The Saldanha steel plant is a unique asset to kickstart hydrogen production in South Africa.

The Saldanha steel plant is a unique asset to kickstart hydrogen production in South Africa.

Read the full report: Creating a Green Marine Fuel Market in South Africa

South Africa has the potential to become a leading producer of green hydrogen. Green hydrogen will be in high demand as countries aim to reduce carbon emissions, especially in sectors like transportation and heavy industries. The country is actively pursuing the Hydrogen Economy as a strategic development opportunity, aiming to capture a significant share of the global hydrogen market thereby generating economic growth and jobs . The Hydrogen Economy is projected to contribute 3.6 percent to South Africa's GDP and create 380,000 jobs by 2050. The country is attracting private sector interest in green hydrogen projects, solidifying its position as a hydrogen investment destination.

The maritime sector can kickstart this new industry by being a consumer and enabler. Deep-sea shipping, being globally regulated, can provide stable demand for green hydrogen. To reduce the shipping fleet's carbon footprint, around 64 percent of its fuel mix is projected to be hydrogen-based by 2050. Green ammonia or methanol are the most promising hydrogen-derived fuels for ocean-going ships. For the sector to meet its 2030 target, five million tons of green hydrogen would be needed for shipping alone. Seaports will need to supply green fuels to ships and serve as clean energy hubs for the export of molecules. Currently, 40 percent of fossil-based fuels are handled in ports, and 20 million tons of ammonia is traded on ships every year.

With support from the Public Private Infrastructure Advisory Facility (PPIAF) and PROBLUE, the World Bank’s blue economy program, the Bank has assisted South Africa in exploring the requirements for establishing green marine bunker fuel value chains at the ports of Saldanha and Boegoebaai. The study revealed that supplying ammonia as ship fuel in Boegoebaai, Saldanha, and Cape Town will require up to 120,000 tons of green hydrogen by 2035. Additionally, both projects have the potential to develop into green hydrogen hubs, each offering a unique value proposition.

Shipping is a key sector for the hydrogen economy, which can create up to 380,000 jobs in South Africa. Photo: Shutterstock

In the Saldanha study case, around 1.6 gigawatt (GW) of renewable energy would be needed to produce 50,000 tons of green hydrogen annually, which is equivalent to 280,000 tons of green ammonia. Out of the estimated capital expenditures of around $2 billion, 66 percent is allocated to investments in solar farms and wind turbines. These investments are crucial for obtaining the "social license” for green hydrogen, adding affordable generation capacity to the energy grid.

A two-hour drive from Cape Town, the port of Saldanha is an ideal location to aggregate demand from multiple hydrogen users, which can help to reduce investment risk. For example, the conversion of the mothballed Saldanha Steel plant to run on green hydrogen shows promise. This project has the potential to become one of the largest first-mover projects in Sub-Saharan Africa, creating over 8,000 direct and indirect jobs in the next few years. By 2027, the facility could start producing green direct reduced iron (DRI) for the European steelmaking market.

