Women selling at a market, Nigeria

Women selling at a market, Nigeria

Nigeria’s aspiration to lift all of its people out of poverty by 2030 presents a serious challenge. Even before COVID-19, 4 in 10 Nigerians lived below the national poverty line – some 80 million people. The global pandemic, rising inflation, and ongoing uncertainty related to the war in Ukraine – combined with relentless population growth – have made Nigeria’s poverty-reduction goals more challenging than ever. Many potential poverty-reducing policies for Nigeria are considered in detail in a new report, A Better Future for All Nigerians: Nigeria Poverty Assessment 2022.

Trade presents one vital – but often untapped – pathway to poverty reduction. Through its effects on investment, technology transfer, and competition, trade can help growth – boosting job creation, increasing domestic value added, and reducing the price of goods that Nigerians buy along the way. All of these effects may contribute to reducing poverty.1

Yet trade may have different impacts on households depending where in the country they live, what jobs they do, and whether they are rich or poor : even if trade leaves people better off on average, some households could lose out. Trade has two types of direct price effects on households’ wellbeing. First, trade policies determine the prices for products that households need to buy. Second, trade policies influence households’ income-generating activities, by changing the prices of goods that they produce. There are also important indirect effects; for example, trade can alter the mix of jobs – and the earnings in those jobs – that are available in the economy by increasing private investment but also exposing domestic firms to international competition.2

In Nigeria, many policies limit trade; the country is not unique in this regard, as protectionist policies have been on the rise the world over and the ongoing war in Ukraine could intensify this. Throughout the past two decades, import bans, tariffs, and foreign exchange restrictions have all curbed the flow of goods into Nigeria. These restrictive policies culminated in Nigeria closing its land border for more than a year in August 2019. Nigeria is also currently negotiating the terms of its participation in the African Continental Free Trade Agreement (AfCFTA); therefore, discussions of trade policy are very topical.

Considering the direct price effects on consumers first, virtually all Nigerians purchase at least some of their food, so protectionist policies that increase food prices could reduce their purchasing power and their living standards. This issue is currently especially important, given the impact of the war in Ukraine on food price inflation.

In principle, households’ exposure to these protectionist price shocks depends on the specific goods that they buy; but it turns out that buying local goods, which poorer Nigerians might do more, offers little insulation against such price shocks. Rice exemplifies this point. Imported varieties were consumed relatively more than local varieties by richer Nigerians, while local varieties were consumed relatively more by poorer Nigerians (see Panel A of Figure 1).3 Yet when Nigeria’s land border was closed in 2019, the prices of both imported and local varieties of rice increased (see Panel B of Figure 1). Since international and domestic markets are so integrated, it may be difficult to escape the price increases and purchasing power drops brought about by protectionist policies.

Figure 1. Consumption and price movements for local and imported rice in Nigeria

Note: Panel A shows the share of Nigerians purchasing any quantity of local and imported price; it does not include own-produced rice. Consumption data do not include Borno. Panel B shows price movements for the goods labelled “Rice local sold loose” and “Rice, imported high quality sold loose” in NBS price data. Source: 2018/19 NLSS (for consumption data), NBS (for price data), and World Bank estimates.

Of course, the direct effects that protectionist policies have on the prices faced by consumers is only part of the story. Fully estimating the effects of trade policy on households’ income and wellbeing – via prices – requires accounting for the income-generating activities of households, as well as their consumption.

A specialized approach applying the “Household Impacts of Tariffs” (HIT) data partially allow us to do this – the HIT has an online tool that anyone can use.4 It looks at the value of what households produce as well as what they consume. The analysis that follows flips the question around protectionist policies and considers what would happen if trade were fully liberalized in Nigeria: while this is unlikely, at least in the short run, it remains a useful benchmark for trade policy.

According to the HIT analysis, fully liberalizing trade would increase household income – measured by the amount of goods they can buy in naira terms – on average by 3.8 percent and reduce the share of people living in poverty by 2.3 percentage points in Nigeria.5 This is because liberalizing trade would decrease prices, and the gains to purchasing power outweigh any direct income losses for households that produce those goods that end up being cheaper.

