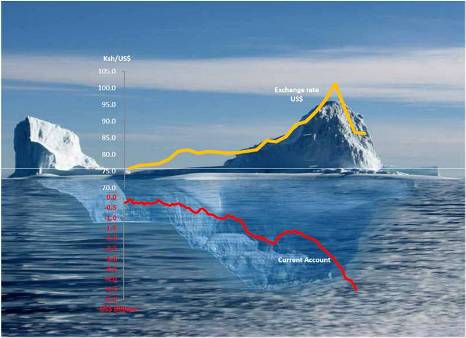

But Kenya’s exchange rate woes are just the tip of the iceberg (see figure). Kenya’s big challenge is to reduce the gap between the import bill and exports revenues, what economists call the “current account deficit” (which remains large, even when services—such as tourism—are included). Last year, the deficit reached more than ten percent of GDP, approximately Ksh 400 billion (US$ 4.5 billion). This is larger than Greece’s.

Figure: Kenya’s exchange rate – The tip of the iceberg (click on it to see it larger)

Source: World Bank estimate, adapted from Kenya Economic Update, December 2011

In order to balance its current account, Kenya would have to more than double the volume of its three top exports—tea, tourism and horticulture. In addition, Kenya is vulnerable to shocks, like increasing oil prices. Oil is one of Kenya’s top imports, and the oil import bill alone rose from $2.7 billion in 2010 to $4.1 billion in 2011, further weakening Kenya’s fragile current account. A large current account deficit does not automatically translate into a falling currency, so long as capital inflows fill the gap. But in Kenya, capital inflows have increasingly been short-term (by contrast to Foreign Direct Investment which finances factories and offices). Short-term capital can leave a country as fast as it comes, and this uncertainty is an additional source of fragility for the national currency.

When the Central Bank increased interest rates sharply at the end of last year, it brought the airplane into safety, cooling the engine that was overheating. The price was some economic slowdown, as loans (which businesses rely on to invest), became more expensive. Now that the plane has emerged from turbulence, every attempt should be made to make it fly faster and higher. Kenya’s first engine—domestic consumption—which is fuelling vibrant service and construction sectors, has always been strong. But the second engine—exports—needs to perform better. If not, Kenya will continue to operate below potential, for years to come.

But how do you do that? What products could Kenya realistically export? Picking winners is typically not a good idea. The government needs to provide the conditions—such as infrastructure, the rule of law, and basic social services—for businesses to thrive, but not run them. At the same time, it is clear that Kenya needs to move into new products, because it cannot grow rich on tea and flowers alone. The natural starting point is manufacturing. Kenya has a good location and a skilled labor force, which is rapidly urbanizing. The global manufacturing market is also changing. Today, Asia is the world’s workshop, producing almost everything from clothes, shoes, toys and increasingly cars. But Asia’s economic success translates into higher wages, and many manufacturing jobs will soon leave its emerging economies. The World Bank projects that 85 million manufacturing jobs will leave China over the next decade. Where will these jobs go? Can Kenya get a share?

A new way to understand a country’s competitiveness is to look at the existing composition of exports or “product space”. Ricardo Hausmann from Harvard University has been spearheading the global analysis of countries’ product spaces, and the World Bank recently hosted him in Kenya. According to him, some countries are richer than others because they have more productive knowledge, which they can use to make more and more complex products. In short, rich countries make a lot of products, including several which only few countries produce. Poor countries only make a few products, and the margins they earn are low because many other nations are also producing them. Realistically, a country will only be able to diversify gradually, moving first to products where a country can apply existing capabilities. Kenya is strong in tea and flowers, but it will have a hard time producing airplanes overnight.

What types of products are within Kenya’s reach, and which activities are most likely to create the conditions for industry to invest and expand? There is some light at the end of the tunnel. Kenya has started to diversify its export products and markets. Three sub-sectors stand out: textiles (exported mainly to the US), chemicals and machines (to Africa and Asia). In the 1990s, these exports accounted, on average, for about US$ 120 million in earnings. In the following decade, the figure was four times larger at US$ 480 million. On an international scale, these are still extremely small numbers, but they are starting to add up.

Still, Kenya is currently punching below its weight. According to simulations by the Harvard team, Kenya should grow at 7 percent a year. If it did, it would reach Middle Income status by 2018, and remain East Africa’s uncontested economic heavyweight. We know that Kenya can grow at such levels. It happened in 2007, but the big question is how to sustain the momentum? Can Kenya really grow at 7 percent year after year, including through election turbulence? Can the second engine start pulling its weight? Once it does, sit back, enjoy the flight, and definitely buckle up!

Join the Conversation