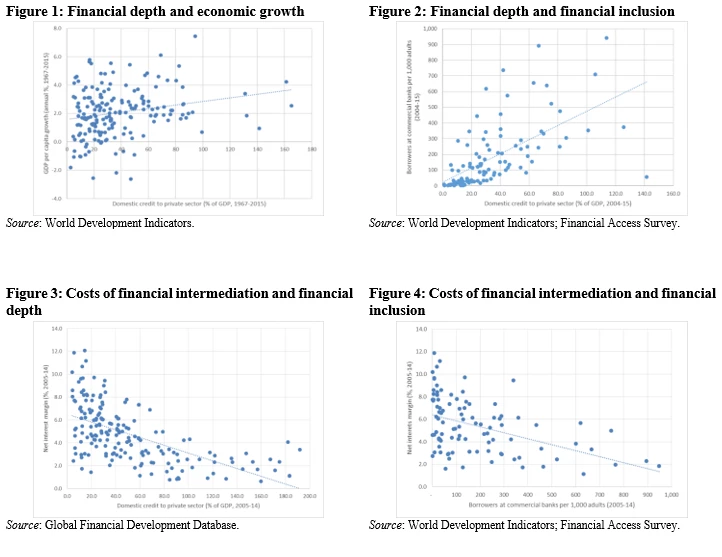

Bank financial intermediation plays a critical role in sustainable and inclusive growth. There is a considerable body of evidence showing that the extent to which an economy is making use of banking intermediation is not only associated with economic growth (Figure 1) and broader access to financial services (Figure 2) but it is a causal factor in explaining overall economic performance (see, for example, Levine, 2005), poverty reduction (e.g., Beck et al., 2007) and reduced inequality (e.g., Demirgüç-Kunt and Levine, 2009).

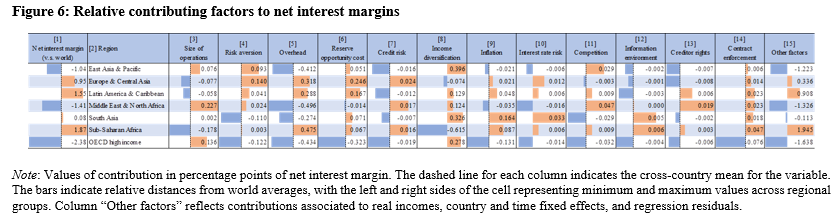

The costs associated with financial intermediation have an important bearing on the depth and breadth of the banking system. High costs of financial intermediation are associated with credit rationing and thus a lower level of credit channeled to borrowers (Stiglitz and Weiss, 1981). The interest spread, i.e., the difference between the lending rate and the deposit rate, is a commonly accepted measure of how costly financial intermediation is for a society. Countries with lower intermediation spreads experience higher levels of financial development (Figure 3) and higher penetration in the use of financial services (Figure 4).

