With the recent opening of a rural savings and credit cooperative, the people in Gebremichael’s Ethiopian village no longer have to save their money in pots or under the mattress at home. He and his neighbors are learning to use formal savings and credit systems.

With the recent opening of a rural savings and credit cooperative, the people in Gebremichael’s Ethiopian village no longer have to save their money in pots or under the mattress at home. He and his neighbors are learning to use formal savings and credit systems.

We know that many in Sub-Saharan Africa have benefited from using the formal financial system, but exactly how many are using it to save, borrow, make payments and manage risk?

With the release of the Global Financial Inclusion Indicators (Global Findex) we now have a comprehensive, individual-level, and publicly-available database that allows comparisons across 148 economies of how adults around the world manage their daily finances and plan for the future. The Global Findex database also identifies barriers to financial inclusion, such as cost, travel time, distance, amount of paper work, and income inequality. Our new Working Paper offers an overview of Financial Inclusion in Africa.

Who are the unbanked?

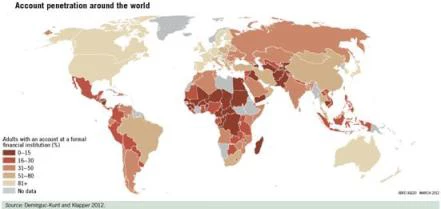

The database covers 34 economies in Sub-Saharan Africa and with over 40 indicators, each sliceable by gender, age, education, income, and rural or urban residence. But Let’s start with the broad strokes: according to the data, 24 percent of adults in SSA have a formal account, ranging from less than 5 percent in the Central African Republic, D.R. Congo, Guinea, and Niger to 54 percent in South Africa and 80 percent in Mauritius. In the developing world as a whole, 41 percent of adults have a formal account. (Global comparisons are also available).

To see images larger, please click on them

Why do 76 percent of adults – almost 500 million people - in SSA remain outside the formal financial system? Eighty-one percent of the unbanked say that they do not have enough money to start a formal account, 36 percent say that having a formal account is too expensive, and about 30 percent cite distance and insufficient documentation. Unbanked adults in SSA were more likely than those in any other region to cite each of these reasons.

How do people use their accounts?

Why open and maintain an account? In Sub-Saharan Africa, 38 percent of account holders report using their account to receive remittances from family members living elsewhere. In the rest of the developing world, only 13 percent of account holders report this.

Africans are also more likely than their counterparts in other regions to use their account to save. Fifty-seven percent of adults with a formal account in SSA saved at a formal financial institution in the past 12 months compared to 39 percent in the rest of the developing world.

What do the unbanked do?

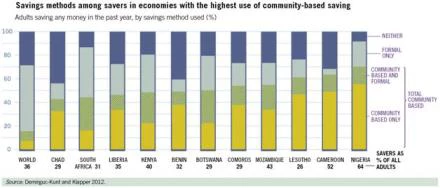

Being outside the formal financial sector means that one must find other ways to manage daily finances and plan for the future. Community-based savings methods often serve as alternatives to the formal financial sector, particularly in Sub-Saharan Africa. In the region, 19 percent of adults (or 48 percent of those who save) report having saved in the past 12 months using a savings club or a person outside the family. Women savers are 32 percent more likely than men to use only a community-based method to save.

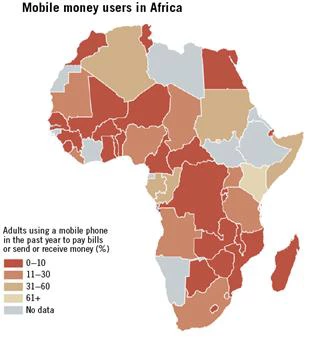

The recent growth of mobile money has also allowed millions of people who are otherwise excluded from the formal financial system to perform financial transactions relatively cheaply, securely, and reliably. Mobile money has achieved the broadest success in Sub-Saharan Africa, where 16 percent of adults report having used a mobile phone in the past 12 months to pay bills or send or receive money. In Kenya, where the M-PESA service was commercially launched in 2007, 68 percent of adults report using mobile money. The share using mobile money is less than 5 percent in all other regions.

Many mobile money users are not otherwise included in the formal financial system - in Kenya 43 percent of adults who report having used mobile money in the past 12 months do not have a formal account; in Sudan it’s 92 percent.

The complete database, report, and survey are available at http://www.worldbank.org/globalfindex.

Join the Conversation