Wind turbine in Northern Tunisia, Bizerte Governorate. (Shutterstock.com/Mashhour)

Wind turbine in Northern Tunisia, Bizerte Governorate. (Shutterstock.com/Mashhour)

Over the past decade, Tunisia's energy sector has faced significant challenges, resulting in a growing dependence on oil and gas imports and a widening of the financial deficit of the national electricity and gas utility STEG. Last summer, a critical moment was reached with the occurrence of significant power cuts, as STEG had neither the technical means nor the financial resources to fully meet the growing peak demand. Tunisia’s lack of domestic oil and gas production can be turned into an opportunity if the country takes full advantage of its renewable energy resources and its strategic location between North Africa and Europe to become a hub for green energy, industrial investment and trade. The World Bank is providing technical and financial support to the government of Tunisia to turn this vision into a reality.

Growing energy demand and falling national production of oil and gas has resulted in an increase in reliance on energy imports from 5% of consumption in 2010 to 50% in 2022 (according to data from the Government of Tunisia and STEG). For the national power and gas utility STEG, this has meant an increasing reliance on imports of natural gas from neighboring Algeria. Moreover, the import price of natural gas has increased significantly since 2021 and STEG had to invest in generation, transportation, and distribution networks due to growing demand. As a result, STEG’s financial health has deteriorated in the absence of cost-reflective tariffs and insufficient subsidies. The issue is compounded by lack of payment discipline from public sector customers and rising levels of electricity theft.

So how can the country turn the lack of domestic oil and gas resources into an opportunity? The main response lies in Tunisia's abundant solar and wind energy resources, with an estimated production potential of 320 gigawatts (GW) in comparison to the current peak demand of approximately 5 GW. The government aims to increase the share of renewable energy from about 8% in 2022 to 35% of electric generation capacity by 2030. The good news is that it does not need to use its limited financial resources to invest in solar or wind power plants. The private sector is willing to take on this task and sell the electricity to STEG, which will benefit from cleaner and more cost-effective energy compared to the current gas-based production.

However, for investors to commit with confidence, it is crucial to ensure reliable payments for their production, which means that STEG’s financial health needs to be improved. Thus, the government and STEG also need to draw up an ambitious multi-year turnaround performance contract, where the government would provide financial and political support to clear payment arrears and solve STEG’s most pressing issues like bills payment discipline and fraud, and find the right balance between revenue requirements, tariffs and subsidies. The World Bank is providing a comprehensive technical assistance program to the government and STEG covering renewable energy development, STEG performance enhancement and the setting up of a regulatory authority to ensure transparent and equitable access to the grid by private investors.

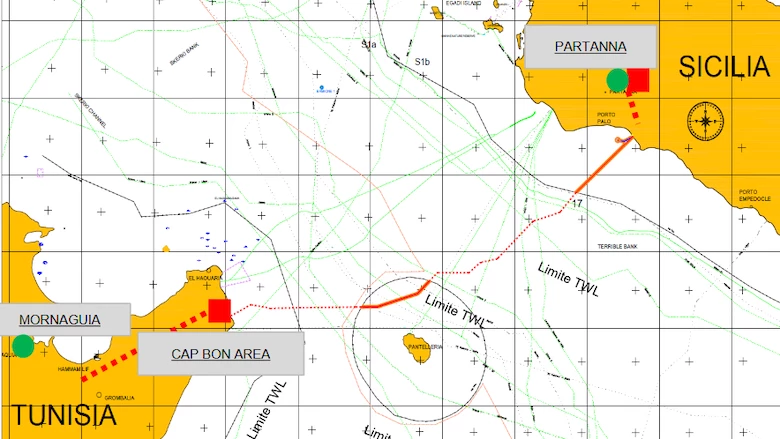

The third element of this energy transition is related to energy connectivity with Europe. The Tunisia-Italy Electricity Interconnector (Elmed) is co-financed by STEG and Italian power transmission operator Terna with EU grants and loans from the World Bank and other international financial institutions. It will connect Tunisia to Sicily through a 600-megawatt submarine interconnector that will allow electricity to be traded between the two shores of the Mediterranean in both directions. The World Bank has been involved in supporting the development of this project for many years when it was still at the pre-feasibility stage. Elmed is now expected to become operational by 2028 and strengthen Tunisia's security of energy supply by allowing imports from Europe during peak demand periods and when it is cheaper to do so. But more importantly, Elmed offers Tunisia the opportunity to scale up renewable energy production and export it to Europe when there is a surplus. Thus, Tunisia will be able to reduce the cost of electricity production and both sides will benefit from trade.

Map of the future Elmed Interconnector.

The large-scale development of renewable energy could catalyze economic growth in Tunisia in several ways: firstly, by reducing energy cost and decreasing the need for subsidies; secondly, by making this energy green and minimizing dependence on imported fossil fuels, thereby contributing to more balanced trade flows; and thirdly, by attracting foreign direct investment in green industrial production and exports, thereby creating jobs and economic opportunities. The World Bank is working closely with the Tunisian government to fully integrate the vision of a green energy transition at the heart of the country's industrial, social and economic transformation. In addition to creating a legal and business environment conducive to attracting investors, the government should prepare the ground by ensuring that appropriate university and vocational educational programs are in place to train the new generation of young people and workers eager to enter sectors linked to green industries.

Join the Conversation