In “Securities Trading by Banks and Credit Supply: Micro-Evidence”, we explore the effects of the financial crisis on securities trading by commercial banks and the subsequent effect of the latter in credit supply. We find that banks with higher trading expertise increase their investments in securities in crises and decrease their supply of credit.

Banks today hold a considerable amount of securities among their assets. However, there is an important policy and academic debate as to whether they should be able to do so. The investment behavior of banks is portrayed in Figure 1, where was a sharp decline in price in the security around 2009; at the same time, German banks with higher trading expertise increased their holdings of said security.

Although there is a growing theoretical literature that argues that, during crises, securities’ trading has negative externalities on credit supply, there is insufficient empirical evidence about this phenomenon. Our paper contributes to that evidence by employing an empirical identification strategy to a unique dataset on German banks.

Data and hypotheses

We use a proprietary security and credit quarterly registers database from the Deutsche Bundesbank, from the last quarter of 2005 until the last quarter of 2012. For each security, this dataset includes information about the amount held by each bank, which was merged other sources[1] of security data (e.g. issuer, price, rating, coupons and maturity). Regarding data on individual loans, banks report -on a quarterly basis- on all borrowers whose overall credit exceeds €1.5 million (which amounts to about 70% of the total credit volume).

The main testable hypothesis of our paper is that, during a crisis, banks with a higher trading expertise (“trading banks”) increase investments in securities, in particular the ones that present a larger drop in price. We also test whether or not this increase, if it exists, has implications in the supply of credit.

Results

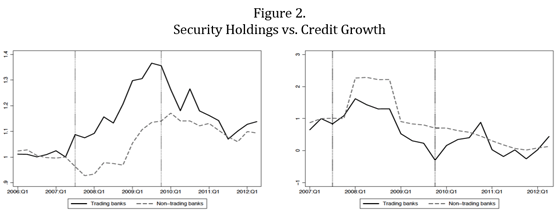

Summary statistics suggest that trading banks increase their security holdings during the crisis and decrease credit, as can be observed in Figure 2 (where the vertical lines are the crisis period).

We use an empirical model that controls for the unobserved and time-varying features of securities (e.g. risk, liquidity, outstanding volumes) and banks (e.g. reputation, management policies) in order to isolate the effect of interest and to test the former hypothesis.

We find the following main results:- Do trading banks increase their security investment during the crisis? Yes, we find that they do. Trading banks buy and sell nearly twice as much securities as non-trading banks.

- Is there heterogeneity in the previous finding? Yes. We find that trading banks buy more of the securities that presented a larger drop in price in the previous quarter. Moreover, there is a stronger impact for securities with lower than triple-A credit ratings as well as with residual maturity above one year.

- Does the increase in security investment affect the supply of credit in the economy? Yes. We encounter evidence that trading banks decrease their lending during the crisis. This decrease is greater for trading banks with higher levels of capital.

Conclusion

The previous results seem to suggest that during a crisis securities trading by banks crowd out credit supply. However, at the same time, the increase in security holdings largely stems from the acquisition of risky assets, which implies that banks act as risk absorbers. Thus, restrictions on banks could affect the liquidity of the market. As a result, the debated question as to whether banks should engage in securities trading has an ambiguous answer according to the findings of this paper.

References

Abbassi, Puriya, Iyer, Raj, Peydró, José-Luis and Tous, Francesc. 2016. Securities trading by banks and credit supply: Micro-evidence. Forthcoming in Journal of Financial Economics. _____________________________________

[1] ISIN, Bloomberg, FactSet.

Join the Conversation