Managing nature’s assets is key to sustainable growth in Africa: Insights from the Changing Wealth of Nations 2021

Managing nature’s assets is key to sustainable growth in Africa: Insights from the Changing Wealth of Nations 2021

Sustaining Africa’s growth over the coming decades will require a new approach to economic management, one that looks beyond gross domestic product (GDP), and considers the underlying assets of its countries and how they can contribute to sustainable prosperity.

The World Bank’s Changing Wealth of Nations (CWON) 2021 report and database, which measures the wealth composition of countries across human capital, physical capital and natural capital, found that the Sub-Saharan Africa region has one of the highest concentrations of natural assets in its wealth of all regions in the world, at almost 20%.

This means that African countries need to give special attention to how they manage these natural resources. Such assets can be either the engine of economic transformation, or the catalyst of volatile growth.

Subsoil natural resources such as oil, gas and minerals are a particular challenge for policymakers. Given their exhaustible nature, growth driven by resource extraction is inherently unsustainable. That is unless the revenues are used to build wealth in other parts of the economy, rather than to fuel increases in consumption.

This means that resource management is not simply about maximizing inward investment to generate government revenues, but about re-investing those revenues in a healthy and productive workforce, in building infrastructure and productive cities, and by enhancing the value of other forms of natural assets like croplands, forests and fisheries.

The Changing Wealth of Nations 2021 (CWON) measures the evolution of these assets and so we can examine how resource-rich African countries have fared.

The record is not good, however.

In 2003, oil prices rose from around $36 to $61 in 2005, marking the beginning of more than a decade of sustained high commodity prices: a commodity super cycle. For the countries of Sub-Saharan Africa, most of whom have an abundance of natural resources such as oil, gas, and minerals, this was a once-in-a-generation opportunity in terms of investment and revenues driving unprecedented levels of GDP growth. However, by 2014, as oil prices began to slide, economic growth slumped.

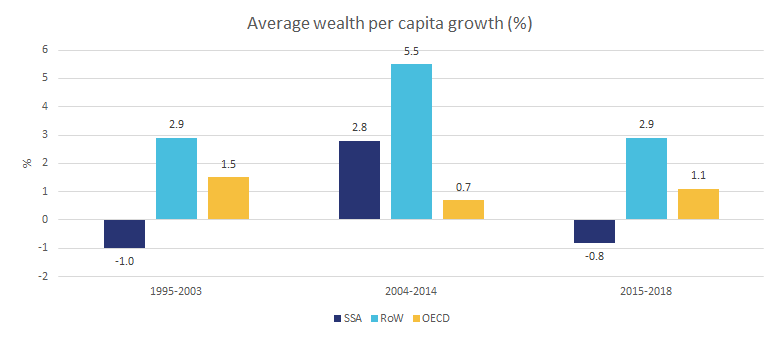

Similarly, when we look at changes in wealth per capita, the decade-long boom was followed by a bust.

Natural resources as an engine of economic transformation?

Despite many resource-rich countries such as Australia, Chile and the United States transforming into prosperous diversified economies, others have faced an uphill struggle. This challenge is known by economists as the paradox of plenty, or by some, the resource curse.

The decade from 2004 to 2014 was a test of whether such a paradox of plenty exists. Higher commodity prices meant a big boom in exports, government revenues, and values of natural capital.

The legacy of the boom is, unfortunately, one of missed opportunity. Some countries with the biggest commodity price boom also saw the biggest bust. This was accompanied by countries failing to diversify their economies and their asset base in a way to withstand commodity price movements.

This is also clearly reflected in the CWON data. In 26 countries overall—11 of which are in Sub-Saharan Africa—wealth per capita declined between 1995 and 2018. The losses were not isolated to the depleting subsoil assets like oil and minerals, but also many countries saw declining value of renewable natural capital wealth, including from deforestation and over-fishing.

Declining values of wealth per capita means that future generations are at risk of being materially worse off than current generations. In other words, the development path is economically unsustainable.

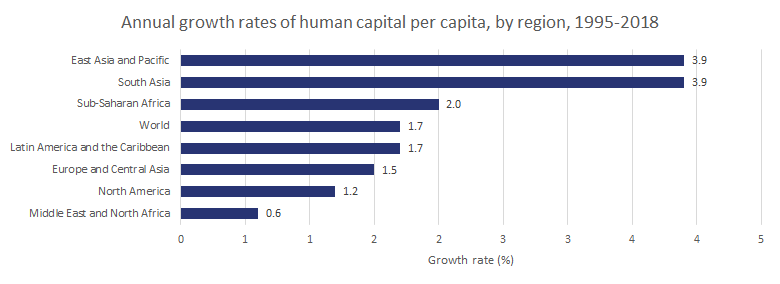

This edition of the CWON also shows that resource-rich countries saw rising economic concentration during the boom and that this has been accompanied by lower human capital accumulation, relatively higher public sector employment, and lower levels of female human capital.

Looking ahead, as commodity prices begin to rise again, there is an opportunity to learn from the missteps of the last boom and bust cycle.

Natural wealth can again help generate revenues, investment and jobs. However, how countries re-invest the proceeds from natural resources will determine the legacy of this decade. Investing in human capital alongside other assets can help to improve the resilience and diversity of their economies.

Since many countries in Sub-Saharan Africa are lagging in terms of wealth per capita, they need to accumulate assets much faster than other regions. Successful countries, with the highest levels of per capita wealth globally are also those that have the highest concentration of wealth in human capital.

The Changing Wealth of Nations 2021 report, database and tools can be found here: www.worldbank.org/cwon

Join the Conversation