Growth of food sales concept. | © shutterstock.com

Growth of food sales concept. | © shutterstock.com

The relationship between rising inflation and economic growth is a topic of ongoing debate in macroeconomics. According to the classical “neutrality of money” view, increases in inflation have little effect on real gross domestic product (GDP), as inflation increases both prices and wages similarly and merely alters the units of measurement. A related viewpoint is that rising inflation is not the cause of depressed economic growth but rather just a symptom of underlying economic problems that depress growth, such as supply-side disruptions or fiscal imbalances. Alternatively, some macroeconomic theories, like New Keynesian theories, postulate that rising inflation can increase real GDP in the short run, at least under certain conditions. Such theories have a difficult time explaining “stagflation,” which is simultaneous high inflation and slow economic growth.

In our paper, titled "Inflation and Disintermediation" (Agarwal and Baron 2023), which is forthcoming in the Journal of Financial Economics, we present a new perspective on how rising inflation can depress GDP. Our research explores the idea that rising inflation leads to banking sector losses, prompting banks to reduce lending and ultimately affecting economic activity.

Role of Asset-Liability Mismatch

Our study focuses on a key friction within the banking sector: asset-liability mismatch to inflation. In the presence of rising inflation, asset-liability mismatch can erode banks' equity and net interest margins, prompting a contraction in lending to households and firms. Our paper devises a measure of each bank's asset-liability mismatch to rising inflation. Our measure is not simply an interest rate sensitivity measure. Even in the absence of tighter monetary policy or higher policy rates, banks’ balance sheets and cash flows are still affected by higher inflation expectations, which lead to market repricing of nominal lending rates, deposit rates, and long-term bond yields.