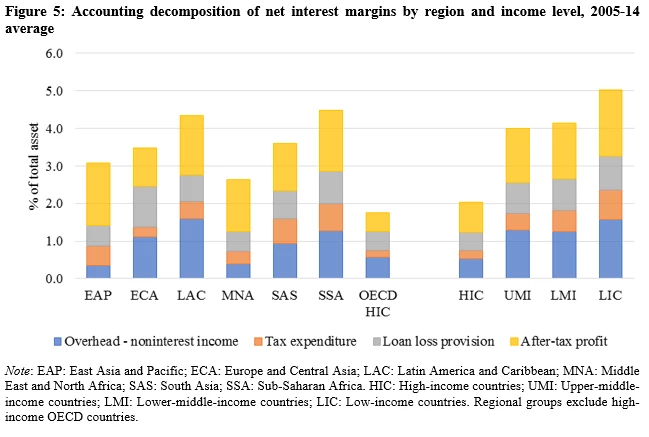

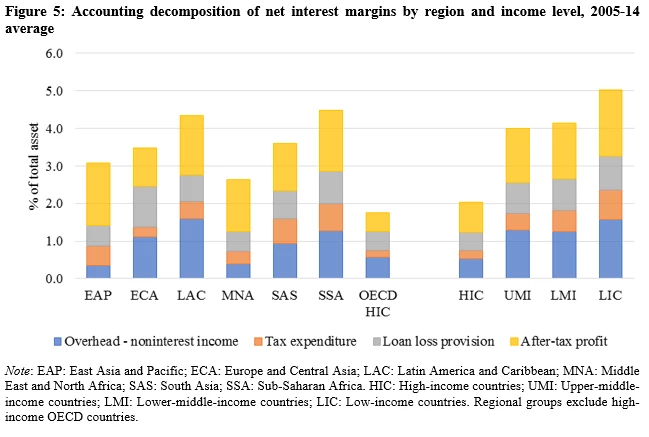

In a recent paper coauthored with Nan Zhou, we investigated the determinants of bank net interest margins – used as a proxy for financial intermediation costs – in 160 countries using a panel of more than 14,000 banks during 2005-14. First, we used an accounting decomposition framework to provide summary statistics on the size of net interest margins and to highlight the cost and profit components in countries, regions and income groups. The analysis provides evidence that the costs of financial intermediation are negatively associated with income levels: net interest margins are significantly higher in lower income countries. On the other hand, a regional focus shows that costs of financial intermediation are especially high in Latin America and the Caribbean (LAC), and Sub-Saharan Africa (SSA). Accounting decomposition of net interest margins indicates that higher margins in lower income economies, LAC and SSA are mostly explained by higher overhead (probably reflecting low economies of scale and low productivity), higher credit risk (which may reflect a weaker environment) and greater bank profitability (which may be due to low market competition). Figure 5 shows the results for regional and income groups.

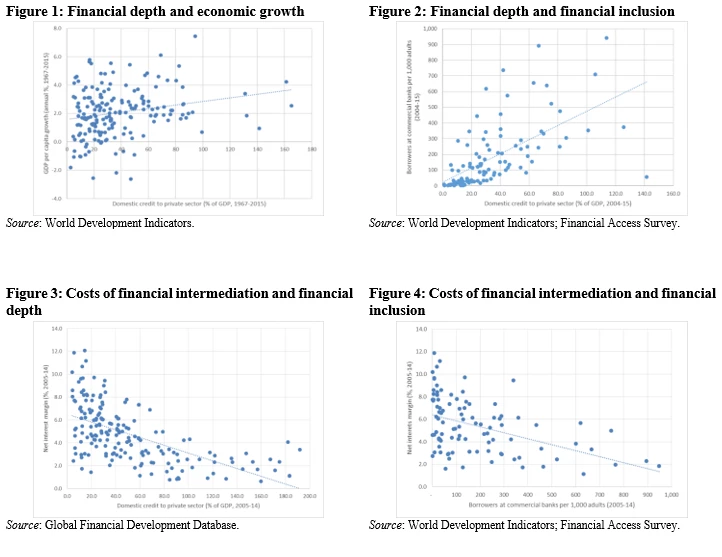

Second, we used regression analysis to examine underlying bank-level, structural, macroeconomic and institutional determinants of net interest margins. The econometric analysis shows that higher intermediation spreads are significantly associated with larger lending operations, higher risk aversion, higher opportunity costs arising from reserve requirements, higher overhead, higher credit risk, lower competition, higher interest rate volatility and higher inflation. In general, the impact of these variables is stronger in less wealthy economies. We also find suggestive evidence that a relatively underdeveloped credit infrastructure negatively affects net interest margins across countries: deficiencies in the contractual and information frameworks are associated with higher intermediation spreads. However, the estimated impact of institutional variables is largely absorbed by country-fixed effects.

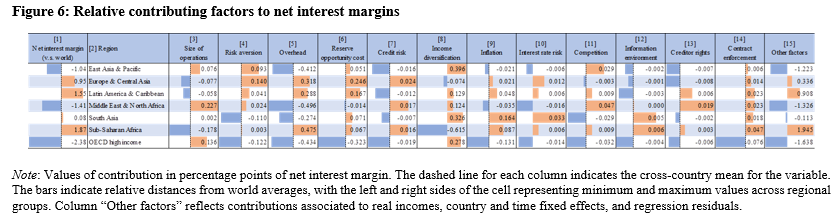

Finally, based on the regression results, we constructed bar-charts of relative contributing factors to financial intermediation costs using a decomposition of the difference between each country’s net interest margin and the average banking system in the world, to help visualize deficiencies and focus policy makers’ attention. While the usefulness of the bar-charts is to highlight country-level areas of focus, some interesting patterns emerge (Figure 6).

