Girl holding flags at local elections in Turkey | © shutterstock.com

Girl holding flags at local elections in Turkey | © shutterstock.com

Banks are the heart of the financial system. They mitigate macroeconomic and financial shocks and enhance economic stability. Banks also play a leading role in providing financial services to underserved people. The World Bank Global Findex Database 2017 shows that 69% of adults around the world have an account in a formal financial institution, where the banks constitute the vast majority along with other regulated financial institutions. In that sense, banks play a significant social role in economic development.

Unlike private banks, profit maximization is not the primary motive for state-owned banks. The social role of promoting financial development, especially in areas that are not served by private banks, is presented as one of the rationales for state ownership of banks. But, at the same time, state ownership of banks makes them more open to political influence. Therefore, the political determinants of bank branching are an important issue, especially for countries where state-owned banks form a large share of the formal financial sector.

In my recent research study, I explore the role of the influence of spatial factors in the policy-making process over the course of political cycles and focus on whether selective opening of bank branches can turn into a political opportunity. Examining the change in the number of bank branches, I argue that the central government can focus on the allocation of physical public investments before elections to increase its share of the votes. Contributing to the literature on the political allocation of public resources, my results show that electorally competitive cities benefit from the delivery of physical public goods—state-owned bank branches in this case.

State-Owned Banks as Visible Public Goods

How do banks relate to political opportunity? I argue that the visibility of banks matters. Not all state actions and investments provide similar visibility in terms of demonstrating to the public an improvement in the provision of public goods. When authorities allocate resources to less tangible and more complex issue areas, such as improving education or the health care system, the results might be less visible to the public.

On the other hand, delivering public goods and services with a higher degree of visibility, such as fixing potholes or opening new banks, not only convinces voters that the incumbent works, but also signals their potential. Public goods that are of high salience to the voters do not need additional advertisement. Even citizens who might not use those services note their presence and that might affect their vote. Moreover, unlike building roads and highways, opening a state-owned bank branch does not require a long procedure, time, or infrastructure. The governing party can easily rent, buy, or use a building and turn it into a bank branch.

How Does Political Competition Matter?

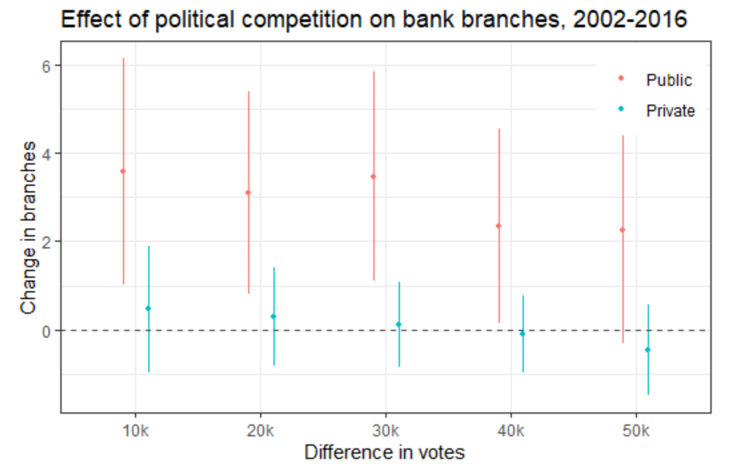

I look into the impact of political competition on the spread of bank branches in 81 cities in Turkey from 1961 to 2016. Using city-year-level data for the number of bank branches for 188 banks and 14 nationwide election results, I show that cities in which elections were won by a lower margin of victory are more likely to enjoy an increase in the number of state-owned bank branches. The number of state-owned bank branches increased by one on average in those cities. This impact is larger under single-party governance compared with the coalitions. For instance, high competition led to a net change of three state-owned bank branches on average for the recent single-party period of 2002–16.

There is small, or no, impact on the number of private bank branches and the years after elections. However, this does not completely rule out the possibility of the potential direct or indirect influence of politics on private banks. Recent studies on bank lending indicate that private banks might also be subject to political interference in the United States and France. However, unlike the United States and France, where private banks dominate the banking system, state-owned banks represent one-third of the financial system in Turkey. Even in this case, my results suggest the minimum impact of the role of politics on the spread of banking in Turkey.

My study adds to the literature that studies the impact of politics on the allocation of public financial resources. Although some studies have looked at the credit market and lending cycles, such as loans given before and after elections and their contribution to economic productivity, I take a step back and ask whether bank branching itself could be an electoral tool.

Does Political Competition Increase Financial Inclusiveness or Inequality?

Both effects might be in play. My findings indicate that greater political competition produces more state-provided financial services. The government opening public bank branches strategically to aid the incumbent reduces the cost of public service to people with no prior access to formal institutions. More broadly, given that distance was cited as a barrier to access formal financial services by 12% of people without a financial institution account in Turkey, political competition might contribute to financial inclusiveness in swing cities in the long run. On the other hand, these political considerations produce a less efficient allocation of public resources, thereby contributing to economic inequality between swing cities and those that tend to have pro-incumbent or pro-opposition majorities.

Nisan Gorgulu (@NisanGorgulu) is a PhD candidate in Economics at The George Washington University. More details about her research can be found on her website.

Join the Conversation