Recent World Bank economic research explores how Infrastructure is critical for development | Image: iStock

Recent World Bank economic research explores how Infrastructure is critical for development | Image: iStock

As the world economy attempts to recover from the current COVID-19 crisis, there is significant public debate surrounding whether public investment in infrastructure can be an effective stimulus for the economy. The answer to this question depends on the size of the associated “multiplier”—a parameter that captures the overall economic impact of an additional dollar of government spending. To improve our understanding of this issue, a recent research paper from the World Bank Infrastructure Chief Economist’s Office—What Have We Learned about the Effectiveness of Infrastructure Investment as a Fiscal Stimulus: A Literature Review—surveys the current state of the evidence, drawing on some 100 academic articles and shedding light on the following critical policy questions.

Under which conditions are public investments effective for stimulating the economy?

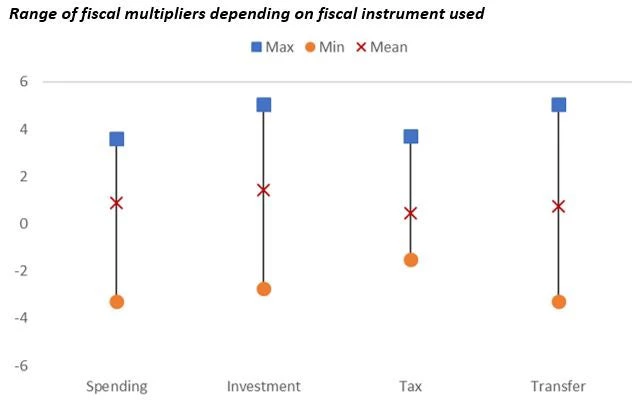

Multipliers associated with public expenditure and investments are on average about twice as high as those from tax cuts and fiscal transfers . Among public spending categories, multipliers related to public investment display the highest values, typically at around 1.5 (on average across all states of the economy) meaning that a dollar of public investment leads to 1.5 dollars of economic activity.

The size of multipliers is very sensitive to the economic context in which the stimulus takes place. In particular, public spending multipliers are significantly higher during downturns than during average periods or booms (where they are usually estimated to be negative and never significantly positive).

Fiscal stimulus may be particularly effective (and the multiplier correspondingly larger) when monetary policy is loose with near-zero interest rates. This is because higher government spending can be expected to increase inflation, which in turn drives the real interest into negative territory further boosting the economy by stimulating private consumption and investment spending.

Unfortunately, there are relatively few studies that estimate public investment multipliers specifically for developing countries, due to the lack of the necessary long time series data. However, the most recent evidence suggests that public investment in developing countries may carry higher returns, as the size of the initial stock of public capital is much lower, and the baseline quality, quantity, and accessibility of economic infrastructure is often inadequate, meaning that improvements may be particularly beneficial.

What lessons can be learned from stimulus programs in past economic and financial crises?

Resilient recovery sometimes requires balancing conflicting objectives. If the most pressing concern is to create jobs as quickly as possible, accelerating labor-intensive shovel-ready public works projects, like urban or rural roads, may be the most effective approach.

If, on the other hand, the overarching objective is to stimulate innovation as a basis for productivity gains and long-run growth, investing in foundational digital infrastructure may be more relevant.

Following the Global Financial Crisis of 2008, the American Recovery and Reinvestment Act (ARRA) 2009 adopted a hybrid approach aiming to capture both short-run and long-run benefits. Thus, some funding went into pre-existing public works programs, while another portion was used to launch innovative digital programs, such as the National Broadband Plan and Broadband Technology Opportunities Program, as well as green infrastructure programs. The wide range of empirical evidence available on the US ARRA suggests that multipliers ranged from 0.4 to 2.2, indicating the differential impact of different types of investment programs (as well as some methodological disagreement among economists). The weaker multipliers were associated with expenditure on pre-existing public works, due to implementation delays of one year beyond the receipt of federal grants, as a result of regulatory reviews.

What are the implications for the use of infrastructure as a fiscal stimulus during recovery from the COVID-19 pandemic?

The current COVID-19 crisis has many peculiarities that distinguish it from earlier ones and complicate inferences based on earlier crises. On the one hand, the context of the pandemic may depress public investment multipliers, due to stronger precautionary behavior and hoarding of cash, amplified by fear of disease that prevents people from engaging in travel and social activities. At the same time, the severity of the economic downturn, accompanied as it is by loose monetary policy, present conditions that in the past have tended to enhance the efficacy of fiscal stimulus.

#Infra4Dev is a blog series that showcases recent World Bank economic research to explore how Infrastructure is critical for development.

RELATED

How can we explain the rise in transport emissions… and what can we do about it?

Can policy measures reduce the environmental impact of urban passenger transport?

If you build it, they will come: Lessons from the first decade of electric vehicles

#Infra4dev Conference 2022: Infrastructure, Recovery & Growth: Building out from the Pandemic

Join the Conversation