Henning Marquardt / Shutterstock

Henning Marquardt / Shutterstock

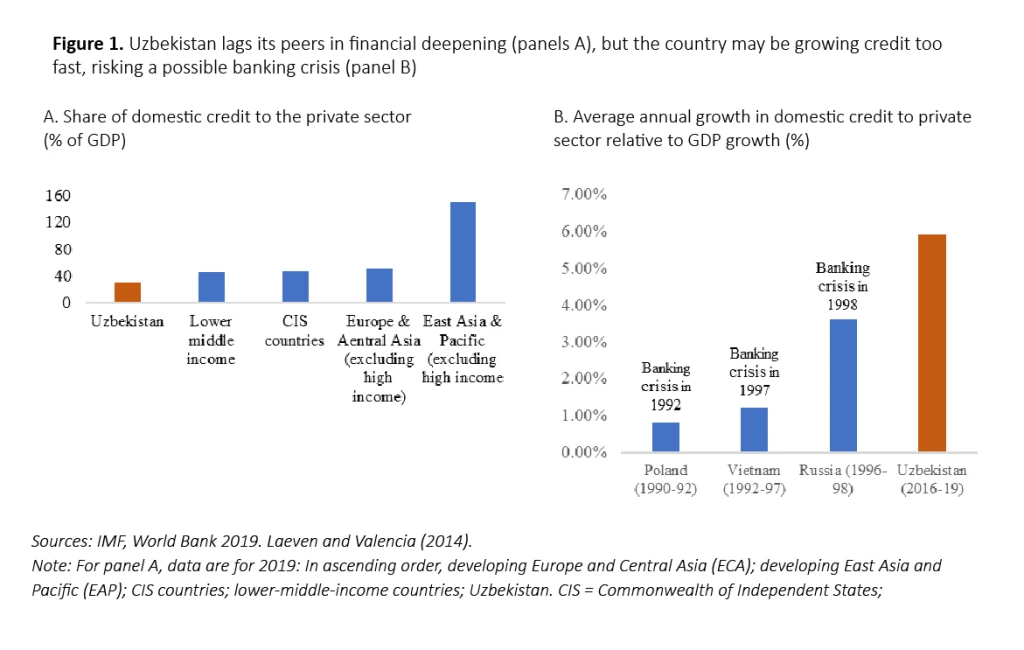

After nearly two decades of largely state-led and centrally-planned economic management, Uzbekistan has taken notable steps in transitioning to a market economy. To transition its financial system to market principles, Uzbekistan has started implementing major reforms in the banking sector, including the restructuring and privatization of state-owned commercial banks . Such reforms have put Uzbekistan on the list of many other current or former transition economies that have adopted market-based reforms, including some, such as Poland, Russia, and Vietnam, that began as early as the mid-1980s (Svejnar 2002).

Many countries around the world have banking systems working within a centrally-planned economy and/or banking systems dominated by state-owned banks (Cull et al. 2018). These countries can learn from Uzbekistan’s recent experience with banking transition. How much can a new transitioning country reasonably expect to accomplish within the medium term of four to seven years? Which banking reforms are the most essential and how should they be sequenced? What are the complementary reforms that need to happen in tandem for the new banking market to function properly—such as the reform of SOEs or the competition framework?

To answer these questions, our recent paper uses new bank-level data from Uzbekistan to compare early transition outcomes in Uzbekistan to those of former transition economies such as Poland, Russia, and Vietnam. Furthermore, it compares Uzbekistan’s transition more broadly to the qualitative and quantitative evidence from existing literature.

Uzbekistan has shown early success with its institutional reforms and the ongoing transformation of state-owned banks. Notably, it reduced the on-lending of state funds to state-owned enterprises on preferential terms , expanding the room for competitive financing of individuals and private businesses. However, the onset of economic liberalization has also created tradeoffs — for instance, that a fast growth of credit may overheat the economy. Fast credit growth during 2018-2019 occurred in Uzbekistan amidst a backdrop of still-dominant state ownership and control over banks; highly concentrated and dollarized corporate credit portfolios; gaps in corporate governance frameworks; the need for more human capital investments in the banking sector; and gaps in the availability of timely and accurate data reporting.

Past international experience from Poland, Russia, and Vietnam highlights that financial liberalization should be matched with the strengthening of regulatory institutions to help avoid costly financial crises . These crises often emerge from fast credit growth fueled by weak credit underwriting standards. Since 2017, the Central Bank of Uzbekistan has improved its regulatory and supervisory framework starting with the overhaul of the laws on Central Bank and Banks and Banking, allowing for establishment of an independent central bank and regulator—the first milestone for a successful long-term transformation of the banking sector. These initiatives will help mitigate systemic risks and ensure that the banking system supports Uzbekistan’s transition by allocating capital in the economy to its most productive uses. Still, these are early days of the banking transition, and more needs to be done to gradually implement the upgraded international practice for bank regulation and supervision such as the Basel III standards.

Other crucial reforms include enhancing the banking culture, upgrading human capital in banking, strengthening credit risk management, mobilizing more bank deposits from many more depositors, and expanding the variety and availability of modern financial products, especially in high-potential sectors with large financing needs such as agriculture.

Another lesson from earlier reformers is the need to complement banking sector reforms with the reform and privatization of state-owned enterprises. As banks reduce lending to state enterprises, equally important are reforms to strengthen the private sector to which banks will increasingly lend . To deal with distressed and unviable firms and to release needed capital back to the economy, the insolvency framework must be modernized and bank capacity to workout bad loans strengthened. The need for the latter has become even more important in the context of past credit expansion, and major risks such as the COVID-19 pandemic and the impact of the Russia-Ukraine war.

Join the Conversation