The recent Transforming Transportation 2019 conference paid a great deal of attention to the applications and benefits of AFC, which have been at the heart of many World Bank and IFC-supported urban mobility projects.

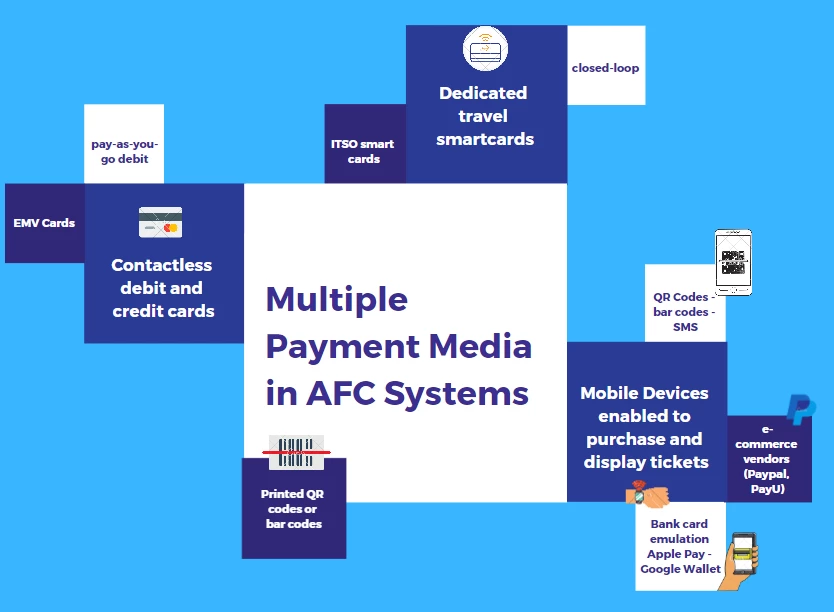

For users, the development of AFC is a critical step toward making public transport more efficient, affordable, and accessible. The keywords here are integration and interoperability. AFC systems are now becoming compatible with an ever-increasing number of payment methods besides smart cards —near-field communication devices (including smartphones), debit and credit cards, e-commerce platforms (e.g PayPal, AliPay), and even printed QR codes and SMS, opening the way for integration with other transport services such as bikeshare schemes, paratransit, or even carpooling services.

Going beyond ticketing, AFC systems generate a wealth of anonymized data, fostering private-sector led innovations looking at improving service provision, customer experience, integrating services and making transaction processing more robust and efficient. For example, AFC data combined with Automatic Vehicle Location (AVL) data is an increasingly common resource for planners to understand mobility patterns better, identify underserved areas, deficiencies in ticket recharge network coverage (blackout areas), and are helpful when tackling potential fraudulent behaviors (fare evasion).

Decisions, a vision, and three dimensions: The rise of AFC holds great promise for public transport users. But the deployment of this technology can be overly complex, hard to future-proof, and, if left unchecked, expensive. To get this right, decision makers need to come up with a clear vision, making sure their integrated ticketing system meets a number of key criteria: the system should be interoperable, flexible, secure, and scalable, should be developed under a city-owned standard, and prevent captivity on single providers. The following three dimensions can be particularly useful in realizing this vision:

1. Institutional setup: Before going into the detailed design of an AFC, designate a lead institution in charge of the decision making for the entire transport system. This institution should champion the planning and implementation of an integrated AFC project, representing the interests of the public, and reaching agreements with AFC technology companies and transport operators. To facilitate this, international norm ISO 24014-1 on interoperable fare management systems for public transport provides a clear, actionable roadmap.

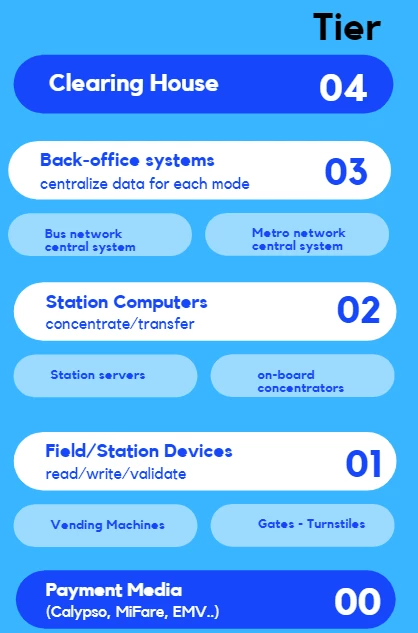

2. Technical dimensions: Getting the standard right. To develop a flexible ticketing system that can be readily expanded to all modes across the city, the lead institution needs to focus on generating a publicly-owned standard defining how transactions are processed at each of the 5 tiers of AFC (see figure below). This is referred as the interoperability standard, and is the key for integration between modes, operators and technology providers. A comprehensive standard should include clear provisions on:

- Payment methods

- The interaction between payment methods and readers at stations and in buses;

- The interaction between central systems (for each transport mode) and the central clearing house (i.e. where all AFC transactions are settled and paid)

- Data security across the entire system.

By allowing seamless integration between transport modes and payment mechanisms, interoperable AFC systems are one of the main factors behind the emergence of Mobility as a Service (MaaS)—a new model that allows citizens to use one account to access a variety of commuting options, including mass transit, pooled and shared services, feeder systems for first-mile/last-mile connectivity, etc. As cities continue to modernize fare collection and rethink the way people move around, what other recommendations do you think are worth discussing?

Learn more:

- Public Transport Automatic Fare Collection Interoperability: Assessing Options for Poland (World Bank, 2016)

- Interoperability between fare collection systems on public transport in Latin America and the Caribbean (Inter-American Development Bank, 2018 – in Spanish)

The views reflected on this blog do not necessarily reflect the views of the World Bank, or any of the registered speakers during Transforming Transportation.

Join the Conversation