Initial Evidence

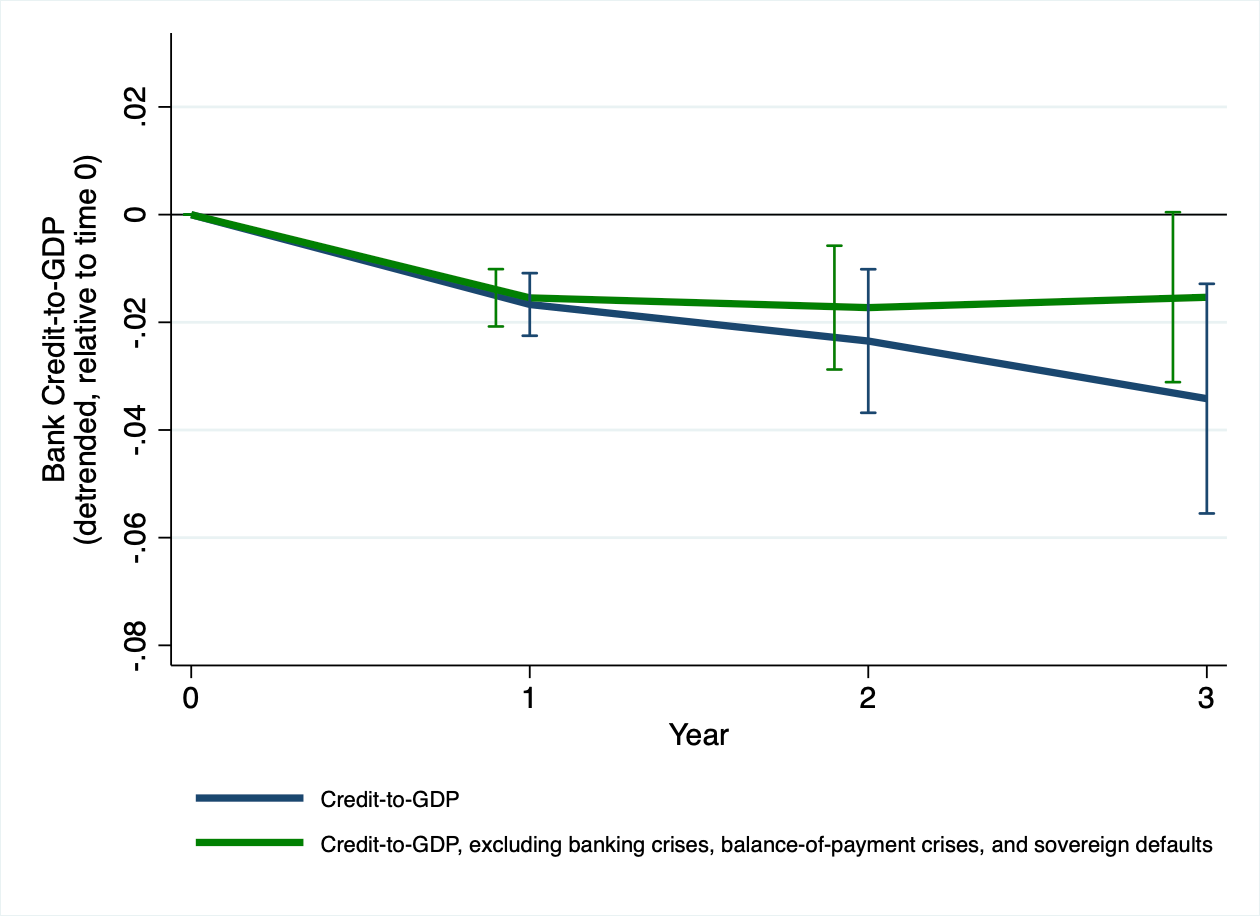

We uncover two initial findings that support our hypothesis on the contractionary effects of rising inflation on bank lending. First, by analyzing a country-level dataset covering 47 developed and emerging economies since 1870, we find that increases in inflation correlate with future short-term decreases in a country's aggregate bank credit-to-GDP ratio (see Figure 1). Second, by examining historical and international inflation episodes with individual bank–level data—including Germany's hyperinflation in the 1920s and episodes in emerging economies in recent decades—we observe that lending contraction primarily occurs among the banks that are most exposed to inflation, as measured by our bank-level inflation exposure measure.

Establishing Causality

To establish a causal relationship between rising inflation and impairment in the ability of the banking sector to lend, we analyze a natural experiment in the United States in early 1977. The inflation rate experienced a one-time increase from 5% to 7% and then remained stable for the subsequent year (before increasing again much more rapidly starting in mid-1978). The natural experiment exploits “random” differences across states in the 1970s in reserve requirements for Federal Reserve nonmember banks, which are state-chartered banks and adhere to reserve requirements from their state regulators. As reserve requirements primarily mandate a minimum ratio of non-interest-bearing cash to demand deposits, we show that higher reserve requirements substantially increase nonmember banks’ exposure to inflation, since the real value of non-interest-bearing cash is eroded when inflation unexpectedly rises. Since nonmember banks have different reserve requirements by state, this in turn leads to differences in inflation exposure. In contrast, member banks have uniform reserve requirements across all states (set by the Federal Reserve at the national level) and thus serve as a control group, as we do not expect to see systematic differences in member banks’ inflation exposure across states.

We analyze this natural experiment using a two-stage instrumental variables framework as follows. In the first stage, we show that nonmember banks with higher state-level reserve requirements have higher inflation exposure, as measured by our bank-level measure of inflation asset-liability mismatch. In contrast, for member banks (the control group), we see no effect on inflation exposure. Then, in the second stage of our analysis, we find that banks with the highest inflation exposure reduce their lending the most after the increase in inflation. We estimate that overall U.S. loan growth decreased by 3.2 percentage points due to higher inflation, relative to average loan growth of 19% in 1977.

