Action on climate change is more and more important to the international community as a prerequisite for long-term sustainable development.

Small Island Developing States (SIDS) are particularly vulnerable to the consequences of climate change and natural disasters due to their remote locations along the Pacific, Indian Ocean, Caribbean, and Africa. To highlight the extraordinary challenges these nations face and their resilience, the United Nations has declared 2014 as the International Year of Small Island Developing States with the Third International Conference on SIDS currently held in Apia, Samoa, to further build partnerships for sustainable development. Increasing the financial resilience of SIDS to natural disasters is one key issue addressed.

Small States, Big Numbers

Disaster losses can have a severe impact on the economies of small island nations. In 2004, Hurricane Ivan hit Grenada, a state of only 133 square miles in size. It devastated the nations’ main economic driver, the nutmeg crop, and left two thirds of the population without sufficient housing. Total damages were estimated around US$900 million, equivalent to 200% of national GDP at the time. While Grenada’s experience is extreme, SIDS across the world have suffered disaster impacts which reached significant losses in terms of their GDP.

Since 2010, the World Bank Disaster Risk Financing and Insurance Program (DRFIP) has helped governments of SIDS find innovative ways to reduce the financial burden of natural disasters on the government budget, households, businesses, and agricultural producers. The Program was founded as a partnership between the World Bank, the Global Facility for Disaster Reduction and Recovery (GFDRR) and donor partners to bring together the Bank’s support in building financial protection against natural disasters within the broader disaster risk management and climate change adaptation agenda.

The Caribbean Catastrophe Risk Insurance Facility launched in 2007 is a good example. The first ever multi-country risk pool was set up by 16 Caribbean countries with support of the World Bank and now provides member governments with immediate liquidity following disasters. So far, it has made eight payments for more than US$32 million, all within 14 days of the triggering event.

Learning from the experience of the Caribbean, in 2013, Tonga, Cook Islands, Marshall Islands, Samoa, Solomon Islands and Vanuatu established the Pacific Catastrophe Risk Insurance Pilot program as one component of the Pacific Catastrophe Risk Assessment and Financing Initiative (PCRAFI). Working together, these nations are now pooling their country-specific risks into one, better-diversified portfolio, helping improve budget flexibility and strengthening early disaster response. Earlier this year, Tonga was the first country to benefit from a payout of the pilot when it received US $1.27 million for recovery after Cyclone Ian swept across Ha’apai Island in January.

Better Risk Information for Comprehensive DFRI Strategies and Smarter Investments

