Somalia’s economy is reeling from COVID-19 shocks, alongside the pre-existing structural challenges from conflict, climate change and a recent locust plague. The latest World Bank Somalia Economic Update, however, projects gross domestic product (GDP) growth to reach pre-COVID-19 levels of 3.2% in 2023, thanks largely to improved remittances and aid inflows.

Improvement is cautiously manifested in the formal private sector, as revealed by the third wave of the COVID-19 (coronavirus) Follow-up Enterprise Survey, a sequel to previous rounds of survey summarized here and here. These surveys are conducted through a partnership between the World Bank, the International Finance Corporation (IFC), Somalia’s Ministry of Commerce and Industry, the Somalia Chamber of Commerce (MoCI) and the United Nations Industrial Development Organisation (UNIDO).

The third round of the survey was conducted in August-September 2021, focusing on registered businesses with at least five employees each in the cities of Mogadishu, Baidoa, Beledweyne, Bosaso and Kismayo. In Mogadishu the survey widened its sample to include micro-enterprises with less than five employees. The three rounds of survey sequentially covered 550, 494 and 500 firms, respectively.

Results

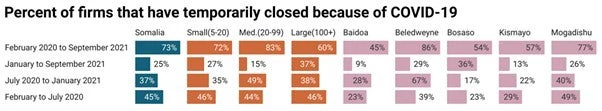

A year and half since the onset of the pandemic, the survey shows that business closures have become less severe. Overall, seven out of 10 formal businesses with 5+ employees suspended operations at least once, between February 2020 and September 2021. Consistent with easing up of the COVID-19 related restrictions, the rate of temporary closure has been declining, although at an uneven pace across regions and firms.

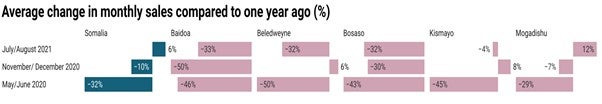

There have been some positive signs in sales recovery. After contracting by almost a third in the early periods of the crisis, year-on-year change in monthly sales, on average, is positive during the third wave of the survey. It is however important to note that the improvement is compared to a period when Somalia was already experiencing the impacts of COVID-19 (i.e., June/July 2020). The improvement is also uneven across regions, revealing the existing vulnerabilities.

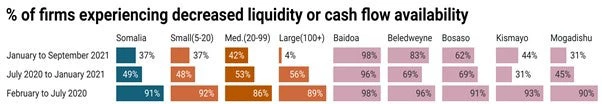

Measures of the financial health of businesses also show improvement, albeit unevenly across regions. The share of businesses facing liquidity and cash flow shortages has declined from 49% during the round 2 survey to 37% in round 3. Mogadishu and Bosaso declined consistently in liquidity and cash flow shortages since the first round of the survey. However, the remaining three cities saw an increase in round 3.

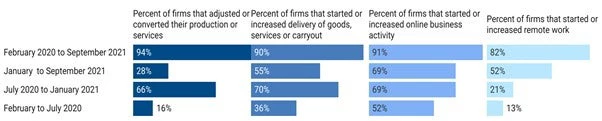

This survey also reveals the agility and adaptability of the firms to the new business environment, precipitated by COVID-19. Share of firms leveraging technology (i.e., through e-commerce and remote working arrangements) increased consistently through the survey. From the onset of the pandemic to September 2021, 94% of Somali businesses adjusted their products, or services. Leveraging the growing penetration of mobile money and e-commerce, accelerated by the need for contactless interaction, about 90% of surveyed firms had started, or increased, trade and delivery of goods and services since the pandemic. While we lack data to determine the content and significance of these adjustments, the rate suggests that these could have potential long-term positive impacts on business.

Amid these positive signs, cuts to workforce and working hours continue to be pervasive for formal firms. In July/August 2021, 40% of these firms reported reducing working hours, compared with the same month in 2020. Similarly, between January and September 2021, 47% of firms reported reducing the number of permanent workers, while 43% reduced temporary workers. Notably, by September 2021 full-time permanent employment in established and formally registered businesses contracted on average by 48% compared to February 2020.

Government support to businesses remains very limited. Between February 2020 and September 2021, only 3% of businesses received support from either local or national government to mitigate COVID-19 crisis. Less than 1% of the firms received such support between January and September 2021. Some 60% of businesses relied on bank and non-bank financing to bridge liquidity challenges, while 20% deferred payments in a bid to stay afloat.

A resilient outlook?

Businesses in Somalia remain broadly optimistic about rebound prospects in the medium-term, buoyed by mobile phone technology and non-bank financing. Businesses, particularly in Beledweyne and Mogadishu, were bullish in their sentiment that sales would improve (74%). Further, 72% expected workforce growth, a pointer to the fact that most are projecting a rebound in business in the months ahead.

The survey results continue to inform World Bank Group projects in Somalia. For example, the findings informed the design of the World Bank COVID-19 response operations, including additional financing for the Somalia Capacity Advancement, Livelihoods and Entrepreneurship through Digital Uplift Project. The project aims to expand access to finance to support the recovery of viable but vulnerable micro, small and medium enterprises in targeted productive sectors, with special focus on women-owned and -managed businesses.

The survey has also informed the Somalia Investment Climate Reform Project II (SICRP2) managed by IFC to sharpen focus by targeting micro and small traders who were adversely impacted during the pandemic. The project provided continued support to the Ministry of Commerce and Industry to disseminate update-to-date trade regulatory information to traders through the Somalia Trade Information Portal. The World Bank and IFC have also jointly supported the implementation of the online business registration and licensing system launched in March, which helped businesses impacted during COVID-19 to obtain faster and more efficient government services.

Anonymized micro-data for round 1, 2 and 3 surveys can be downloaded freely from Enterprise Surveys website.

Join the Conversation