The global pandemic of 2020-2022 had truly unprecedented consequences. Along with other crises, such as the war in Ukraine, it plunged the global economy into a steep slowdown that dealt the biggest setback to global poverty in decades.

But global responses to the pandemic were equally unprecedented. During the crisis, countries employed toolkits that combined large fiscal, monetary, and prudential policies such as grants, credit facilities, and relaxed capital requirements.

Still, global inflation, food and energy supply disruption, and accumulating debt remind us that the effects of the pandemic linger and will continue to create long-term uncertainties that must be managed.

Helping low- and middle-income countries (LMICs) manage such shocks is a critical role for the World Bank, which includes the International Bank for Reconstruction and Development (IBRD) and the International Development Association (IDA).

During the pandemic, multilateral organizations like the World Bank contributed an extraordinary level of support to LMICs. Those commitments expanded the ability of these countries to respond to the combined supply and demand shocks that COVID-19 delivered. Between 2020 and 2021, the World Bank issued $101 billion in new loan commitments to IBRD borrowers and IDA-eligible countries. And $11 billion in grants were issued through IDA.

In fact, IBRD’s commitments as a share of total long-term public and publicly guaranteed commitments for LMICs rose in response to the pandemic, from 15 percent in 2019 to 20 percent in 2020 and 18 percent in 2021. IDA’s comparable long-term commitment also grew, from 41 percent in 2019 to 52 percent in 2020, eventually dropping back to 44 percent in 2021. From April to September 2022, IDA committed more than $56 billion on highly concessional or grant terms.

Similarly, the IMF made some $250 billion – or a quarter of its $1 trillion lending capacity – available to member countries in 2020 in response to the pandemic, through the Catastrophe Containment and Relief Trust.

This increase in lending commitments supported numerous projects in vulnerable and less-resilient countries that lack the fiscal and monetary capacity needed to counter the impact of multiple negative shocks and avoid catastrophic outcomes.

Bilateral lending – direct government-to-government lending – also played a part in supporting LMICs’ responses to the pandemic. Yet bilateral loans decreased when additional lending would have been a more appropriate response.

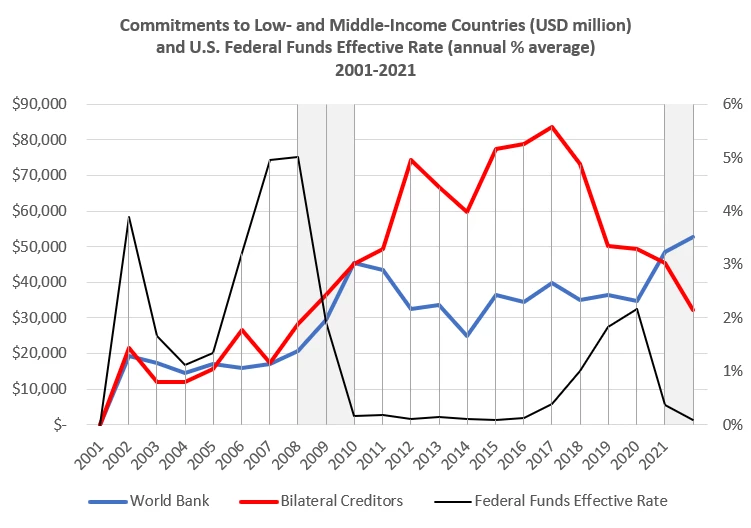

In 2021, when the World Bank committed $52 billion, bilateral creditors committed just $32 billion. The World Bank’s commitment increased 40 percent and 9 percent in 2020 and 2021, respectively, while bilateral commitments decreased by 8 percent and 30 percent. In fact, these lenders’ cumulative commitment had been steadily decreasing from a 2016 peak, dropping 13 percent each year on average over the 2017-2020 period, when the U.S. Federal Reserve pushed its target rate from 0.25 percent to 2.5 percent.