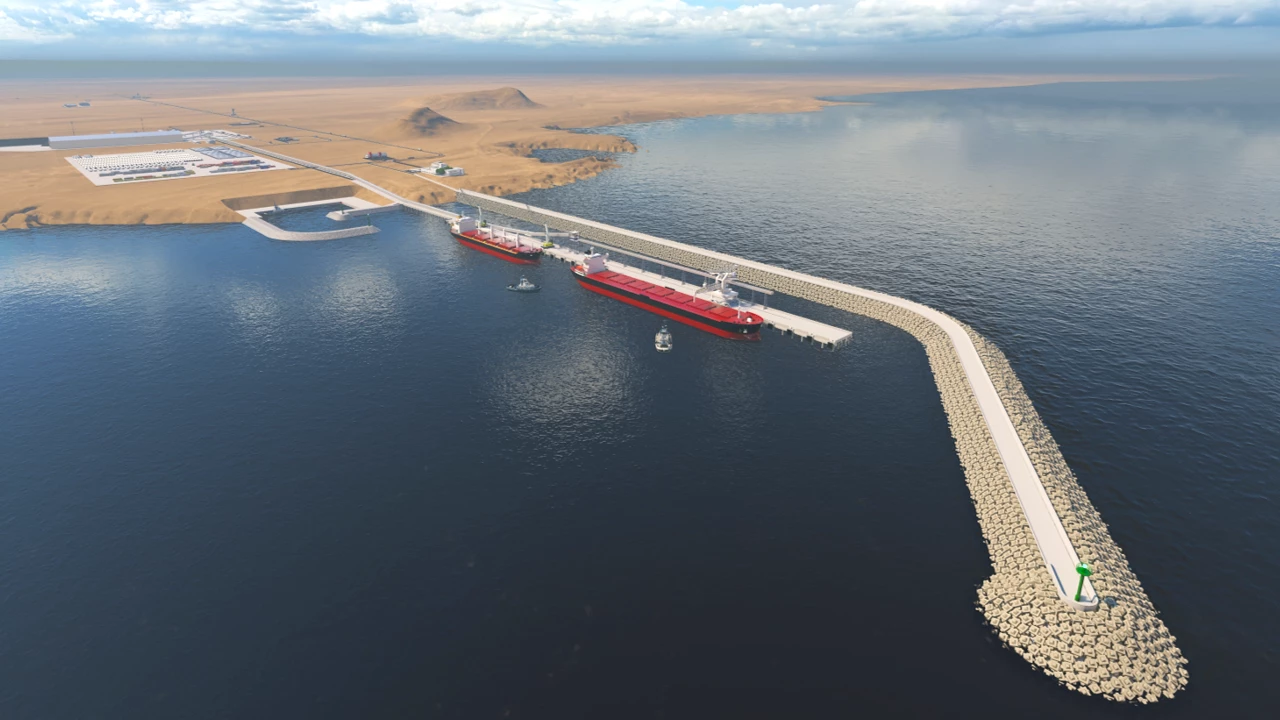

The Boegoebaai mega project in contrast will boost the country’s position as a mega exporter for green molecules. The Northern Cape provincial government has set out an ambition to develop 40 GW electrolysis capacity, producing around four million tons of green hydrogen annually. This will require around 80 GW of renewable energy. Boegoebaai, located 20 kilometers south of the Namibian border, offers ample available land for the gradual expansion of solar parks and wind farms. The site provides favorable conditions for developing a vertical hydrogen value chain, including domestic production of photovoltaic modules and electrolyzers.

Mining contributes 28 percent to the Northern Cape's GDP. The new port at Boegoebaai will not only facilitate the export of green molecules but also enable cost-effective export of minerals like manganese, a critical mineral for the energy transition. South Africa is the largest manganese producer, serving around 25 percent of global demand.

The port of Boegoebaai combines two of South Africa’s major strengths: Minerals and Green Hydrogen. Image: NCEDA/PRDW Consulting Port and Coastal Engineers

Both Saldanha and Boegoebaai account for a pipeline of hydrogen projects registered as Strategic Integrated Projects (SIPs). SIPs are projects of great economic or social importance to the country and receive expedited approval and shorter delivery timeframes. South Africa has around 20 projects linked to green hydrogen across the country, including many projects in other provinces. Recently, the three Cape provinces signed a memorandum of understanding to foster collaboration and synergies in the development of green hydrogen.

The Hydrogen Economy presents a significant opportunity globally, but the cost-competitiveness of green hydrogen compared to fossil-based alternatives is a challenge. Green hydrogen projects require access to affordable capital, which is scarce in emerging economies despite their favorable solar and wind resources. The bankability of projects is complicated by the reliance on long-term contracts and the absence of a global spot market. Only around 10 percent of announced projects have guaranteed offtake, and the price of green fuels is not yet competitive with oil-based alternatives. De-risking early mover projects is crucial, and unique demand sources like global shipping can help achieve that. As a truly maritime nation, South Africa has lots to offer.

Read about how South Africa can create a market for alternative marine fuels here.

Join the Conversation