Pressures on female employees in Côte d’Ivoire’s cashew processing industry to redistribute earnings among family and friends are high, and a key barrier to achieving long-term savings, says a World Bank study. Photo: Arne Hoel/World Bank

Pressures on female employees in Côte d’Ivoire’s cashew processing industry to redistribute earnings among family and friends are high, and a key barrier to achieving long-term savings, says a World Bank study. Photo: Arne Hoel/World Bank

In recent years, governments across the continent have expanded social safety net programs in growing recognition of their importance to reducing poverty and creating economic opportunities for vulnerable people. Yet, the coverage of these programs remains disproportionately low relative to the extent of poverty in the region, reaching on average approximately 10% of the population in African countries.

Where the poor still have limited access to formal safety nets and social assistance, informal support networks that are family and community based (or “kin networks”) remain critical resources in helping build resilience and mitigate financial hardship. For instance, financial transfers within these kin networks enable risk sharing and can help address household shocks.

However, these networks also create social pressures to redistribute income, which might hinder individuals’ capacity to save and to reap the benefits of their productivity. For women, the pressure to redistribute earnings may be even greater based on their relatively lower standing within these networks.

An impact evaluation by the Africa Gender Innovation Lab in collaboration with the Jobs Group at the Social Protection and Jobs Practice seeks to assess the effects of this social pressure to redistribute income on the workplace-level outcomes, motivation, and incomes of female employees in Côte d’Ivoire’s cashew processing industry.

The impact evaluation has so far revealed that pressures on factory workers to redistribute earnings among family and friends are high, and a key barrier to achieving long-term savings. At baseline, the female cashew factory workers reported facing intense demands to share their earnings with others; for instance, 83%stated that they gave money to someone several times a month. Workers transfer a significant share of their earnings, 29% on average. Moreover, 73% of workers agreed or strongly agreed with the statement that redistributive pressures make it difficult for them to save, as seen in Figure 1.

Figure 1: Problems Saving Money

Respondents express a desire to avoid a large subset but not all of the transfer requests they receive. However, refusal is perceived as socially costly, unless workers can credibly claim having insufficient funds to share. Indeed, workers employ multiple informal strategies to shield earnings from redistributive pressures. Locking earnings away is a commonly encountered strategy that workers use to reduce cash on hand, making it possible to save while credibly denying transfer requests (McNeill and Pierotti 2021). Before the project, workers accumulated their savings through informal rotating savings and credit associations (ROSCA), mobile money, and/or keeping money at home. However, workers reported that these existing ways of saving made it hard for them to say no to transfer requests, and none of the workers had access to an account in the formal banking sector.

Through the impact evaluation, half of the female factory workers in the study received access to an innovative financial product: a direct-deposit commitment savings account, which gave users the ability to discreetly deposit any excess wages over a predetermined cutoff into a private account. This blocked savings account provided workers with a more effective alternative to lock earnings away. Among the first wave of selected participants who received access to the accounts, take-up was high, reaching 55%.

Notably, when workers were asked if they would take up a direct-deposit savings account that was private or non-private (that their kin network would know about), respondents indicated a much higher demand for the private over the public direct-deposit account (see Figure 2). The most frequent response given for declining the public account was that a public account would increase pressure from their family, friends, and people in their community, which aligns with the hypothesis that redistributive pressure undermines worker savings.

Figure 2: Respondent Interest in Private vs Public Account (n = 317)

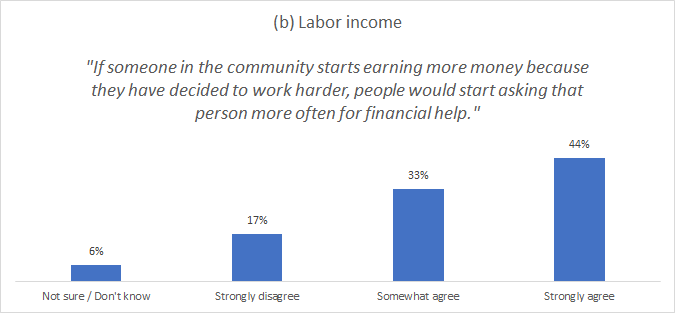

These findings suggest that we should nuance our understanding of informal safety nets within kin networks. While financial transfers within kin networks can support poverty reduction and provide important social benefits, they can also undermine savings and prevent workers from retaining more of their earned income. In a broader sense, these pressures may also stymie gross domestic product growth and economic transformation: If workers know they will be compelled to redistribute their earnings from wage employment, they may be less motivated to increase their labor productivity through costly effort. Similarly, they may opt to take on traditional or informal sector work where earnings are less visible in order to be more profitable (see Figure 1) and avoid opportunities for stable wage employment in modern sectors, hampering the structural transformation of the economy.

Tackling the likely underlying cause of redistributive norms—a lack of formal safety nets—is likely to improve output and growth. Government social safety net programs could not only improve the welfare of the unemployed, but could also boost the productivity of the employed by reducing their responsibility to redistribute.

In our next blog, we will examine more closely the linkages between redistributive pressure and labor productivity. We will also explore how these challenges relate to high labor costs and limits to industrial sectors that have so much promise in reducing poverty. Stay tuned for more on this soon!

For more information on this study, please see the following policy brief: Working Under Pressure: Improving Labor Productivity through Financial Innovation

Join the Conversation