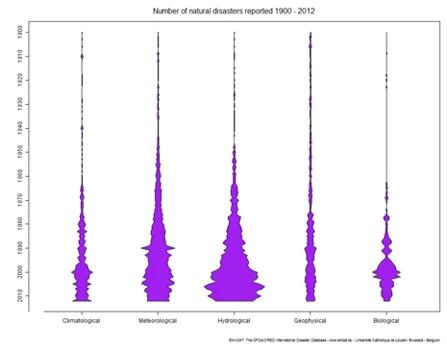

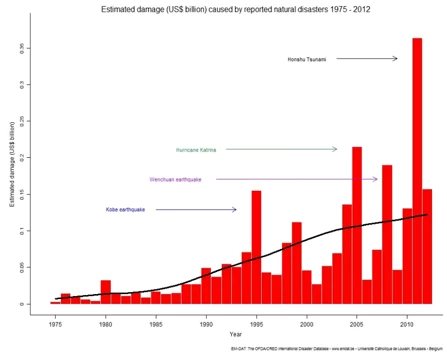

The frequency of natural hazards has increased over time. From 1970 to 2010, approximately 3.3 million people were killed (on average, 82,500 deaths per year), and the property damages exceeded US$2,300 billion, or 0.23% of the cumulative world output. After a disaster, governments should be able to respond fast with robust emergency relief aid as well as reconstruction. In fact, they should rebuild better. However, the average fiscal response after disasters across countries and time is close to zero (Melecky and Raddatz 2008, table 2). [1] This result can stem from very heterogeneous responses of countries, including due to the varying available fiscal space and ability of the private sector to respond alongside the government. In addition to good preparation, having available resources to respond after disasters is key, and financial development could help.

Natural disasters have direct costs typically measured as damages, casualties, and output losses. In addition, natural disasters can constitute a major issue for public finances, particularly debt sustainability. The reconstruction of public infrastructure destroyed by a disaster requires increases in government expenditures at the same time the contracted economic activity may reduce the government's ability to collect taxes. Moreover, governments need resources to provide emergency relief, aid, and social assistance to affected people.

The effect of disasters on public finance and debt sustainability depends on the government's response to the disasters. Governments can increase spending for reconstruction and relief if they can mobilize fiscal revenues, borrow from domestic or international markets, or benefit from previously contracted fiscal insurance. However, when a government does not have these financing options, it must maintain or even decrease expenditures, and potentially increase the economic cost of disasters.

The combination of expenditures, revenues, and borrowing that the government chooses could depend on its access to debt financing, the cost of borrowing, and the demand for government services. For instance, countries with developed debt markets that can borrow at low cost may prefer that route to mobilizing revenues through taxation or curbing expenditures after disasters. And countries in which private insurance markets cover a large part of the reconstruction costs may focus more on emergency relief, face smaller funding requirements, and grow spending moderately.

In a recent paper, Melecky and Raddatz analyze fiscal responses after natural disasters and examine whether these responses could be boosted by debt market development and greater penetration of private insurance. Using annual data for high- and middle-income countries [2] during 1975–2008, they estimate that greater debt market development enables countries to increase government expenditures after natural disasters by approximately 55%. Although fiscal deficits increase more in financially developed than in financially underdeveloped countries (by 75% versus 10%), the additional resources that an efficient debt market can mobilize help significantly mitigate the macroeconomic costs of disasters.

Further, countries with low insurance penetration expand their government deficit after disasters by 15% (compared with no expansion in countries with high insurance penetration), but do not manage to reduce the negative consequences of disasters as much as countries with high insurance penetration. Countries with high insurance penetration could use resources from insurance payouts to recover productive capacities, and little fiscal effort is needed to dampen the macroeconomic costs of disasters.

Overall, the output loss in financially underdeveloped countries appears to be 2%–10% of GDP versus, on average, no significant loss in financially developed countries. Yet, in contrast to countries with developed debt markets, countries with high insurance penetration can mitigate the economic costs of disasters without engaging in deficit financing of expenditures.

The analysis offers important policy messages about using financial development policy for boosting fiscal response to disasters. Namely, countries with more developed debt or insurance markets suffer less from disasters. However, insurance penetration seems to mitigate the macroeconomic consequences of disasters without requiring an increase in the fiscal burden, and is thus ex post more efficient.

Although the results relate to private insurance penetration, fiscal insurance policies could have a similar positive hedging effect and help enhance disaster relief response and reconstruction and further diminish the real consequences of disasters in a fiscally sustainable manner. Using fiscal insurance, governments could avoid jeopardizing fiscal sustainability after natural disasters by purchasing financial products that transfer and disperse some of the financial risks from natural disasters into international financial markets. However, challenges in pricing and cost-benefit analysis concerning these products often leave countries hesitant to use them, assuming they will be able to meet the financial costs of disasters with their current expenditures and the help of official aid.

Recent experience suggests that, despite these challenges, countries would like to arrange for some risk transfer mechanism as part of their climate change risk mitigation strategies. These mechanisms include contingent debt arrangements with international financial institutions, such as Sri Lanka’s Catastrophe Deferred Drawdown Option with the World Bank, [3] or genuine insurance pooling, such as the Caribbean Catastrophe Risk Insurance Facility. [4]

____________________________________[1] Martin Melecky and Claudio Raddatz, "How Do Governments Respond after Catastrophes? Natural-Disaster Shocks and the Fiscal Stance," Policy Research Working Paper Series 5564, World Bank, Washington, DC (2011).

[2] Note, however, that to maximize the coverage of countries, Moldova and Lesotho, two low-income countries, appear in the sample. Their exclusion from the sample does not change the reported results of the study.

[3] http://www.worldbank.org/en/news/press-release/2014/09/25/progressive-steps-reduce-impacts-disasters[4] http://www.worldbank.org/en/news/feature/2014/04/21/caribbean-central-america-climate-catastrophe-risk-coverage

Join the Conversation