Let me start by sharing a telling anecdote: “At her first job in Tokyo in the 1970s, Ms Yukako Uchinaga hid in the ladies' room every day at 8pm while an inspector made sure all female employees had gone home. Then she came out and put in more hours. "My boss used to say, 'I don't want to be put in jail'," said Ms Uchinaga … referring to a labor law that capped women's overtime at two hours a day. "I complained it was unfair, like being in a 100-metre race with my hands and feet tied while all my male colleagues ran freely.”

Let me start by sharing a telling anecdote: “At her first job in Tokyo in the 1970s, Ms Yukako Uchinaga hid in the ladies' room every day at 8pm while an inspector made sure all female employees had gone home. Then she came out and put in more hours. "My boss used to say, 'I don't want to be put in jail'," said Ms Uchinaga … referring to a labor law that capped women's overtime at two hours a day. "I complained it was unfair, like being in a 100-metre race with my hands and feet tied while all my male colleagues ran freely.”

According to Bloomberg, women occupy just 1 in 70 management positions at Japanese companies.

And according to the World Bank Group's Enterprise Surveys, which collect firm level data across 125 economies, only every fifth firm has a female as top manager. Even top tier Fortune 500 companies are not so balanced in gender parity with only 18 out of 500, or 4 % of their top executives being female.

Why?

Women don’t have enough time to climb the corporate ladder.

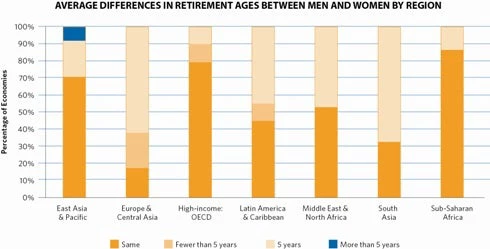

According to the World Bank Group’s report Women, Business and the Law 2012 the retirement age for women comes earlier than for men in 52 economies (out of 141 covered). But, there is no economy, where the retirement age for men is earlier than for women. Moreover, according to the same report women cannot work the same night hours as men in 44 economies. Meanwhile, the average number of days mandated by law for maternity leave is 106, while the average number of days mandated for paternity leave is only 3. The Math is self-evident.

There are 11 economies where women must retire at an earlier age than men. These economies are: Algeria, China, the Democratic Republic of Congo, Croatia, Israel, the former Yugoslav Republic of Macedonia, Mauritania, Mozambique, Romania, Saudi Arabia, and Uzbekistan. In one-third of the economies covered by Women, Business and the Law, the retirement age for women is 5 years earlier than that for men. In China, women are scheduled to retire 10 years earlier than men if they are in non-managerial position and 5 years earlier if they are managers. Statistical analysis shows that in economies where the retirement age for women is lower than for men there are fewer female top managers in firms.

A similar situation persists regarding pensionable ages, that is, the age at which individuals can claim pension benefits. The only economy where the pensionable age is effectively higher for women than for men is Saudi Arabia—with a difference of 5 years. This is because men have to accrue 25 years of work experience before qualifying for pension benefits. Assuming a man starts working at the age of 25, he becomes eligible for pension benefits at the age of 50. However, Saudi women can only claim benefits at age 55, regardless of the number of years of work experience.

Here is a regional overview of the average differences in retirement ages for men and women from the newly released Women, Business and the Law note “Mapping the Legal Gender Gap in Getting a Job.”

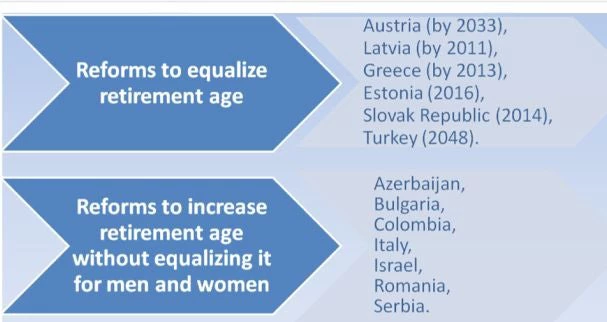

Mandating earlier retirement ages for women is ironic because on average women tend to live longer than men. Well, jokingly, maybe women live longer, because they work less. But on a serious note, mandating earlier retirement and pensionable ages may cause women to have a longer retirement with a smaller pension. The good news is that the situation is changing and some economies are gradually equalizing the retirement age for men and women. This reform is coupled with a raise in retirement ages overall, as a response to increasing life expectancy. Some economies, like Greece, were forced by their fiscal situation and the financial crisis to increase their retirement age for all. Greece is also in the process of leveling the retirement age for men and women.

That said there are also economies which are increasing the retirement age, but are not removing gender differentiation.

Earlier retirement for women does not only affect career prospects, but also lifetime earnings, pension benefits and retirement savings. With increased life expectancy and a tight fiscal situation in some economies, equalization of the retirement ages for men and women makes ‘smart economics’.

Join the Conversation