Market-developing policies aimed at addressing deficiencies in the contractual and information infrastructure and at maintaining macroeconomic stability can have important repercussions for the costs of financial intermediation in lower income economies and should be the main concern of policy makers in these countries. These policies should be complemented by market-enabling policies aimed at increasing contestability in the banking system, and by policies aimed at promoting technological innovation in the production and distribution of banking services to reduce overhead and increase efficiency. On the other hand, further promoting income diversification and reducing credit concentration in the system should be the key focus of policy makers in higher income economies concerned with lowering the costs of financial intermediation.

References

Beck, T., A. Demirgüç-Kunt, and R. Levine (2007). Finance, Inequality and the Poor. Journal of Economic Growth, 12(1), pp. 27-49.

Demirgüç-Kunt, and R. Levine (2009). Finance and inequality: theory and evidence. World Bank Policy Research Working Paper 4967.

Levine, R. (2005). Finance and growth: theory and evidence. Handbook of Economic Growth, 1, pp. 865-934.

Stiglitz, J. E. and A. Weiss (1981). Credit Rationing in Markets with Imperfect Information. American Economic Review, 71(3), pp. 393-410.

The costs associated with financial intermediation have an important bearing on the depth and breadth of the banking system. High costs of financial intermediation are associated with credit rationing and thus a lower level of credit channeled to borrowers (Stiglitz and Weiss, 1981). The interest spread, i.e., the difference between the lending rate and the deposit rate, is a commonly accepted measure of how costly financial intermediation is for a society. Countries with lower intermediation spreads experience higher levels of financial development (Figure 3) and higher penetration in the use of financial services (Figure 4).

In a recent paper coauthored with Nan Zhou, we investigated the determinants of bank net interest margins – used as a proxy for financial intermediation costs – in 160 countries using a panel of more than 14,000 banks during 2005-14. First, we used an accounting decomposition framework to provide summary statistics on the size of net interest margins and to highlight the cost and profit components in countries, regions and income groups. The analysis provides evidence that the costs of financial intermediation are negatively associated with income levels: net interest margins are significantly higher in lower income countries. On the other hand, a regional focus shows that costs of financial intermediation are especially high in Latin America and the Caribbean (LAC), and Sub-Saharan Africa (SSA). Accounting decomposition of net interest margins indicates that higher margins in lower income economies, LAC and SSA are mostly explained by higher overhead (probably reflecting low economies of scale and low productivity), higher credit risk (which may reflect a weaker environment) and greater bank profitability (which may be due to low market competition). Figure 5 shows the results for regional and income groups.

Second, we used regression analysis to examine underlying bank-level, structural, macroeconomic and institutional determinants of net interest margins. The econometric analysis shows that higher intermediation spreads are significantly associated with larger lending operations, higher risk aversion, higher opportunity costs arising from reserve requirements, higher overhead, higher credit risk, lower competition, higher interest rate volatility and higher inflation. In general, the impact of these variables is stronger in less wealthy economies. We also find suggestive evidence that a relatively underdeveloped credit infrastructure negatively affects net interest margins across countries: deficiencies in the contractual and information frameworks are associated with higher intermediation spreads. However, the estimated impact of institutional variables is largely absorbed by country-fixed effects.

Finally, based on the regression results, we constructed bar-charts of relative contributing factors to financial intermediation costs using a decomposition of the difference between each country’s net interest margin and the average banking system in the world, to help visualize deficiencies and focus policy makers’ attention. While the usefulness of the bar-charts is to highlight country-level areas of focus, some interesting patterns emerge (Figure 6).

Market-developing policies aimed at addressing deficiencies in the contractual and information infrastructure and at maintaining macroeconomic stability can have important repercussions for the costs of financial intermediation in lower income economies and should be the main concern of policy makers in these countries. These policies should be complemented by market-enabling policies aimed at increasing contestability in the banking system, and by policies aimed at promoting technological innovation in the production and distribution of banking services to reduce overhead and increase efficiency. On the other hand, further promoting income diversification and reducing credit concentration in the system should be the key focus of policy makers in higher income economies concerned with lowering the costs of financial intermediation.

References

Beck, T., A. Demirgüç-Kunt, and R. Levine (2007). Finance, Inequality and the Poor. Journal of Economic Growth, 12(1), pp. 27-49.

Demirgüç-Kunt, and R. Levine (2009). Finance and inequality: theory and evidence. World Bank Policy Research Working Paper 4967.

Levine, R. (2005). Finance and growth: theory and evidence. Handbook of Economic Growth, 1, pp. 865-934.

Stiglitz, J. E. and A. Weiss (1981). Credit Rationing in Markets with Imperfect Information. American Economic Review, 71(3), pp. 393-410.

Join the Conversation