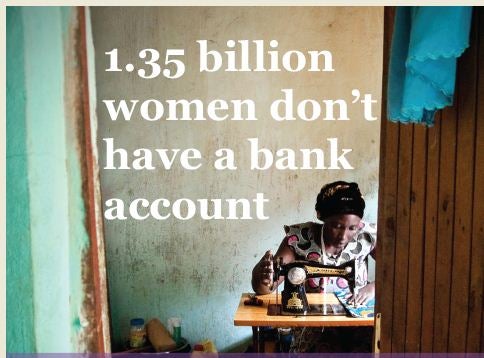

Last April 21, representatives from government, the private sector, and the financial inclusion world came together for Financial Inclusion Pathways for Women and the Poor. Panels covered a range of topics, including financial education, mobile banking and SME finance. But at the heart of all the discussions was the challenge posed by 2.5 billion unbanked people around the world –1.35 billion of them women. What actions can the public and private sector take to give the financially excluded—especially women who have the potential to transform economies-- access to finance?

Already, more than 35 countries have set targets and made financial inclusion commitments to improve access to credit, savings, electronic payments and remittances and to strengthen consumer protection and financial capability for its citizens. For its part, the World Bank has launched the Financial Inclusion Support Framework, which will help countries meet their financial inclusion targets with a combination of knowledge, technical assistance and financing. The new G20 Basic Set of Financial Inclusion Indicators, which covers access to and usage of financial services, will help countries measure and monitor progress towards their financial inclusion targets.

Through its Women’s Empowerment Initiative, Lebanon’s BLC Bank is offering an array of services—including access to capital, training and networking opportunities—to support women-owned businesses. Countries like Uganda are focusing on empowering women with the capability and information to manage their finances, which aligns with the G20’s focus on financial literacy under the Russian Presidency. According to Uganda Finance Minister Maria Kiwanuka, trainers are conducting sessions on business management and accounting in places like markets where many women work. This is a solution customized for a country where many women may not have the means or the time to seek out the knowledge they need.

Which brings me to my key takeaway from the day of discussions: The financial inclusion challenge may be global, but the solutions will need to be collaborative (between the public and private sector), innovative and customized to local realities. Alfred Hannig of the Alliance of Financial Inclusion said it best: “The unbanked community is very diverse; one size does not fit all when it comes to advancing financial inclusion.”

If you missed the event, you can check out the panels here.

Join the Conversation