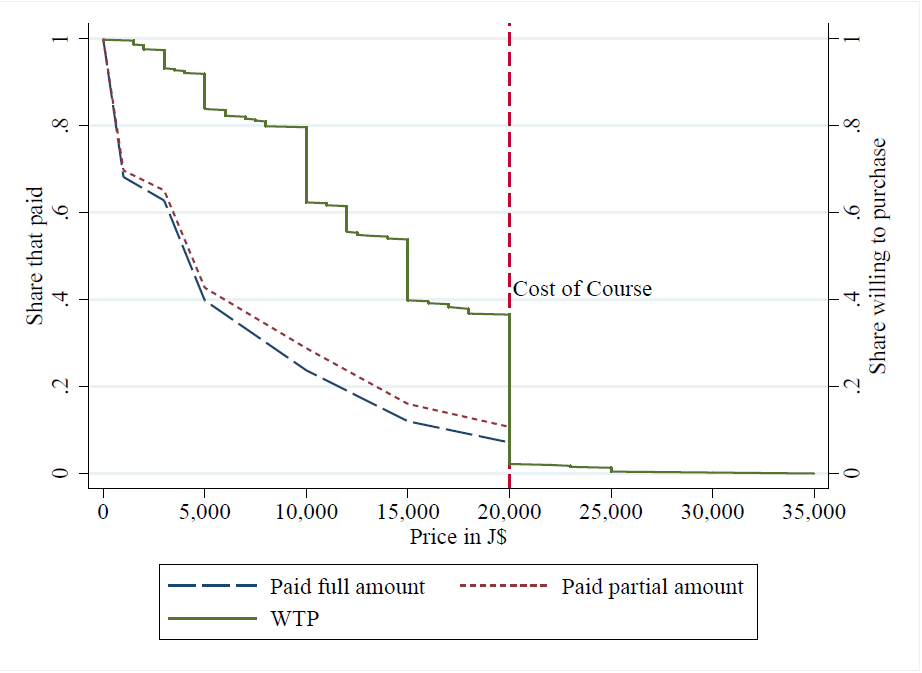

Despite these implementation difficulties, the BDM and TIOLI studies both provide some answers to our motivating questions of how governments should price business training. Figure 1 shows the demand curve for business training in this sample from our BDM experiment, both in terms of their expressed WTP in the BDM exercise, as well as in terms of actual payment.

Figure 1: Demand for Business Training using BDM

We see demand falls as price moves from the typical free or token fee approach of governments towards a price that reflects the cost of the course. Demand is inelastic in this range, so that doubling the price reduces demand by less than half. Nevertheless, charging for training does screen out many microenterprises from participating: 76 percent of entrepreneurs attend at least one training class when it is free, 65 percent when they have to pay a nominal fee of 5%, 43 percent when charged one-quarter the cost, 29 percent when charged half the cost, and only 11 percent when charged the full cost. In the TIOLI sample, which consists of somewhat wealthier entrepreneurs with larger firms, 90% attend at least one class when it is free, and demand falls to 48% when charged half the cost, and 37% when charged three-quarters of the cost. In both cases, we randomized the offer to pay for the course in three installments, but this offer did not affect demand.

We also find effects of prices on participants selection:

· Higher prices change who is trained: higher prices screen out poorer, older, and more risk-averse entrepreneurs with smaller businesses. However, higher prices do not differentially affect female business owners.

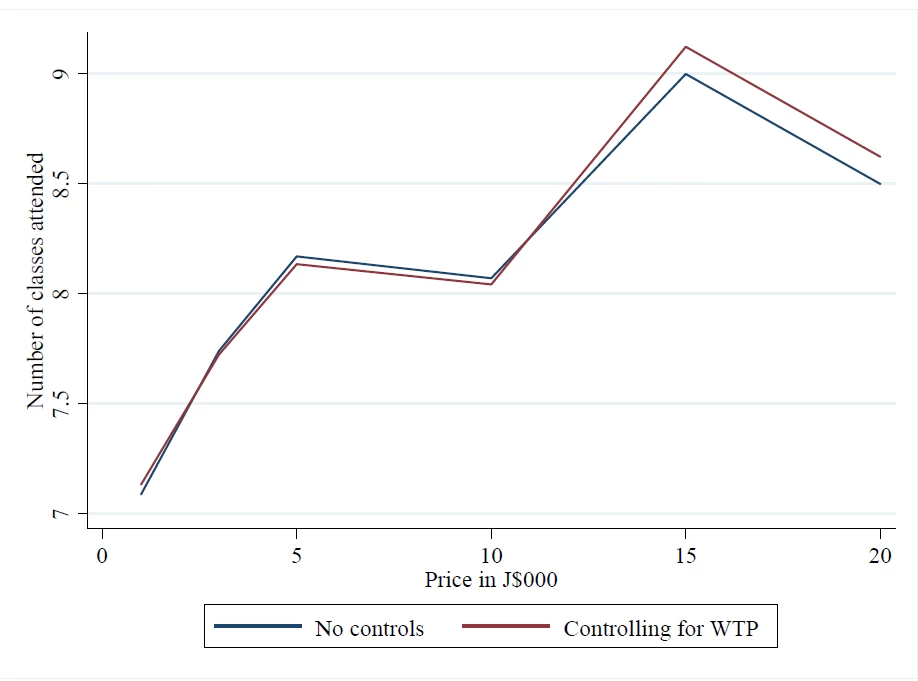

· Higher prices both select entrepreneurs who are more likely to attend training, and have a sunk cost effect: entrepreneurs with a higher willingness to pay are more likely to attend when selected for training; and conditional on willingness to pay, those who are randomly assigned higher prices and pay for training go to more sessions. This is shown in Figure 2 – those who pay J$1,000 ($7.50) attend only 7.1 classes out of 10 on average, compared to 8.1 for those paying 25% to 50% of the cost (and even higher for the smaller sample paying close to full cost).

Figure 2: Sunk-cost effect- paying more leads entrepreneurs to attend more training sessions

Overall, our results suggest the optimal price for business training is unlikely to be either free or full cost. Charging for training does screen out those firm owners who are less likely to attend, selects those who expect to benefit more from it, and induces more effort in attending training. But a lot of these effects occur from charging only one-quarter of the full cost, and charging close to or at full recovery cost ends up screening out many business owners and making costlier to achieve targeted recruitment numbers. Our work also highlights the need for further innovations in ways to measure the willingness-to-pay for expensive services.

If you are interested in hearing more about this, David is presenting this work in the virtual NEUDC conference this Friday (in Panel F, the 11:30-1:10pm session).

Join the Conversation