Typhoon Haiyan, known as Super Typhoon Yolanda in the Philippines, was one of the strongest tropical cyclones ever recorded | © shutterstock.com

Typhoon Haiyan, known as Super Typhoon Yolanda in the Philippines, was one of the strongest tropical cyclones ever recorded | © shutterstock.com

Climate change and environmental-related natural disasters are associated with massive human losses, physical damages, and economic and fiscal losses, all affecting countries' ability to meet their development goals. There is also growing global recognition that such disasters could pose risks to financial system stability, for example through loan losses and repricing of financial instruments, that would seriously affect the solvency and profitability of financial institutions.

So how significant are such risks for the financial sector? Central banks and financial sector authorities are increasingly interested in understanding and quantifying climate and environmental risks, including using forward-looking tools such as scenario analysis and stress testing. But systematic empirical evidence from historical data has been relatively scant. In a new World Bank policy research paper, we attempt to gauge the impact of climate and environmental risks on the stability of the banking sector, the largest and most important component of the financial sector in most developing countries.

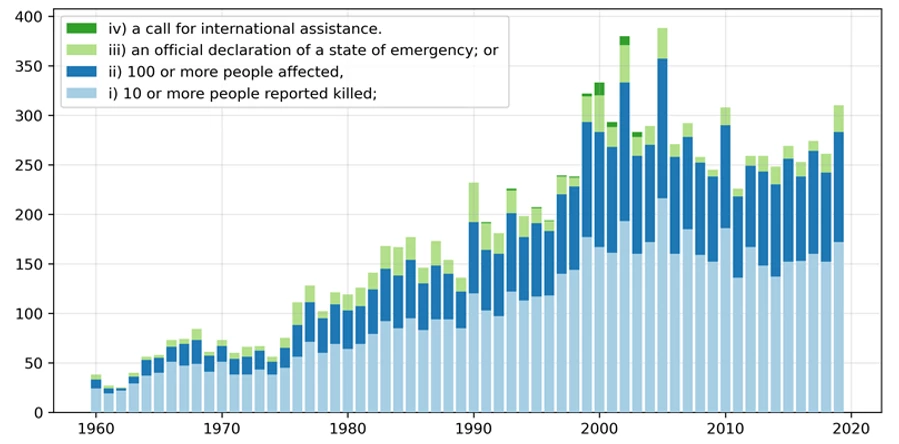

Using a large global dataset consisting of 184 economies over forty-years between 1980 and 2019, we find that severe climate and environmental disaster episodes lead to an increase in the level of system-wide non-performing loans to total gross loans (henceforth NPL ratios), a key measure of bank asset quality (figure 1). We found that the effects are persistent. For this global sample, NPL ratios are estimated to increase by 0.37 percentage points after disaster episodes associated with an official declaration of emergency. Two and three years after an episode involving multiple types of disasters, the cumulative increases in NPL ratios stand at 0.56 and 0.6 percentage points, respectively. This empirical relationship is found across multiple World Bank regions and observed across almost all income groups, especially for low-income countries.

Figure 1: Total Number of Climate and Environmental related Natural Disasters Over Time

Source: Authors calculations, EM-DAT database.

To address important caveats of the cross-country results, including a lack of consistency on cross-country sources of major natural disasters and the inability to measure impacts at a more granular regional level, we complement our analysis with a country-specific example from the Philippines. The Philippines is exposed to frequent natural disasters such as typhoons, floods, storm surges, tsunamis, and landslides, most of which are exacerbated by climate change, causing severe economic and fiscal shocks and threatening its socio-economic development. For instance, the 2013 Super Typhoon Yolanda (Haiyan)—the strongest typhoon to ever make landfall in the world— was a tragic reminder of natural disasters' devastating impact. The World Bank’s 2022 Philippines Country Climate and Development Report (CCDR) estimates that the economic damages in the country could reach up to 7.6 percent of GDP by 2030 and 13.6 percent by 2040.

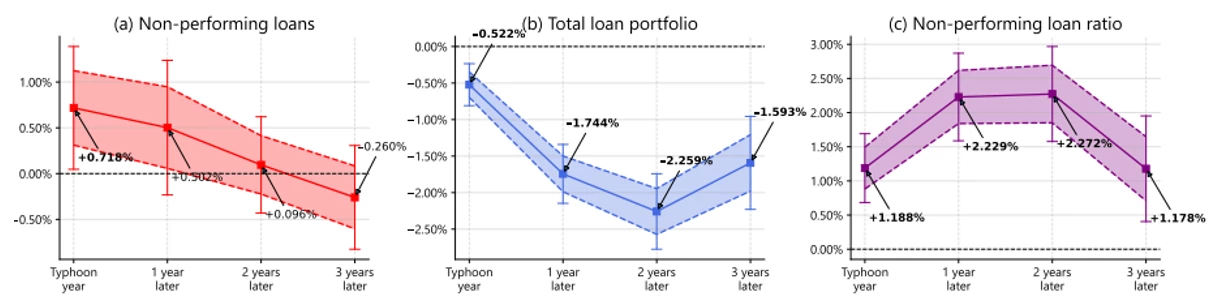

Using banking sector data at the regional level, we studied the impact of typhoons on NPL ratios between 2011 and 2018 for the Philippines. We found that a 1 percentage point increase in the typhoon damage ratio, defined as the amount of damage divided by regional GDP, would lead to an increase in the NPL ratio as large as 2.3 percent (figure 2). This estimate is larger in magnitude than those found for the cross-country sample.

Figure 2. Impacts of typhoons on non-performing loans in The Philippines

Impacts of a 1 ppt increase in the damage ratio (calculated as typhoon damage over regional GDP)

Source: Authors calculations, Bangko Sentral ng Pilipinas, NDRRMC reports, Philippine Statistics Authority

The dashed lines represent the standard errors and the whiskers delineate the 95% confidence intervals.

Our results show how important closely monitoring climate and environmental-related natural disasters is for the banking sector, as well as the critical role that financial sector supervisors and regulators play to actively monitor, assess, and mitigate climate-related risks, as promoted by the Network for Greening the Financial System and international standard setters like the Basel Committee. A first step would be to collect information to track such risks, including filling any data gaps that could hinder a full understanding of climate risks. Once information is in place, central banks and supervisors could consider a more detailed assessment of these risks —specifically the various risk channels that may be at work behind the empirical results highlighted in this paper. Banking regulators should consider climate stress testing—both at the system level and by individual banks—to build further understanding of climate and environmental impacts under various historical and future scenarios. Our paper provides inputs to parameters used in a stress test: for instance, the assessed magnitude of impacts on NPLs could guide the selection of model parameters in climate stress tests.

The World Bank is actively supporting financial sector authorities to better understand and manage climate and environmental risks. Our activities range from stress testing climate risks, to supporting supervisors with climate data catalogues and risk management regulations. At the same time, we support the development of green finance taxonomy and green sustainable bond markets. These engagements will help World Bank client countries and their financial sectors to better cope with these risks and transition towards more climate-proof investment and lending portfolios.

Join the Conversation