Education is mostly financed by public resources in many developing countries. Photo: Scott Wallace / World Bank

Education is mostly financed by public resources in many developing countries. Photo: Scott Wallace / World Bank

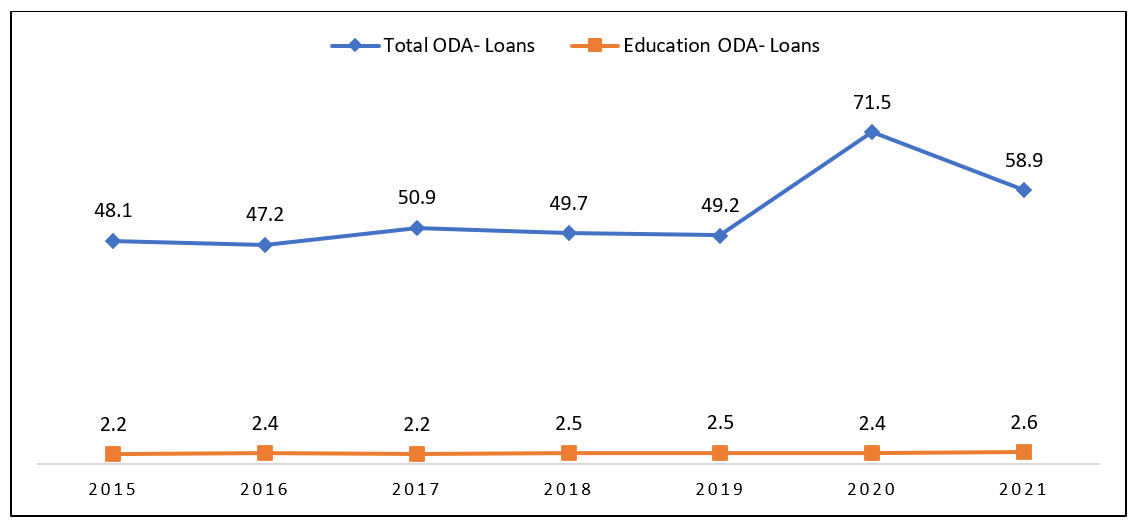

The COVID-19 pandemic has had far-reaching effects on economies worldwide, with many countries experiencing negative GDP growth in 2020 and downgraded growth forecasts for 2021 and 2022. To mitigate the economic setbacks caused by the pandemic, developing countries sought financial assistance from international partners, which contributed to higher external debt levels. For example, between 2019 and 2020, the total volume of concessional loans increased by $ 22.2 billion (or 45.2 percent). As a result, global external debt as a share of GDP reached 114% in 2020, one of the highest levels since 1990.

Official Development Assistance (ODA) Disbursements--Loans Only (in billion USD constant 2021)

Source: OECD Creditor Reporting System

High public debt could lead to fiscal consolidation, which could have implications for government expenditure, including education spending. Governments have several tools at their disposal to address a debt crisis, including inflation targeting, financial repression, debt default, or restructuring. However, reducing debt through fiscal consolidation remains one of the most common tools used by governments to curb fiscal imbalances. Fiscal consolidation refers to the government’s policy intended to reduce the fiscal deficit and the accumulation of debt. While there is no consensus on the most effective route to fiscal consolidation, empirical evidence from several countries suggests that fiscal consolidation based on expenditure reduction tends to be more effective than tax-based consolidations.

A recent study investigated how fiscal consolidation due to high external debt could hinder education spending, which plays a central role in education financing, especially in developing countries. Education is mostly financed by public resources in many developing countries, and a contraction of public expenditure could lead to fewer resources for human capital investments. This study aimed at understanding the relationship between external debt, fiscal consolidation, and government expenditure on education in developing countries.

Higher debt level increases the risk of fiscal consolidation

The study’s results confirm that an increase in the government's external debt is associated with a higher likelihood of conducting a fiscal consolidation policy to curb the fiscal deficit. Specifically, a 1 percent increase in the debt-to-reserve ratio is associated with 0.25 percentage point increase in the probability of a decline in total government expenditure relative to government revenue. Countries with the highest development challenges, such as Sub-Saharan Africa and low-income countries, seem to be more exposed to a higher risk of fiscal consolidation, given the recent increases in debt levels. As a result, the most vulnerable developing countries may be facing a higher risk of expenditure reduction to control the increased debt service burden.

Fiscal consolidation is likely to hinder education expenditure

Education spending tends to overreact to an increase in the debt burden. In other words, the decline of education spending is proportionally larger than the increase of the debt burden. A 1 percent increase in external debt volume without any changes to reserve levels could lead to a 2.9 percent decrease in spending per school-age child. Education spending is disproportionally sensitive to changes in the debt levels, making it a likely target for governments to adjust the fiscal deficits. Therefore, external debt poses a significant threat to education financing, especially in the current context of rising debt levels caused by the pandemic.

Protecting the education budget should be a priority in the period following the COVID-19 pandemic

Despite the strong increase in the total volume of loans in 2020, the volume of loans to the education sector declined by about $100 million from the previous year. This suggests that the COVID-19-related debt proceeds were not directly invested in the education sector. However, given the high debt burden faced by developing countries, a decline in government expenditure on education should be expected in the coming years.

While it is difficult to predict how the pandemic-related debt will evolve, simulating the effects of a hypothetical increase in external debt on education expenditure can help understand the extent of the debt problem. For instance, a 5% increase in external debt could lead to a $12.8 billion decline in the volume of government education expenditure in low- and middle-income countries , all things being equal. This is almost equivalent to the total official development assistance to the education sector in 2021 ($14.1 billion). The total volume of concessional loans increased by 45.2 % in 2020 and the expected impact on education spending can be damageable to the education sector if mitigating measures are not implemented.

Therefore, it is crucial to implement mitigating measures that would protect education budgets and ensure that the pandemic's long-term impact on human capital investments is minimized. Policymakers in developing countries should prioritize protecting education budgets and consider alternative financing mechanisms to ensure that education spending is not disproportionately affected by the high debt burden.

Join the Conversation