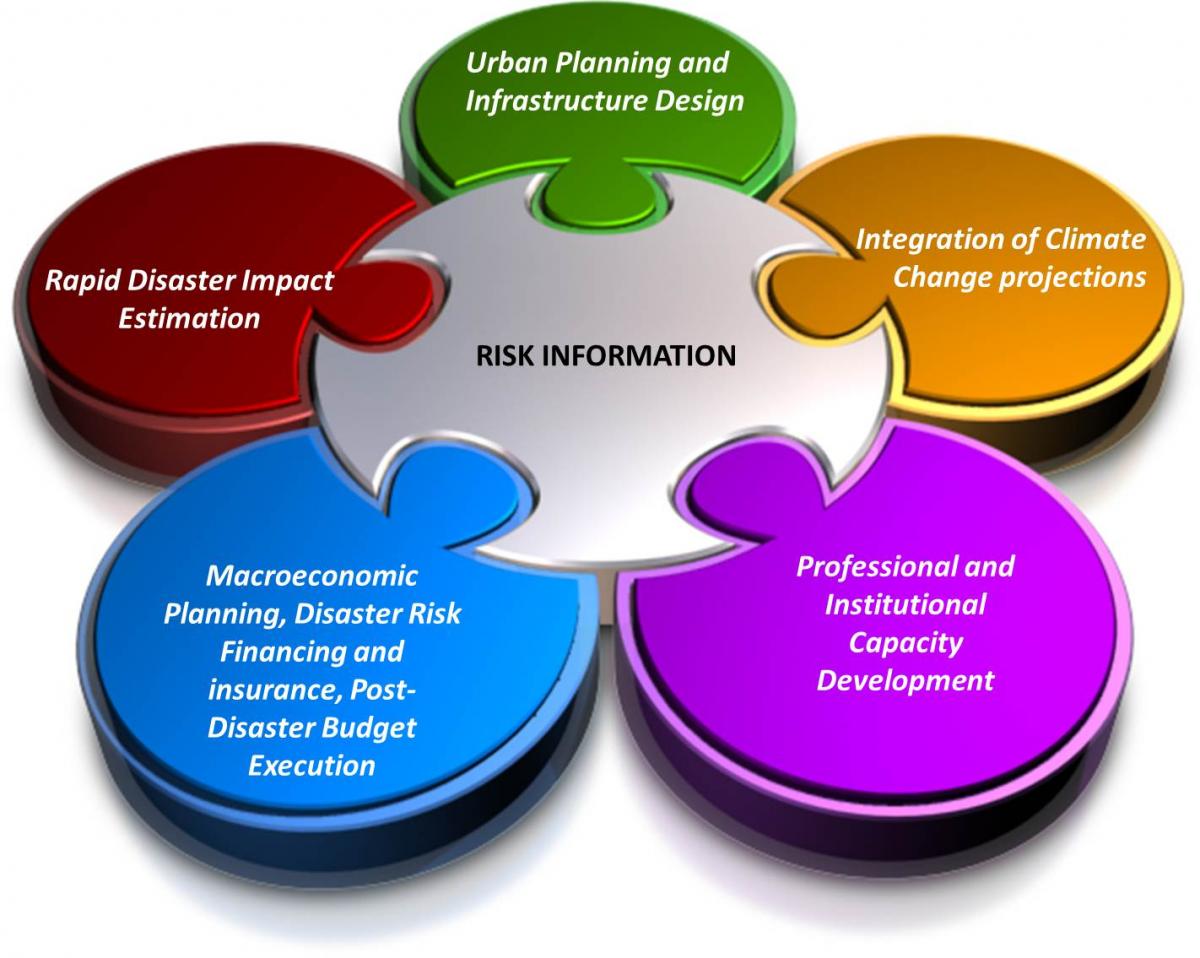

Yet we must not forget that financial protection complements, but does not replace, risk reduction. DRFI initiatives need to be integrated into wider disaster risk management strategies. One common element bringing these two aspects together is the need for appropriate disaster risk data. A robust understanding of natural disaster risks – particularly in terms of economic losses – and good data on hazards, exposure and vulnerability is critical for financial protection. Maps combining these components offer a powerful way of showing the spatial dimensions of disaster risk, as well as the underlying factors often hidden from policymakers when data about exposure and hazard are not available. For example, the maps representing the risk profile for the South Pacific nation of Vanuatu show the tropical cyclone and earthquake hazards, distribution and value of public and private infrastructure, and the average annual loss in each administration unit.

Information often gathered for DRFI can also support the areas relevant to helping SIDS decrease the risk and impact of natural disasters, such as land use planning, and early warning systems.

Risk financing initiatives have often provided the incentives to invest in gathering the required data as those data are critical to price risk financing solutions such as catastrophe risk insurance policies and ultimately transfer those risks to the capital markets. But investing in detailed risk data yields payoffs far beyond enabling better decisions in financial protection. The same information can help governments, the private sector, communities, and individuals make informed decisions in reducing their risk.

What’s next?

As the UN conference in Samoa shows, SIDS are more and more taking the lead in finding innovative ways of working together to develop regional solutions for problems facing their economies. The DFRI program aims to further foster this leadership and support SIDS in strengthening their financial resilience towards natural disasters, developing national DRFI strategies to be further enhanced through regional cooperation. Moving forward and based on those recent experiences, international partners should explore the establishment of a dedicated contingent credit facility for the SIDS in order to support them to build an integrated DRFI strategy relying on national reserves, contingent credit and catastrophe risk insurance. This could build on the Small Island States Resilience Initiative announced by the World Bank at the summit.

Join the Conversation