Implications for the Broader Economy

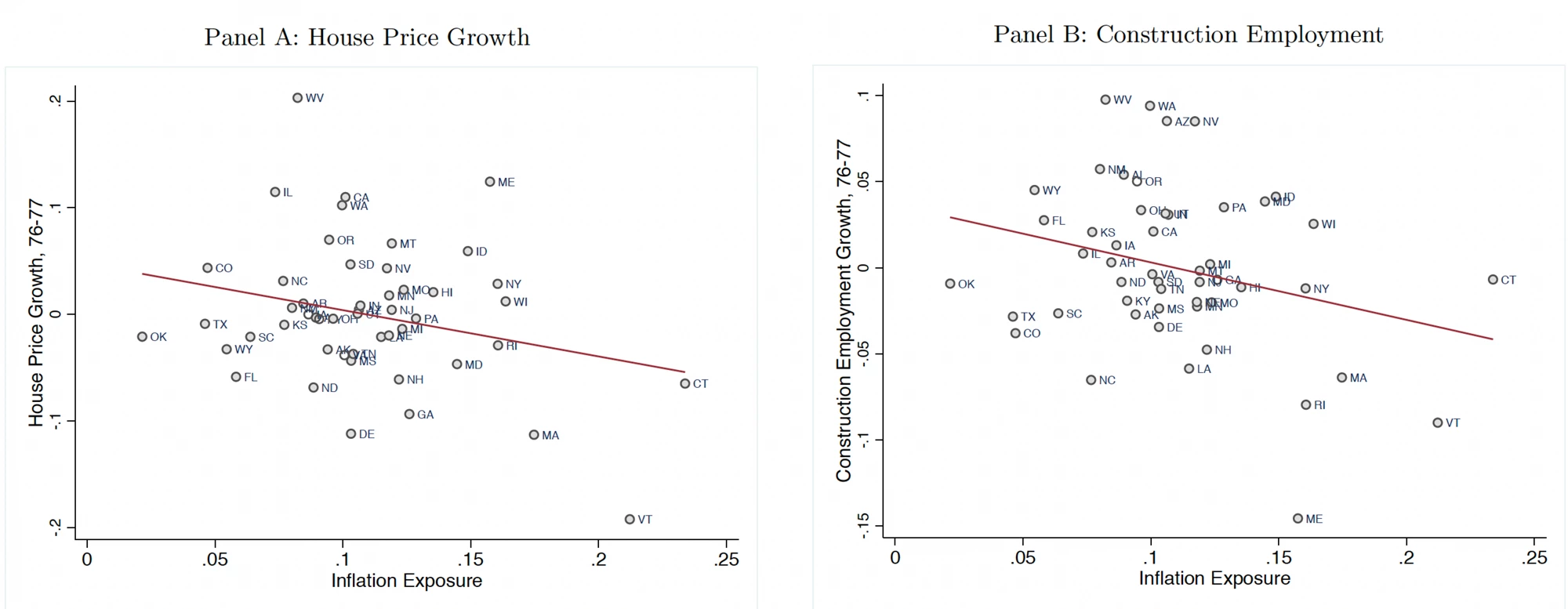

We find that banks with high inflation exposure primarily reduce residential mortgage lending, which subsequently affects house price growth and construction employment in affected states (see Figure 2). These effects are not observed in other employment sectors. Our findings indicate that the credit supply contraction triggered by inflation primarily impacts the housing sector, consistent with a large body of literature demonstrating that banking channels tend to have strong effects on construction employment and housing.

Conclusion

In conclusion, our research demonstrates that unexpected increases in inflation tend to have a contractionary effect on the banking sector . Inflation-exposed banks respond by reducing lending, which, in turn, impacts house prices and construction employment. More generally, these results suggest why rising inflation can lead to financial instability, especially following significant and unexpected increases in inflation. Additionally, our analysis of historical and international inflation episodes reinforces the significance of banking channels in understanding the consequences of inflation worldwide. By shedding light on the relationship between inflation and economic growth, our research contributes to a better understanding of the macroeconomic implications of inflation and its effects on the banking sector.

Figure 1: Bank credit-to-GDP ratio after large increases in inflation

Using a 47-country panel covering 1870–2016, this figure plots the average future change in a country’s aggregate bank credit-to-GDP ratio, subsequent to the start of an “inflation episode” (defined as a year with an increase in the inflation rate of at least 10 percentage points and with a positive level of inflation over the entire episode). The bank credit-to-GDP ratio (the y-axis variable) is first detrended using the past five-year trend within a country. The blue line shows the estimates using all inflation episodes, and the solid green line excludes inflation episodes that coincided with banking crises, balance-of-payment crises, or sovereign defaults. The vertical bars in both panels represent 90% confidence bands estimated from standard errors double clustered by country and year.

Figure 2: Effect of rising inflation on residential house prices and construction employment

Join the Conversation