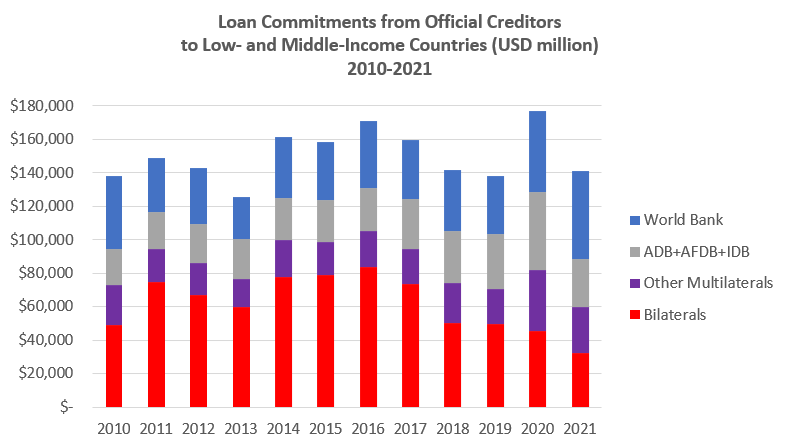

Meanwhile, the World Bank maintained its course and grew its commitment to LMICs by 7 percent during the same period. And other international multilateral creditors kept their commitments relatively steady. Regional multilateral banks such as the African Development Bank (AFDB), the Asian Development Bank (ADB), and the Inter-American Development Bank (IDB) together committed $93 billion from 2010 to 2021, equivalent to 15 percent of commitments from official creditors and 28 percent of commitments from multilateral creditors.

The commitments of both multilateral and bilateral lenders over the period 2010-2021 can be seen in the chart below.

Source: World Bank International Debt Statistics database

The analysis can be expanded by comparing the bilateral response during the pandemic to that of the Great Recession, shaded in the chart below. In response to that crisis, in 2009, both the World Bank and bilateral creditors committed around $45 billion to LMICs. And bilateral commitments increased, eventually climbing to $74 billion in 2011. This increase in bilateral commitment was possibly due to prevailing low interest rates (when rates are low in high-income economies, lenders tend to look for alternative investments).

Indeed, in the low interest rate period from post-recession to pre-pandemic (2010 to 2019), bilateral commitments to LMICs reached historic levels, peaking at $84 billion in 2016. During the same period, the World Bank (both IBRD and IDA) committed $128.7 billion. Those funds – both bilateral and multilateral loans – supported the most vulnerable, maintained long-term infrastructure investments, and sustained the potential for private sector-led growth. Over the decade that followed the 2008 collapse of Lehman Brothers investment bank (which marked the beginning of the global financial crisis), the IMF provided $500 billion to 90 economies and injected $250 billion into the global financial system, helping to avoid another Great Depression and enable the recovery of the global economy.

Source: World Bank International Debt Statistics database & U.S. Federal Reserve Bank of St. Louis

Yet, while both events were catastrophic, the recession and the pandemic were also quite different. The latter delivered a devasting demand-supply-financial shock to the world economy. Major bilateral creditor countries experienced a collapse of demand for their exports along with a dramatic drop in commodity prices, while capital flows fell dramatically, creating a triple shock. Perhaps that is part of the reason that bilateral commitments fell to pre-recession levels while multilateral lenders continued to increase their commitments to LMICs.

The growth of multilateral financing benefited a range of impacted economies and communities. Examples include IDA’s $154 million grant and credit for technical support to maintain essential health and nutrition services in Senegal and a $13 million package to strengthen the government's health system and access to COVID-19 vaccines in the Solomon Islands. Even middle-income economies received multilateral assistance, such as a $100 million IMF-World Bank loan to Türkiye to support its pandemic response to the pandemic.

Multilateral lenders have long played a vital role in boosting global economic resilience and providing critical support to LMICs during times of economic uncertainty. And during the pandemic and the ensuing war in Ukraine, multilaterals demonstrated their true value. Even as bilateral lending weakened, organizations like the World Bank and the IMF continued to support LMICs.

Join the Conversation