Since the early 2000s, local-currency debt (mostly traded in domestic markets) became a growing and important source of funding for several governments in emerging market economies. Despite their impressive growth, many domestic sovereign debt markets maintain a captive domestic audience that facilitates direct credit to government. This represents a form of financial repression 1, which can lead to a crowding out of private credit.

The degree of this form of financial repression depends crucially on government access to foreign credit. If there is a low presence of foreign investors in domestic sovereign debt markets, governments have to rely heavily on domestic financial institutions potentially worsening the crowding out of private credit. In turn, an increased presence of foreign investors might reduce financial repression, and free resources for the private sector. As a result local firms may be able to finance more investment projects and boost economic activity. Although intuitive, there is little evidence on this topic because of identification challenges.2 In a recent study (Williams, 2018), I use a quasi-natural experiment in Colombia and provide evidence on how the entrance of foreign investors into domestic sovereign debt markets reduces financial repression and increases domestic credit growth, boosting economic activity.

Foreign Investors in Domestic Sovereign Debt Markets

For identification I use a sudden, unanticipated shock that triggered the entrance of foreign investors to the local currency sovereign debt market in Colombia. On March 19th 2014, J.P. Morgan announced the inclusion of several Colombian treasury bonds into its emerging markets local currency government debt index, the largest restructuring by J.P. Morgan in one of its indexes. Since many international mutual funds track their performance against this index, they changed their portfolio, directing capital inflows to the Colombian sovereign debt market, and increasing their presence (Figure 1).

Figure 1: Foreign Share of Domestic Government Debt Securities

Note: This figure presents the evolution of the share of domestic government debt securities (TES) held by foreigners. The dashed line shows a linear trend using the average growth during the 12 months prior to the announcement of the change in the index by J.P. Morgan. The grey bar represents the announcement of the rebalancing by J.P. Morgan.

The entrance of foreign investors had sizable effects on commercial banks depending to their participation in the Treasury market. In Colombia, the Ministry of Finance selects financial institutions to act as market makers in the Treasury market. Each of the intermediaries participating in the program is obliged to absorb 4.5 of the total debt issued by the government in the primary market, and as a benefit, the participating financial institutions get reduced prices through non-competitive auctions in the primary market.

Figure 2: Domestic Sovereign Debt Exposure in Commercial Banks

Note: This figure shows the evolution of sovereign debt over assets dividing by market maker and non market maker banks at the end of 2013. The index is constructed by averaging the growth of domestic debt over total assets at each point in time. The index is normalized to the average holdings of sovereign debt over assets for the two groups in February 2014. The grey bars indicate the events described in the picture.

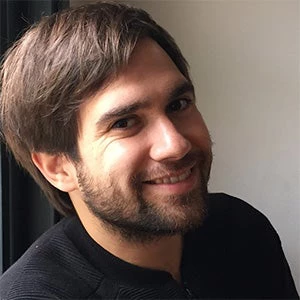

After the entrance of foreign investors, market makers, those more affected by the financial repression channel, reduce their domestic sovereign debt holdings substantially as shown in Figure 2. Consistent with this channel, there is a reduction in the discount paid by the government to market makers in non-competitive auctions for government debt securities (Figure 3).

Figure 3: Discount in Primary Market

Note: This figure shows the evolution of the discount in non-competitive primary market issuances of sovereign bonds in Colombia. It shows the time evolution of this discount. The discount is calculated for each bond in each issuance as the secondary market price divided by primary market price and substracting 1 from that ratio. The blue line is the average across bonds for each month with at least some issuance activity. The red dashed line is the average before March 2014 (pre) and the average after the end of May 2014 (post). The grey bars indicate the events described in the picture.

Consequences for Bank Lending and Economic Activity

If financial repression was leading to a crowding out of private domestic credit, one should observe market-maker banks increasing their credit relative to the rest of the banks. Using data at the city-zone level, I use a differences-in-differences specification to show that market maker banks increased differentially their commercial credit availability by 4.2 percentage points of their assets versus the non-market-maker banks. This finding is illustrated in Figure 3, that depicts the differential credit growth after taking into account city-zone fixed effects in each quarter. This differential credit growth is indistinguishable from zero in before the rebalancing, and becomes positive and significant only during the quarters of the rebalancing.3 Furthermore, the increase in private credit had positive effects on the real economy: industries with higher exposure to market makers experienced a higher growth in employment, production, sales and GDP during the rebalancing period.

Policy Implications

These findings have implications regarding the use of policies to increase the share of foreign investors in domestic sovereign debt markets. For instance, large emerging countries such as China still have a low participation of foreigners in their domestic sovereign debt markets. Moreover, on March 2016, J.P. Morgan included China on a watch list to enter the GBI-EM. Another consideration is that China would have the largest weight in the index. Thus, its introduction could lead to a decrease in the weights of the rest of the countries, ultimately leading to negative spillovers to the other constituents of the GBI-EM.

Finally, results suggest that sovereign debt index rebalancing can have effects on the economy beyond the usual price effects found in the literature.4 Nowadays, the prerequisites to enter these indexes are quite transparent and accessible to domestic policy makers. Working towards the fulfillment of these prerequisites can be a way to increase and diversify the source of funding for governments beyond the much-used domestic financial institutions.

References

Altavilla, C., Pagano, M., and Simonelli, S., 2017. Bank Exposures and Sovereign Stress Transmission. Review of Finance, vol. 21 (6), pp. 2103-2139.

Becker, B., and Ivashina, V., 2017. Financial Repression in the European Sovereign Debt Crisis. Review of Finance, vol. 22 (1), pp. 83-115.

Gennaioli, N., Martin, A., and Rossi, S., 2014. Sovereign Default, Domestic Banks and Financial Institutions. Journal of Finance, vol. 69 (2), pp. 819-866.

Ongena, S., Popov, A., and Van Horen, N., 2016. The invisible hand of the government: “Moral suasion” during the European sovereign debt crisis. Working Paper Series 1937, European Central Bank.

Pandolfi, L. and Williams, T. Capital Flows and Sovereign Debt Markets: Evidence from Index Rebalancings. Journal of Financial Economics, forthcoming.

Reinhart, C., and Sbrancia, B., 2015. The Liquidation of Government Debt. IMF Working Paper No. 15/7.

Williams, T., 2018. Capital Inflows, Sovereign Debt and Bank Lending: Micro-Evidence from an Emerging Markets. Review of Financial Studies, forthcoming.

________________________________________________

1 This is highlighted by Reinhart and Sbrancia (2015)

2 The European Sovereign Debt Crisis sparked a number of related studies analyzing financial repression during the crisis. See for instance Ongena et al. (2016), Becker and Ivashina (2017) and Altavilla et al. (2017).

3 In the paper I show evidence consistent with a credit supply channel not affected by bank observables. More notably, the results are not driven by valuation effects such as the ones highlighted in Gennaioli et al. (2014).

4 See for instance Pandolfi and Williams (2018).

Join the Conversation