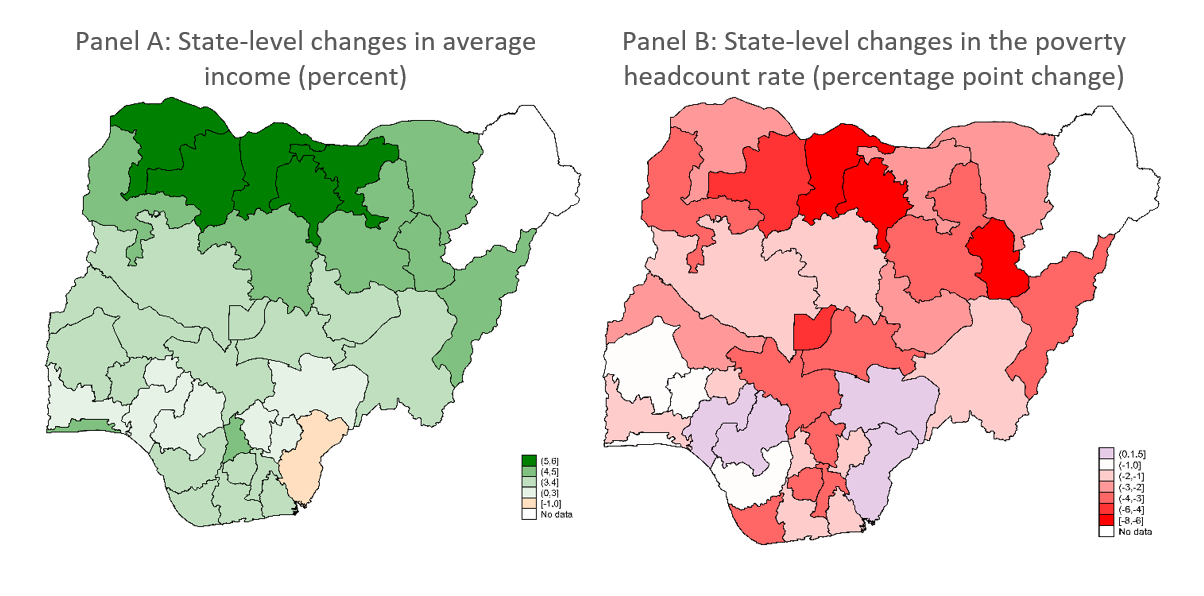

Yet, while the HIT data suggest that the average Nigerian could gain from trade liberalization, the approach indicates that some households could lose out if trade restrictions are eliminated. If trade were fully liberalized, average incomes are predicted to increase in all states except Cross River, but poverty is predicted to increase in four states: Benue, Cross River, Edo, and Ondo (see Figure 2). Trade liberalization would negatively impact at least some vulnerable Nigerians just above the poverty line in those four states, even if the average household gains. In part, this stems from the mix of income-generating activities that dominate in those states. In Benue and Cross River, for example, relatively large shares of workers – especially those just above the poverty line – are engaged in agricultural activities, which could lose out if trade is liberalized and agricultural product prices decline; they would not necessarily be compensated by the lower cost of purchasing the goods that they need.6

Figure 2. State-level changes in income and poverty if trade were fully liberalized in Nigeria

Note: Estimates exclude Borno. Poverty calculated using Nigeria’s national poverty line. Income and poverty changes were calculated using the HIT model, in which 2018/19 NLSS data were incorporated. Income captured by households’ consumption, a measure of their welfare. NBS price data from 2015 to 2017 and information on previous trade policies were used to estimate the pass-through from trade policies to prices. Source: 2018/19 NLSS (for consumption data), NBS (for price data), Humanitarian Data Exchange (for map shape files), and World Bank estimates.

What is more, the HIT data only partly account for the full potential effects of liberalizing trade on Nigerians’ income-generating activities. In reality, if trade opens up, private investment from abroad could boost job creation but some firms may be unable to cope with international competition as imports rise, altering the mix of jobs in the economy. These so-called “general equilibrium” effects could further alter the balance of winners and losers.

Specific government policies may therefore be needed if the gains of trade liberalization are to be reaped in Nigeria. In the short term, this could include social protection to support those households whose wellbeing is under threat. Yet in the medium and long term, deeper reforms will be needed: this includes improving interstate labor mobility and helping workers reskill themselves for sectors in which jobs and incomes benefit from greater exposure to international markets. Also, broader reforms that foster sustainable growth and share its proceeds to poor and vulnerable Nigerians could help those households that might lose out if trade is liberalized; this includes macroeconomic reforms that diversify the economy away from oil, spur structural transformation, and boost wage job creation as well as investment in infrastructure to help households access markets and economic opportunities. With the right mix of complementary policies, Nigerian can take advantage of trade as a pathway to poverty reduction.

1 Global evidence increasingly suggests an overall story of convergence in GDP per capita, with poorer countries catching up to richer ones. Yet this has not corresponded with convergence in poverty rates, in part because growth is not being distributed to poor households.

2 Trade policy may also indirectly influence households’ wellbeing because tariffs are a source of government revenue, which could determine spending on health, education, and social protection, and may be reduced as trade is liberalized.

3 Between August 2019 and August 2021, the price of imported varieties of rice increased by 53.3 percent from 357 naira per kilogram to 546 naira per kilogram. Over the same period, the price of local varieties of rice increased by 50.3 percent, from 273 naira per kilogram to 409 naira per kilogram.

4 The HIT data for Nigeria draw on consumption and income-generating activities from the 2018/19 Nigerian Living Standards Survey (NLSS). For full details of the HIT data see Erhan Artuc, Guido Porto, Bob Rijkers, Household Impacts of Tariffs: Data and Results from Agricultural Trade Protection, The World Bank Economic Review, Volume 35, Issue 3, October 2021, Pages 563–585, https://doi.org/10.1093/wber/lhaa005.

5 Full details will be available in Artuc, E., G. Porto and B. Rijkers. Welfare Enhancing Evasion: Evidence from Nigeria, Mimeo.

6 The income losses in Edo and Ondo are also relatively large for those close to the poverty line, although these are less linked to changing agricultural output prices.

Join the Conversation