In 2020 – during the first year of the Covid 19 pandemic-- economic activity contracted in more than 90 percent of countries, surpassing the Great Depression and both World Wars. The world economy shrank by approximately three percent, and global poverty increased for the first time in a generation. Recently a World Bank team had the opportunity to present the “World Development Report 2022 “Finance for an Equitable Recovery” in the Kyrgyz Republic and discuss key implications with policymakers, financial regulatory and supervisory authorities, and academics at the Bishkek Economic Forum, at the National Bank of Kyrgyz Republic, and the American University of Central Asia.

Governments and regulators worldwide implemented a swift and ambitious economic policy response that included a wide variety of fiscal, monetary, and financial sector policies aimed at limiting the worst immediate economic impacts of the crisis. The Government of Kyrgyz Republic was no exception. The National Bank of Kyrgyz Republic introduced regulatory forbearance measures to support the financial sector. These policies successfully stabilized the economy and provided temporary relief to households and businesses facing dramatic income losses due to the crisis.

However, now – more than two years after the onset of the pandemic – policymakers around the world must balance providing continued support to households and businesses confronting new challenges, such as the global rise in inflation and the war in Ukraine, while gradually scaling back support programs to limit longer-term risks to the recovery, such as over-indebtedness and threats to financial stability.

The World Development Report 2022 recommends four priority policy areas that governments and regulators should act on now to mitigate longer-term risks to an equitable recovery.

1. Managing and reducing financial distress

Restoring credit market transparency and resolving financial distress is urgent to ensure banks can continue to lend.

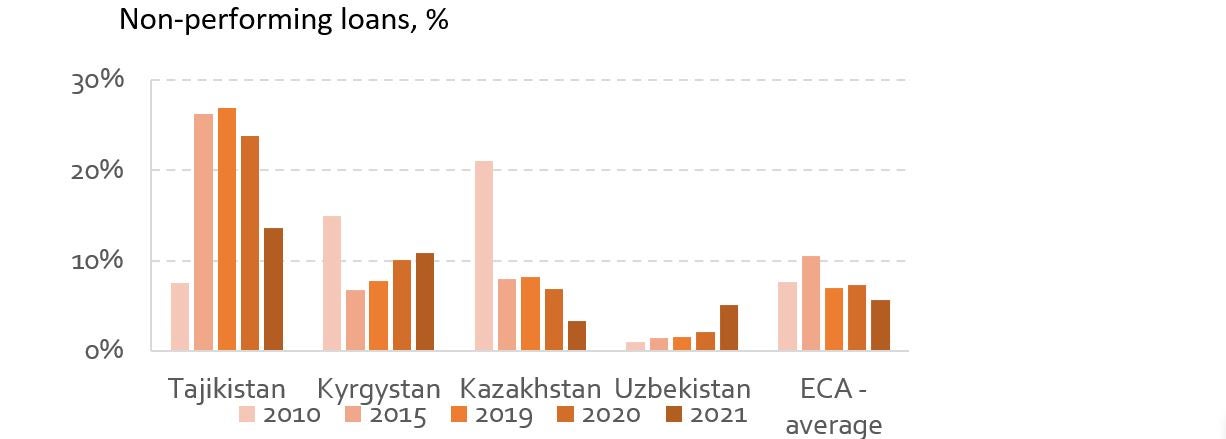

While financial regulators in Europe and Central Asia started withdrawing regulatory forbearance measures in 2021, the Kyrgyz Republic was one of the last in the region to do so. The special forbearance measures were removed in September this year, while the remaining temporary measures will be withdrawn by the end of the calendar year. Although Kyrgyz commercial banks appear well capitalized, the coming year will require close monitoring of non-performing loans that reached 13 percent in July 2022, the highest since 2010 when the Kyrgyz revolution caused a deep economic downturn. Bank supervisors must be prepared to take action, including enhanced measures for banks dealing with asset quality deterioration.

2. Improving the legal insolvency framework

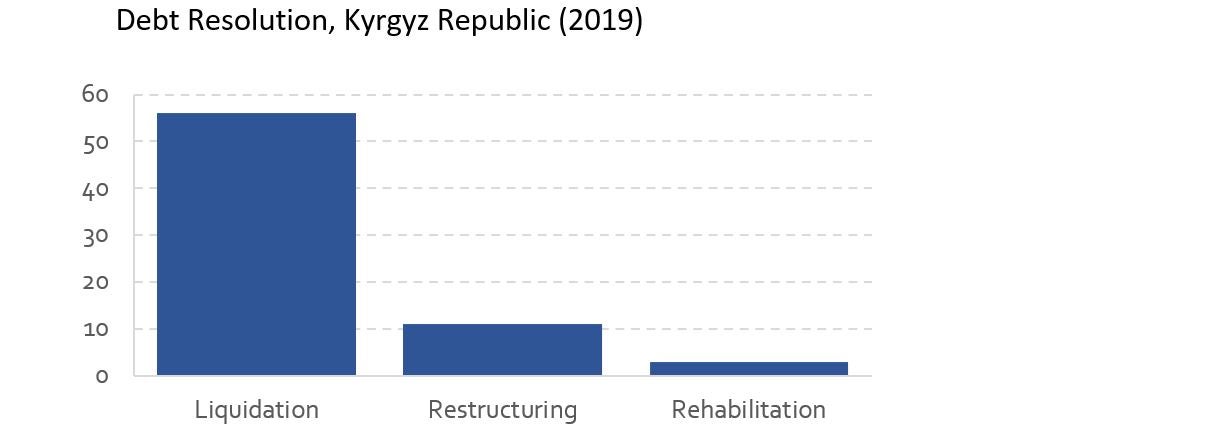

Effective bankruptcy procedures allow households and businesses to discharge unsustainable debts accumulated during the crisis. Unfortunately, many countries still lack effective insolvency institutions. In the Kyrgyz Republic, going bankrupt is still a stigma due to a liquidation-oriented insolvency regime. While the Bankruptcy Law provides for several reorganization procedures, such as rehabilitation, none of these are commonly used in practice. Effective insolvency systems should aspire to strike a careful balance between liquidation and reorganization, and special simplified procedures and alternative out-of-court workout mechanisms should be established for micro, small, and medium enterprises (MSMEs) that cannot handle complex processes and pay high legal fees.

3. Ensuring continued access to finance

For households and businesses to recover, they need continued access to finance to cope with unanticipated economic shocks and to invest in new opportunities. The Business Pulse Survey (2022) reveals that 87 percent of firms in the Kyrgyz Republic face increased production costs, much higher than Tajikistan and Uzbekistan, due to more inputs sourced from Russia. About one-third of the firms face the need to adjust their credit or decrease their debt burden. While there was overall credit growth in 2021-2022, partly thanks to the government support programs, the risk premium has increased. Market-friendly instruments can be effective, such as the portfolio-based partial credit guarantee scheme launched in January 2022 with the support of the World Bank, which is facing high demand.

4. Managing increased levels of sovereign debt

Sovereign debt increased sharply because of the collapse in tax revenues and the dramatically increased spending needs for the pandemic response. The Kyrgyz Republic saw a 20 percentage point increase, which is very large but not an outlier compared to other countries globally. As evidenced by past crises, delaying the resolution of debt sustainability issues is often a precursor to prolonged economic crises and periods of high inflation. This can worsen the regressive effects of the crisis by reducing the state’s ability to spend on social security, health, and education. As with private debt, recognizing and addressing debt sustainability issues promptly and without delay is crucial - not only to ensure a return to economic growth but also to counteract the dramatic effects of the crisis on poverty and inequality.

Join the Conversation