As world oil prices rise to near the levels of 2008, and growth on the continent resumes to pre-crisis levels (as reported on Africa’s Pulse), a natural question to ask is whether Africa’s oil importers are becoming more vulnerable to oil price increases.

A partial answer is given by a recent briefing note by my colleague Masami Kojima.

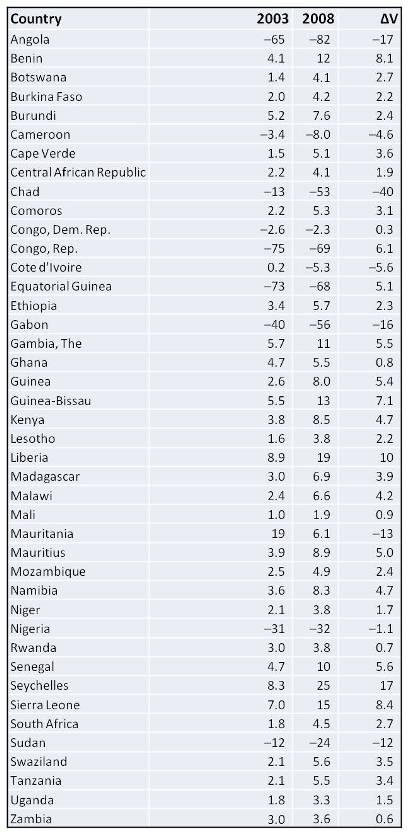

Vulnerability is determined by how much of a country's income is spent on oil imports. Looking at the period 2003-2008 (the latest for which comparable data are available), the study found that vulnerability rose in all oil importers (except Mauritania) and even in some oil exporters such as Equatorial Guinea and Republic of Congo. Also, 15% of the income of Seychelles, Liberia and Sierra Leone is used to import oil. This is among the highest in the world.

Interestingly, despite a significant increase in the price of oil during that period, the rise in vulnerability happened because energy became more oil-driven in 24 out of 42 countries.

This indicates that by changing sources of fuel these countries could reduce their vulnerability, something easier to do than reducing the energy intensity of GDP, which can be challenging in low-income countries.

"Energy intensity of GDP" is how much energy is used to produce a unit of GDP. For instance, if most of your GDP is agriculture, you probably don't use much energy in its production. But if you also produce manufacturing and services, then you probably use more energy per unit of GDP.

Table 1: Vulnerability to oil Prices in Africa

Join the Conversation