Accelerating Financial Inclusion to Unleash The Gambia Growth Potential

Accelerating Financial Inclusion to Unleash The Gambia Growth Potential

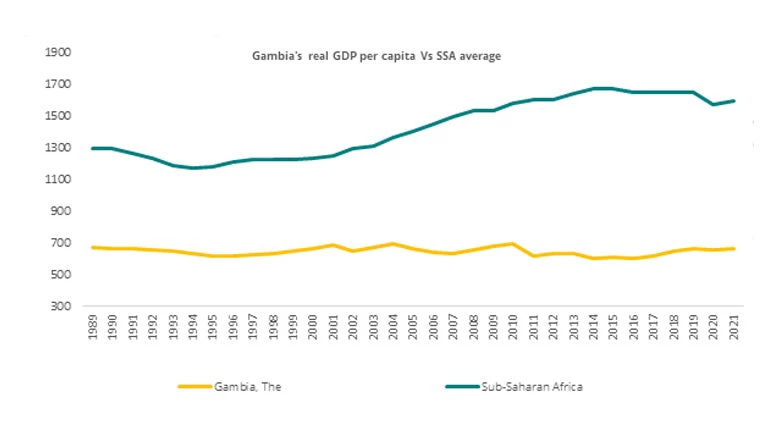

More than two decades under an authoritarian regime have left scars on The Gambia’s economic and social fabric, as witnessed by stagnating GDP per capita and widening gap compared to Sub-Saharan Africa (Figure 1). Still, the country has made progress since its democratic transition in 2017. Real GDP growth averaged 6.1% between 2017-2019 compared to a historically low level of 2.8% between 1991-2016. Steadfast implementation of structural reforms, higher levels of investment, and substantial support from development partners enabled a decline in extreme poverty from 13.5% in 2015 to 10.4% in 2019 in The Gambia (international poverty line of $2.15 per day, 2017 PPPs).

Figure 1 - The Gambia's real GDP per capita has stagnated lagging behind the average real GDP per capita in SSA.

The COVID-19 pandemic and the spillover effects of Russia’s invasion of Ukraine reversed hard-won gains. Hit by the pandemic, The Gambia’s economic growth decelerated to 0.6% in 2020 before recovering to 4.3% in 2021 and 2022. Income per capita grew by 3.5% in 2019 before contracting by 2% in 2020 and weakly recovering to 1.8% in 2022, below population growth. This, combined with high inflation, pushed additional Gambians into extreme poverty – estimated at 20.3% of the population in 2022.

Accelerating economic growth will require addressing key bottlenecks, one of which is financial inclusion. A functional and efficient financial sector intermediates resources, allows information exchange, facilitates risk management, and fuels the economy by unlocking resources for investment and business opportunities by reallocating capital. Access to financial products and services fosters economic growth, promotes entrepreneurship, investment, and productivity, and allows vulnerable populations to invest in education and healthcare while shielding them from financial vulnerabilities.

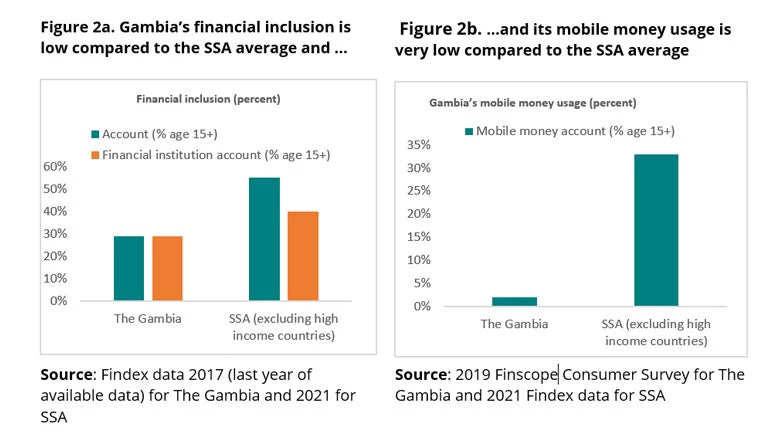

Still, financial inclusion is very low in The Gambia, with only 19% of the population having an account with a formal financial institution, while another 12% use informal savings, leaving 69% completely excluded from formal and informal financial services , much higher than the Sub-Saharan average of 45%.

Constraints to financial inclusion stem both from demand and supply factors. On the supply side, key constraints include uneven legal and regulatory frameworks, limited financial infrastructure, and challenges related to access, eligibility, and affordability of financial services. On the demand side, low income, inadequate financial literacy, poor financial consumer protection, and information asymmetries constitute some main constraints.

What will it take to tackle financial inclusion? Recent World Bank Reports (The Gambia FSAP and the Third Gambia Economic Update) identify ways to accelerate financial inclusion:

- Update the Payment Systems Act could incorporate emerging business models and new types of payment services and infrastructure providers (including FinTechs), to open the market and create a level playing field for new entrants.

- Update the Mobile Money Regulation could be reframed to cover digital payments more broadly, hence, opening the way for licensing companies that provide other e-money services (beyond mobile money).

- Continue legal/regulatory harmonization with ECOWAS’ peer countries and expand the participation of Payment Service Providers (PSPs) in the Pan-Africa Payment and Settlement System (PAPSS). Pursuing both objectives would allow the Gambia to facilitate cross-border digital payments with regional peers faster and more cost-efficiently.

- Enhance GamSwitch to include broader functionalities and adjust its model to ensure broader usage: incorporating fast payment capabilities will allow instant crediting of payee’s account, around-the-clock service availability, and access of banks and non-banks to payments infrastructure, fostering competition and innovation. Consider adjusting the fee structure, establishing interoperability among POS terminals, onboarding agents to boost agency banking, and incorporating mobile wallets, increasing uptake and lowering costs for end-users.

- Harness the opportunities that the high levels of access to mobile phones. Mobile money provides the opportunity to increase access and usage of digital payments. Unstructured Supplementary Service Data (USSD) payments offer an option for low-income individuals. Additionally, SIM cards and mobile phone numbers could be used instead of a universal digital identity system as identity proxies and aliases for financial onboarding and transactions.

- Continue efforts to digitize government payments. Interfaces and connectivity between operational and core payment systems must be enhanced to ensure real-time notification of settlement and information flows for digital government payments. Establishing well-designed Government to Person (G2P) systems can reduce operational risk, improve efficiency in the disbursement of funds, including government payroll and social protection programs, and incorporate excluded populations into the financial system.

Join the Conversation