There has been an ongoing debate regarding the consequences of foreign ownership in the banking sector in Mexico. Some participants in the public discourse argue that foreign ownership earnings leave the country in the form of dividends, leaving little, if any, for reinvestment. Another argument claims that foreigners are not interested in economic development in the country and thus restrict credit, especially to small and medium-size companies.

In this study (read Spanish version), we first analyze the theoretical underpinnings. According to Becker’s theory of discrimination, if one entity were to discriminate, the competition would take advantage of the money left on the table and would eventually take the discriminating entity out of the market or, at least, the entity would show subpar performance. In other words, discrimination in giving credit in the country would go against the best interests of the foreign-owned bank.

If we go back one step, it is not even clear which banks should be considered foreign-owned. For instance, some banks brand themselves in advertisements as national, yet they are traded in the stock market and thus their owners are continually changing. While the percentage varies, about a third of the stock is held by foreigners. At the same time, some banks that area considered foreign-owned have a meaningful percentage of shares held by nationals, and some have key decision makers that are national. Defining foreign versus domestic banks in an economic sense is not a straightforward exercise. Legally, however, we should remember that all banks operating in the country are domestic legal entities paying domestic taxes.

Banks might operate differently due to varying strategies and business models. These seem to be a more meaningful partition of banks than dividing them by country of ownership. Some banks might target commercial loans; others would go after the low-income segment, while others concentrate on private wealth management. These strategies naturally would be reflected in the different metrics of the banks, but are not a reflection of ownership per se.

In any case, given current circumstances there might be restrictions on the amount of capital available to lend due to losses in other countries in which the banks operate. However, cutting losses short and letting profits run would indicate that banks, if they have the capital available to grow, should do it in countries with better prospects. Currently, banks seem to have healthy returns in the country and conditions seem favorable. Thus, banks would be incentivized to grow here even at the expense of other less promising countries in which they operate. Thus, there do not seem to be credible arguments for restricting credit in Mexico due to home bias.

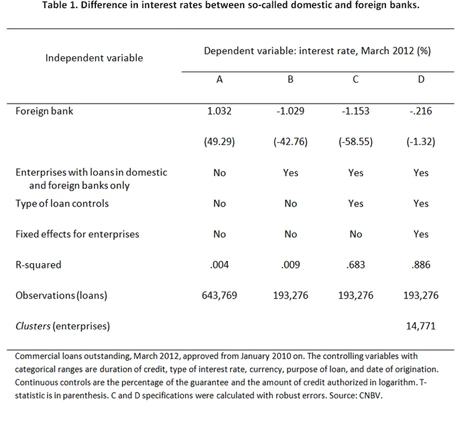

Nevertheless, we analyze the data econometrically. The results show that there is no evidence supporting that foreign banks charge higher interest rates, nor that they restrict credit in general, neither to small and medium-size enterprises in particular.

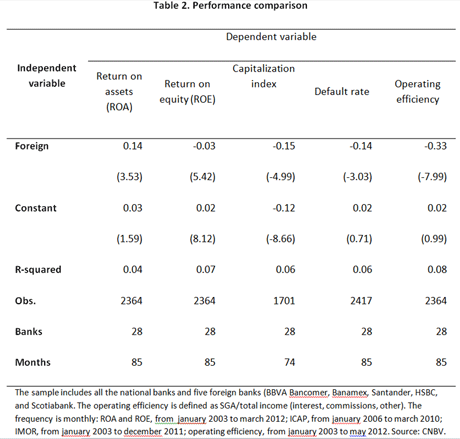

Statistically, foreign-owned banks are also slightly better capitalized with a slightly lower default rate, suggesting perhaps a better implementation of technology, economically understood.

Join the Conversation