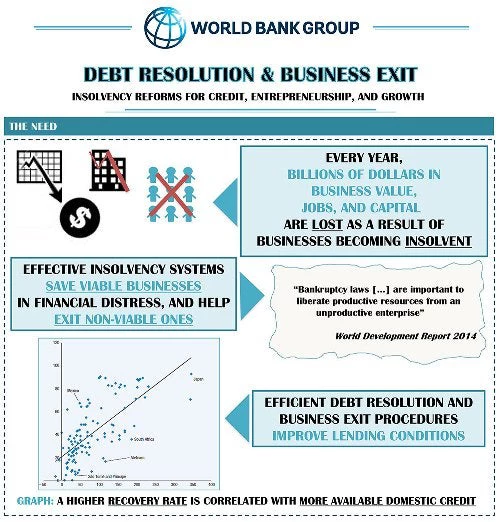

Yet, as a new publication by the Debt Resolution and Business Exit Program at the World Bank Group points out, insolvency is not just about the liquidation of failing businesses. Rather, effective insolvency frameworks also provide an orderly legal process for the reorganization of insolvent entities. As such, insolvency law helps save viable businesses, and allows failed businesses to “exit” the market efficiently and effectively, returning assets to productive use.

The recent World Bank Development Report 2014 notes that “bankruptcy laws […] are important to liberate productive resources from an unproductive enterprise and to ensure that creditors and potential investors in other enterprises are protected if a business fails.” Hence, effective insolvency systems bear the potential for enhancing access and availability of credit, increasing returns to creditors, preserving jobs, and fostering economic growth.

Click to view full infographic.

Sub-Saharan Africa is amongst the regions with the fewest insolvency reforms in the world. A business rescue culture is minimal here due to the lack of proper legal, regulatory, and institutional frameworks. As a result, banks worried about recovering their loans impose stringent collateral requirements on their borrowers, making it difficult for small entrepreneurs to obtain loans for their businesses.

Lwamba is one of many entrepreneurs in the region trying to start his own business. Educated and trained in mechanical engineering in Britain, he returned to his native country of Zambia to open an automobile repair shop. When he applied for a bank loan to purchase essential equipment, he was unable to meet the onerous bank loan requirements.

Watch the video below to learn more about Lwamba, and the need for effective insolvency systems for helping entrepreneurs like him.

Footnote: This video was produced in the context of the Africa Round Table, an annual flagship event between INSOL International and the Global Debt Resolution and Business Exit Program of the World Bank Group. The upcoming fifth Africa Round Table is themed around “ Jobs in Africa: How Insolvency Regimes Impact Economic Growth,” and is scheduled to take place in Kampala, Uganda on October 17-18, 2014. For more information, please contact Antonia Menezes ( amenezes1@ifc.org).

Join the Conversation