Do you ever wonder, looking at the food in your plate, where it has come from and who produced it?

Do you ever wonder, looking at the food in your plate, where it has come from and who produced it?

Surely you have thought about what explains its price on the shelf! Kenyans love sugar, which they use liberally in their tea: on average each Kenyan consumes 400 grams of sugar per week, much more than their Tanzanian neighbors who consume approximately 230 grams. In Africa, only the residents of Swaziland and South Africa have a sweeter tooth.

Globally, 70 percent of the sugar that is produced is consumed in the same country and only 30 percent is exported. In principle this is good for customers in sugar-producing countries, as long as the supply is sufficient to keep prices low. In Kenya, this is not the case: there are occasional sugar shortages and, when they can be anticipated, prices rise to extraordinary levels.

Kenya’s “sugar belt” is in the Western part of the country, around the cities of Kisumu and Kakamega. A World Bank team recently visited this beautiful region, stopping at sugar factories in Muhoroni and Mumias. The sugar sector is a great case study of Kenya’s development challenges and opportunities. The staffs in these factories are committed and very skilled. But the quality of management is mixed, which is holding the sector back. As in many other sectors of Kenya’s economy (especially agriculture and industry), what needs to be done is clear, except it’s just not being done.

Mumias is Kenya’s market leader, accounting for over half of total national output. The company, which was privatized in 2001, is making profits and is now also starting to diversify its product base. Judging by recent financial results, it seems like a well-run company. Muhoroni, by contrast, is having great difficulties.

Here are two numbers which will likely shock many people. First, Kenyan sugar fields produce an average of 60 tons of sugar cane per hectare. This is about half of the productivity in Zambia (113 tons) or Malawi (105 tons).

To grow sugar cane, Kenya’s producers still depend on rain – irrigation is non-existent– and because of the colder climate, it takes on average 18 months until the first cane crop can be harvested (against 12 months in other African countries). Shrinking plot sizes (1 ha on average) also make it difficult to achieve economies of scale and increase productivity.

Second, sugar prices in Kenya are about double the international price. A kilo of sugar costs Ksh 120; in the US and Europe it is about Ksh 60. A year ago, prices rose to nearly Ksh 200. That’s counter-intuitive: with better natural conditions and lower labor costs, agricultural products should cost substantially less in countries like Kenya. High prices not only hurt consumers’ purses but also their security: the high sugar prices in Kenya invite contraband and a lucrative informal trade has flourished in Somalia.

Perhaps some lessons can be learned from the tea sector, which remains the model segment of Kenya’s agriculture sector. There the smallholder farmers have a clear incentive to produce and are certain to get paid in time. Tea fields are on average larger, and most of the Kenyan factories are close to full capacity. International competition generates an environment where productivity remains high and prices low, like other ingredients of a typical Kenya breakfast, such as milk and bread. But will

Kenyans drink their tea unsweetened?

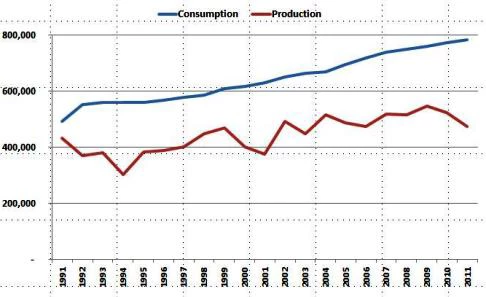

Today, Kenya is facing a structural sugar deficit. Consumption stands at 800,000 metric tons per year, but production remains below 500,000 tons (see figure). This trend is set to continue as population will increase by roughly one million per year for the foreseeable future, and sugar demand by Kenya’s food-processing sector is also growing.

Figure – Kenya’s sugar gap (in metric tons)

Source: World Bank estimates based on Kenya Sugar Board and Kenya National Bureau of Statistics data

What this means is that, barring a revolutionary change in the sector, Kenya will need to import even more sugar to bridge the gap. The good news is that COMESA countries include several strong sugar producers, such as Mauritius, Zambia and South Africa. So far, Kenya has negotiated a delay in the free trade of sugar to allow Kenya’s sugar sector to adjust and become competitive. Once sugar trade restrictions fall in 2014, sugar prices in Kenya should also fall. This will benefit all Kenyan consumers, but some of the producers, especially in Western Kenya, may lose out and will need to be supported during the transition.

At the same time, it will put pressure on Kenya’s sugar companies to further increase productivity while slashing operating costs. The result? Lower sugar prices for Kenyans, who currently pay 39 percent above the COMESA average.

The sector will need fewer, larger, professionally-run companies and similar gains in the agriculture sector, to allow producers to grow more sugar cane faster. Then the sugar sector will have a sweet future, as will Kenya.

Join the Conversation