In the sphere of sustainable development, financial innovation is not just an advantage—it's a necessity. The Development Bank of Rwanda (BRD) recently issued its first Sustainability-Linked Bond (SLB), setting several precedents along the way, including being the first development bank globally to do so. In Rwanda and around the globe, this groundbreaking move, backed by the World Bank, opens up new avenues for private capital mobilization and sustainable development. Let’s delve into why this is so significant.

Trillions of dollars of investment are required annually in emerging markets and developing countries to make adequate progress towards climate goals, to manage the risks of climate change, and to tackle poverty. The scale of this challenge requires the private sector to play a significant role alongside the World Bank and other development institutions.

For Rwanda, a country deeply committed to its own Vision 2050, the challenge is not just in meeting these lofty goals, but finding the financing to make it happen. The Development Bank of Rwanda is a key player in Rwanda’s quest for sustainable development. However, there’s a catch. Its traditional funding sources—namely, the Rwandan government and international institutions—are limited and often access is already stretched.

The World Bank as part of the Access to Finance for Recovery and Resilience Project supported BRD to issue their first ever bond in the local capital market. Based on a careful assessment conducted by the World Bank and BRD, it was decided that an SLB issuance ticked a lot of boxes for BRD as an issuer. SLBs are unique beasts in the financial jungle. Unlike other sustainable bonds, the proceeds of this issue are not set aside for particular projects, which is often a big impediment for smaller issuers to issue such bonds. Instead, SLBs incentivize borrowers to meet key performance indicators (KPIs) related to sustainable development by rewarding them with lower interest repayments. In the case of BRD, these KPIs include: Increasing environmental, social, and governance (ESG) compliance in the local financial sector, boosting funding to women-led projects from the current 15 percent to 30 percent of BRD’s portfolio and financing 13,000 affordable housing projects by 2028.

Game-Changing Credit Enhancement Mechanism

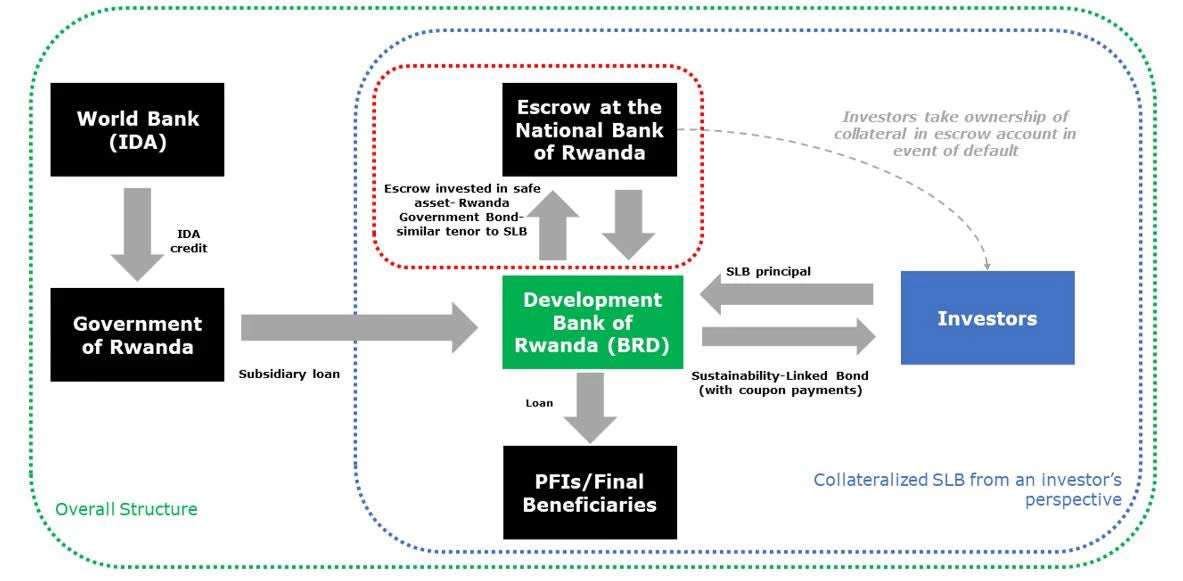

Perhaps the most striking feature of BRD’s SLB is its innovative credit enhancement mechanism. Instead of our typical approach of a line of credit (for USD 40 million), the Government of Rwanda used USD 10 million of IDA funds, made possible by the World Bank lending operation, to collateralize the bond, effectively reducing the risk for investors and lowering the cost of borrowing. This initial issuance begins with a RWF150 billion (USD 124 million) overall issuance program.

The Impressive Outcome

The bond was a hit. Not only did it open the path for BRD to diversify its funding sources away from government dependency, but it was also oversubscribed, drawing demand from 100+ different investors. Notably, the $10 million IDA financed credit enhanced issuance enabled the institution to raise three times the amount in funding from capital markets. This serves as an important signal for other potential issuers and contributes to building capacity in the domestic capital market. The bond raises funding for BRD in local currency, which reduces risks due to foreign exchange fluctuations.

Could this be a Blueprint for the Future?

Can we replicate the approach more broadly in Bank lending - can the $10 million leveraging $30 million in this example, be replicated with $100 million leveraging $300 million to stretch the per dollar outcomes of Bank financing, saving precious fiscal space for our clients? Can we instead talk in the billions? In our view BRD's inaugural SLB is more than just a bond issuance; it is proof of concept of how, by 'financing risk’ (see also New pathways towards mobilizing private capital) MDB and public funding can leverage multiples in private capital from financial markets for meeting the Sustainable Development Goals (SDG). Not only does this approach have the potential to be scaled up and replicated across low-income countries, but it also nudges the World Bank and other major players towards more innovative, impactful financing solutions.

Join the Conversation