Green grass growing on the dry land after has rain fall Metaphor Nature Recovery, Climate change, Global warming

Green grass growing on the dry land after has rain fall Metaphor Nature Recovery, Climate change, Global warming

With the Earth experiencing rapid changes undermining critical life-support structures, transitioning to a low-carbon, climate-resilient global economy has become urgent. This is reflected in the Paris Agreement, a legally binding treaty of 196 entities under which they have pledged to lower greenhouse gas emissions contributing to climate change. Financial institutions and capital markets—which fund investments into future economic activities—must become a greater force for addressing climate change and encouraging low-carbon growth.

Many governments, financial institutions and other stakeholders - including the IMF and World Bank - recognize the importance of scaling up private climate finance, especially in emerging markets and developing economies (EMDEs). One major obstacle to doing so is the lack of a robust climate information architecture, including data, disclosures, and taxonomies to identify low-carbon and transitional investments. Another problem is the proliferation of different approaches to climate-related investment information, which makes it hard to compare performance within and across different markets. A new joint report from the staff from the IMF, the World Bank and OECD, which also received input from BIS staff, suggests core design and disclosure elements for building this information architecture that could provide some comparability and could help reduce the risk of fragmentation in financial markets – and ultimately support the scaling up of low-carbon investment to close the significant climate financing gap.

Addressing the variety of alignment methodologies

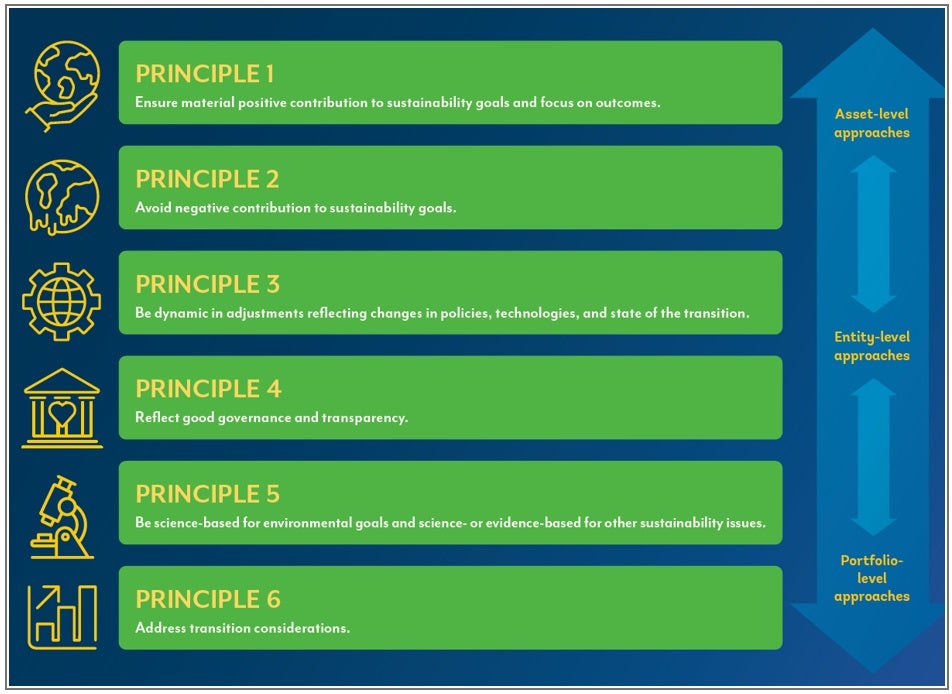

‘Alignment approaches’ refer to a variety of emerging frameworks designed to monitor and ensure global capital flows are contributing to the temperature goals of the Paris Agreement and the Sustainable Development Goals. These approaches use various tools—including taxonomies; scoring methodologies, disclosure frameworks; and transition-planning frameworks which are aligned with temperature objectives and other sustainability goals. In October 2021, the G-20 published a Sustainable Finance Roadmap that proposed six high-level principles on how to design these alignment approaches.

Alignment approaches are spreading globally at a fast pace, leading to a vast array of methodologies, objectives, and governance structures underpinning them. There are, for instance, around 40 taxonomies today. They can be applied in different ways — ranging from national and regional-level regulations to voluntary private sector-led initiatives and corporate-level practices – and for different purposes at different levels They each serve important purposes, including planning for the transition to a low-carbon business model and investment decision-making. These could be used at the asset, entity, or portfolio level.

This progress and innovation is welcome; however, a proliferation of approaches can lead problems of market fragmentation, increased transaction costs, data inconsistencies, and lack of market confidence. Diverging alignment approaches can prevent the financial sector from providing needed financing, pushing achievement of the Paris Alignment goals further away.

The report aims to increase understanding of alignment approaches, including how and when they can be used and how they link together. We provide technical suggestions – based on our respective experience and country developments - and emerging lessons on how to implement them.

This doesn’t mean there is only one approach. Alignment approaches may be developed for individual jurisdictions or at regional level, taking into consideration factors, such as the characteristics and maturity of the local market, regulatory context including mandates, national decarbonization policy priorities, and climate change mitigation financing needs. It is important to find the right balance between local market needs and the need for similar objectives across different markets, referred to as interoperability.

Key lessons and suggestions

Overall, alignment approaches with robust, credible, and science-based grounding tend to be more comparable and interoperable. They can be unified by the overarching goal of achieving similar real-world decarbonization outcomes, ensuring that alignment does not merely lead to a redistribution of greenhouse gas emissions among financial market participants.

Some of the lessons learned include:

- Taxonomies may be more useful with prioritization by sector, particularly those with high carbon intensity or exposure to transition risks and where funding gaps exist. Given the carbon-intensive nature of economies, alignment approaches need to identify and guide the financing of low-carbon alternatives to high-emitting activities. This is especially the case in hard-to-abate sectors, such as steel, cement, chemicals, heavy transportation. Sectoral decarbonization pathways—or standard roadmaps for change for particular industries—are a valuable tool that may be used at asset, entity, and portfolio levels.

- A robust foundation of Environmental, Social, and Governance (ESG) risk management can help avoid negative effects on other sustainability goals, such as just transition, nature, and climate change adaptation. The International Finance Corporation’s widely used standards for ESG due diligence and performance support convergence in disclosure and data availability, thereby reducing the cost burden for corporates and financial institutions.

- Alignment approaches should include all parts of the global economy — particularly small and medium enterprises (SMEs), women, and vulnerable groups. Inclusion can be considered during the design and maintenance of alignment approaches; in the criteria and metrics for assessing their success, for example the degree to which finance reaches SMEs, and in the risk management and safeguard criteria.

- Alignment approaches should be appropriate for EMDEs. Current approaches often overlook the need to accelerate the decarbonization of hard-to-abate sectors in these economies, and to improve the emission profiles for companies—large and small—which are key to supply chains.

Lessons on the good design of alignment approaches are emerging. Given the urgency of the challenge, we need to apply every tool in the box – but in a coherent way that allows international capital flows to build a low-carbon and climate-resilient economy. We hope the lessons in this report will give us just such guidance on how to all pull together towards this common goal.

Related

Report: Activating Alignment

Join the Conversation