As uncertainty increases about where the global economy is headed and whispers grow about a “double-dip,” spare a thought for Lesotho.

A small developing country (population less than 2 million), Lesotho is located in one of the most resource-poor parts of Southern Africa. Around 37% of households live on less than $1/day and about half are below the national poverty line. As a small and relatively undiversified economy, heavily dependent on foreign markets, Lesotho is very vulnerable to shocks. It is also ill-equipped to deal with them.

A small domestic market means that Lesotho perforce has to look to external markets for growth. It has done a reasonably good job of this, increasing its diamonds exports, selling water and power to South Africa , and exporting textiles to North America taking advantage of AGOA. These efforts have helped it transition from a predominantly subsistence economy to being at the verge of attaining middle income status today.

Dependence on foreign markets can however be risky. When the external environment was favorable, the country managed good growth (averaging 3.4% between 2004 and 2008), faster than sub-Saharan Africa. However when the global economy suddenly went sour in 2009, the same dependence led to a steep decline in growth (see Figure 1).

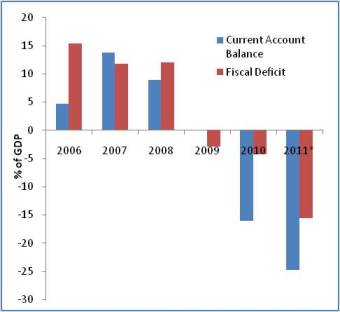

An even bigger shock came from the subsequent decline in transfers from the Southern African Customs Union (SACU), as imports into the region went down. SACU transfers fell by almost 17 percentage points of GDP in 2010/11, plunging the Government into a serious fiscal crisis and throwing the current account into deficit (Figure 2, second panel).

It has taken fully two years for growth to recover. The current recovery is being driven by an improving external outlook and higher infrastructure spending (financed in part by grants and concessional loans from donors). This could easily change.

The Government is however banking on this recovery to help it consolidate fiscally. Consolidating fiscally means trying to control the fiscal deficit, either by increasing revenues or by cutting expenditures. In the case of Lesotho the focus is largely on controlling expenditures, as the scope for increasing revenues is limited.

Even consolidation is far from being an easy task. Public expenditures remain a big driver of the economy, and this year the country faces especially large spending needs, in part because of recent floods and severe weather. These have devastated crop production and an assessment warns that Lesotho is on the verge of a major food security crisis. The Government has also committed to donors to start construction of the economically crucial Metelong Dam.

To meet these spending needs, the Government is heavily dependent on foreign resource flows. Domestic revenues do not fully cover even current expenditures, (Figure 2, right panel), while capital expenditures in FY12 will be an additional 24% of GDP.

The gathering storm clouds are therefore ominous. The only tool Government has at its disposal is fiscal policy. There is room for improvement here. The state is overextended (public expenditures in 2010/11 were 64% of GDP) and not all public money is well spent. Some recent decisions have even worsened the situation. Correcting this can give Government more room for maneuver. The IMF has a program to help the government consolidate fiscally, and the Bank is assisting it in improving the quality of expenditures.

But will this be enough? What more can we do to make the country less vulnerable to shocks? And how can we help insure small poor countries like Lesotho against the risks that inevitably come with the opportunities that international markets offer?

Figure 1: Economic growth is projected to pick-up

Figure 2: Fiscal and external imbalances are worsening

Join the Conversation