There is growing evidence that outward foreign direct investment (OFDI) can increase a country’s investment competitiveness, crucial for long-term, sustainable growth. Some countries are thus using OFDI as a channel for new development and a catch-up strategy to acquire knowledge and technology, upgrade production processes, boost competitiveness, augment managerial skills, and access distribution networks.

Chinese firms are investing in renewable energy in Africa, where solar power in particular holds great potential. For instance, Chinese firm JingkoSolar opened a photovoltaic module factory in Cape Town, South Africa, in 2014, that produces unites like the ones pictured here.

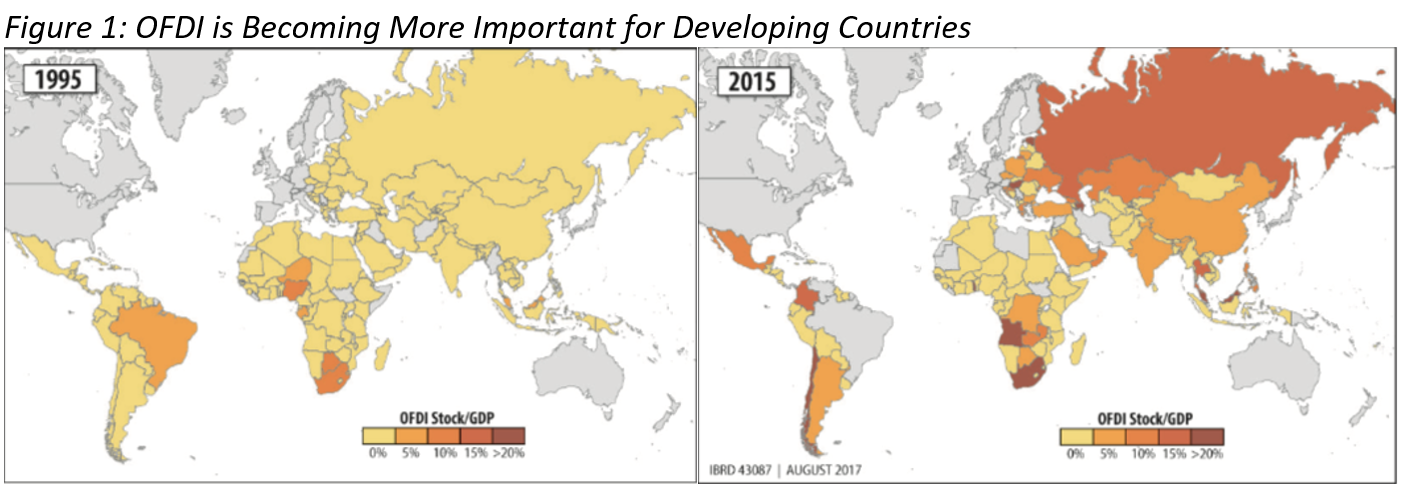

The first edition of the World Bank Global Investment Competitiveness report examined the rise of OFDI from developing countries. In 1995, OFDI from developing countries constituted just four percent of global FDI flows, while in 2014 this share reached a record 27 percent. As a result, the number of developing countries engaged in OFDI has notably increased. In 1995, 87 developing countries were engaged in OFDI, but many only marginally. Today, that number has risen to 109 countries, with 26 of these having an OFDI-to-GDP ratio of 10 percent or more.

In parallel, the number of host economies increasingly relying on OFDI from developing countries has also shot up. At the beginning of the 21st century, only 11 countries had at least half of their direct investment stock in the hands of developing country investors. By 2012, this number reached 55 countries, many of which combine high host market risk and low financial development. For these economies, attracting FDI from developing countries may therefore be one of their best options to raise investment, in the relative absence of FDI from advanced economies (often less willing to enter challenging investment climates) or non-FDI alternatives (portfolio investment or debt).

Note: The five color thresholds correspond to shares of OFDI stock over GDP that are 0-5 percent, 5-10 percent, 10-15 percent, 15-20 percent and greater than 20 percent. GDP = gross domestic product; OFDI = outward foreign direct investment.

What are the implications for development?

These findings are important given the growing body of evidence that OFDI can support developmental goals for source economies. The evidence, so far, is clearest with regard to innovation and exports. Regarding innovation, the evidence finds that OFDI can be used to source knowledge and technology not present in the home market (Amann and Virmani 2014). These knowledge effects can benefit not only outwardly invested firms, but also domestic firms in the home economy (Criscuolo 2009 and Mani 2013). Regarding exports, the evidence finds that OFDI can boost home country exports through complementary relationships, for instance by opening new export markets or increasing the demand for intermediate exports. Looking at Southeast Asia from 1981 to 2013, for example, a one percent increase in OFDI led to a $750 million rise in exports for the Philippines, $72 million for Singapore, $41 million for Thailand, and $31 million for Malaysia (Ahmad, Draz, and Yang 2016).

OFDI from developing countries can thus be used both as a ‘springboard’ and as a ‘stepping stone.’ When targeting developed markets, developing country firms use OFDI as a ‘springboard’ to acquire new capabilities (Luo and Tung 2007), in contrast to developed country firms, which generally exploit existing capabilities when undertaking OFDI. When targeting other developing markets, OFDI can be used as ‘stepping stone’ to first enter smaller, closer, and more similar economies (Arita 2013). Part of the reason may be the ‘institutional advantage’ that developing country firms have in other developing countries, given their experience operating in uncertain and corrupt investment climates (Cuervo-Cazurra and Genc 2008).

Policy considerations

The combination of these new data trends and empirical evidence suggests several policy considerations for developing country governments:

- Include OFDI in national development strategies, given OFDI’s potential role as a catch-up mechanism (Stephenson 2017);

- Review restrictions on OFDI, weighing costs and benefits, and ensure any restrictions are based on sound policy goals;

- Target growing OFDI from other developing countries, especially given that knowledge created in developing countries may be more adapted to the needs of other developing countries (Moran, Gorg, and Seric 2016, Deng 2010, Farole and Winkler 2014); and

- Boost absorptive capacity – such as through training programs, infrastructure provision, and network formation – as low absorptive capacity can limit positive OFDI home effects.

Developing country firms should be encouraged to venture abroad when they see market opportunities. Investing in foreign markets can promote learning, skills development, and capabilities formation likely to make these firms more successful in future corporate activities. This success can then lead to knowledge transfer, revenue generation, and upgrading in the home market. In today’s globalized world, OFDI is increasingly becoming an indispensable tool for firms to both maintain and increase their investment competitiveness.

Join the Conversation