It is easy enough to find data on flows of foreign direct investment (FDI). There are also plenty of anecdotes out there that purportedly encapsulate what businesses worldwide are thinking. It is far more difficult, however, to establish rigorous connections between global investment trends and individual investment decisions by international companies. In the World Bank Group’s newly published Global Investment Competitiveness Report 2017–2018, our team does just this, combining new survey data, rigorous econometric analysis, and extensive literature reviews to reveal what is going on behind the headline numbers.

Here are some of the key takeaways:

FDI is crucial for development

FDI has overtaken aid, remittances, and portfolio investment as the largest source of external finance in many developing countries. Achieving the Sustainable Development Goals will require a massive increase in capital flows to developing countries on a scale that only private sector investment can deliver. FDI supports development in other ways besides providing capital. It helps developing economies to integrate into international markets. It also spurs productivity gains by increasing competition and by enabling knowledge to spread across borders.

Developing economies benefit not only from incoming FDI but also from outward FDI (OFDI). OFDI into other developing countries (or “South-South” FDI) is an increasingly important driver of knowledge spillovers between developing countries, contrary to the common perception of knowledge spillovers as flowing predominantly from developed countries. Firms in developing countries are increasingly turning to one another as partners in innovation, perhaps because production and managerial methods may be more easily transferable between economies at similar levels of development.

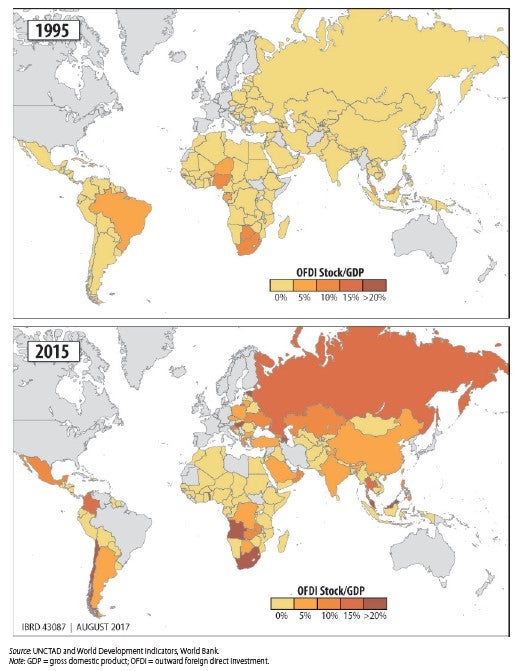

OFDI from developing countries is increasing

FDI from developing countries has increased twentyfold in the last two decades and currently represents nearly one-fifth of global FDI flows. While large developing countries account for a majority of these outward flows, 9 out of 10 developing economies have companies that have established overseas affiliates. Outward FDI, or OFDI, helps firms from developing countries to access capital, technology, and markets. OFDI tends to flow to large, growing economies that are geographically near and culturally similar to the investor’s home country.

Figure: Outward FDI has grown rapidly in most developing countries

Risk-tolerant investors: regional and developing-country MNCs

OFDI, especially investment to nearby economies, is key to addressing the persistently low level of FDI flows to countries in fragile and conflict-affected situations (FCS). FCS receive just 1 percent of global FDI, or one-fifth of the global per capita average . Managers of developing-country multinational corporations (MNCs) have some important advantages as investors in FCS. In general, they are relatively willing to target higher-risk markets in host economies with weaker institutions. They are more accustomed to uncertainty, more ready to deal with unpredictable and opaque bureaucracies, and more familiar with the local business environment than their counterparts from developed economies.FDI drives innovation by linking high-growth firms to multinationals

The fastest-growing firms in developing economies are the main engines of job creation. They tend to be smaller, younger, and more flexible than their competitors, and are better able to assimilate new technologies. Our analysis shows that knowledge spillovers from FDI occur primarily through contractual linkages between foreign MNCs and high-growth domestic firms.

Governments often seek to foster such linkages by forcing MNCs to source inputs locally. These policies usually deter investment, as I’ve written previously. If local firms can provide the necessary quantity and quality, MNCs are happy to buy from them. But local content requirements may lead investors to take their capital elsewhere. Governments seeking to facilitate linkages should focus on helping domestic firms to upgrade their capacity.

Governments can attract investment by reducing risks

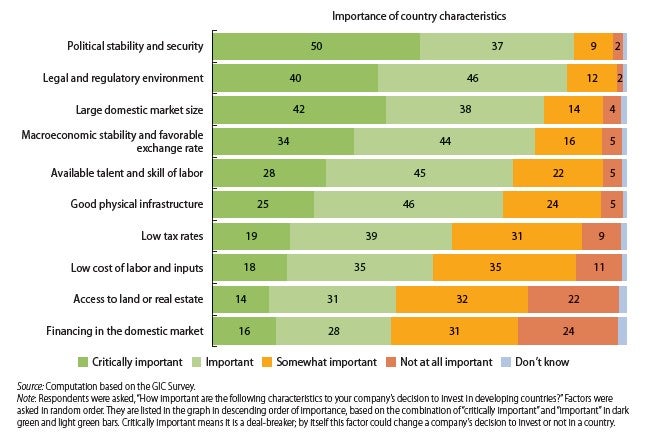

As our new survey shows, firms considering investing abroad value political stability and a business-friendly regulatory environment above other factors. By addressing these core concerns, policy makers can reduce investors’ perceptions of risk, which very often derail otherwise viable investments. In terms of investment policies, firms care about the ability to quickly obtain permits and to wholly own their affiliates. Investment incentives (such as tax breaks) can help countries seal the deal when an investor is on the fence, but cannot make up for serious flaws in the broader investment climate.

Figure: Business-Friendly Legal and Regulatory Environment Is Important for Investors

Share of respondents (percent)

Investment climate reforms reduce uncertainty and unpredictability

Join the Conversation