The latest evidence on the private rates of returns to schooling shows that the returns to primary education are no longer the highest, having been surpassed by tertiary education. In my blog, Make the Rich Pay for University: Changing Patterns of Returns to Schooling, I argue that this suggests three things:

1. The continued need to focus on investing on the poor, by ensuring that they get a good education;

2. Increased investment in education quality, informed by the evidence base on what works to improve learning outcomes; and

3. Expansion of tertiary education opportunities—with a focus on cost-recovery at the university level.

In response (regarding the call for cost-recovery at the tertiary education level), my colleague Francisco Marmolejo asks whether it’s only about the fees. He cites many examples of countries and institutions where attempts to raise fees have not happened, for a variety of reasons. He also raises the important concern about equity. Excessive fees may lead to situations where students from poorer families cannot afford to attend the school of their choice. But there are limits to public finance, and in situations of growing social demand for tertiary education, there is a need to think deeply about options. Francisco puts forward a comprehensive set of policies – including integration, relevance, autonomy, a level playing field, and “establishing financial mechanisms that support students on an equitable basis.”

In response (regarding the call for cost-recovery at the tertiary education level), my colleague Francisco Marmolejo asks whether it’s only about the fees. He cites many examples of countries and institutions where attempts to raise fees have not happened, for a variety of reasons. He also raises the important concern about equity. Excessive fees may lead to situations where students from poorer families cannot afford to attend the school of their choice. But there are limits to public finance, and in situations of growing social demand for tertiary education, there is a need to think deeply about options. Francisco puts forward a comprehensive set of policies – including integration, relevance, autonomy, a level playing field, and “establishing financial mechanisms that support students on an equitable basis.”

I agree with Francisco that the solution is not only about fees; but cost-recovery, or more accurately, tertiary education finance, is a big part of the solution. Let me pick up on his suggestion of “establishing financial mechanisms that support students on an equitable basis.”

Increasing demand for tertiary education – due to the global demand for skilled labor, rising returns to tertiary education, and social aspirations – will stretch the current model of publicly-subsidized tertiary education systems and challenge the current fee-based models. Even the poorly performing traditional student loan systems won’t help.

To ensure quality, relevance, autonomy and accountability, much more will need to be spent on tertiary education. There are really only three sources of funds: (1) public funds – which are scarce and not growing in most countries; (2) private funds – which only help finance the education of the rich; and (3) future earnings – what graduates earn once they complete their degrees.

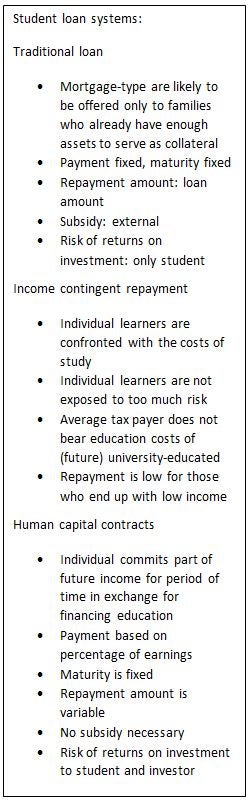

As Nicholas Barr has written, public funds are insufficient for expanding the system and maintaining quality. A reliance on fees won’t help the poor. Traditional student loan programs – which require automatic repayment upon graduation and rely on collateral and parental sponsorship – won’t help expand opportunities, don’t promote equity, and don’t increase the amount of resources going into the system. Most education systems are not able to tap future earnings in a sustainable or equitable manner. In most education finance systems, future resources are used to finance the current system through traditional – sometimes called mortgage-type – student loan systems.

Only the third option creates – in an equitable and sustainably way – new resources coming into the system by using future incomes to finance the current system and to expand; namely, income contingent student loan/repayment programs. In such systems, tuition is charged, all students “pay” but they have the option of deferring payment until they graduate. From then on repayment is based on labor market earnings. Income contingent loans are collected through the income tax system. They were first introduced in Australia in 1989 to help university students finance their tuition costs at a time when tertiary education enrollments in Australia were relatively low. Since then many countries have followed suit including Korea, New Zealand, UK and USA. There are prospects for income contingent loans in Chile, Colombia, Germany, Malaysia and Thailand.

Do income contingent programs work? The experience from Australia is positive. Enrollments grew and among low wealth groups.

A more radical approach are so-called ‘human capital contracts’. A human capital contract is a financial product that allows for the provision of funds to a prospective student through an equity-like arrangement, where the financier receives a portion of the graduate’s future earnings for a specified period of time. Recently, a number of companies have begun to attempt to commercially underwrite human capital contracts for the first time. Like income contingent loans, human capital contracts are better aligned with the financial interests of the receiver of the funds, and the stream of payments required should be relatively more affordable to individuals who experience adverse economic events such as unemployment or other decreases in disposable income. However, legal and regulatory challenges remain.

The benefits of income contingent payments rests of repayment rates. This is a considerable challenge in low income and even some middle income environments, where tax systems are insufficiently developed. There are significant barriers for the adoption of income contingent programs in countries that lack efficient agency for debt payment. Can the private market do a better job?

High returns signal that tertiary education is a good private investment. The public priority, however, isn’t a blanket subsidy for all, but a concerted effort to improve fair, equitable, sustainable cost-recovery at the tertiary education level.

Follow Harry Patrinos on the Education for the Global Development Blog and twitter.

Follow the World Bank Group Education team on Twitter @wbg_education

Join the Conversation