Shop owner opening her store. | © shutterstock.com

Shop owner opening her store. | © shutterstock.com

Small firms dominate the economies of developing countries. This phenomenon occurs in all sectors, but it is particularly salient in the retail sector. For example, in Mexico, there is one mom-and-pop shop for every 100 inhabitants, while in the United States, there is one mom-and-pop shop for every 2,200 inhabitants. These stores are not just prevalent, but also economically important, contributing 7 percent to gross domestic product, generating 11 percent of employment, and representing 15 percent of all microenterprises in Mexico.

Given their importance, both academics and policy makers have studied various factors that might explain why there are so many small firms in developing countries. The literature suggests that supply-side constraints, such as a lack of access to credit or poor contract enforcement, among others, hinder their growth. However, programs aimed at reducing some of these barriers have found that, in many cases, interventions have relatively small and short-lived effects on the growth of small firms, suggesting that there might be other factors, particularly on the demand side, that limit their growth.

Our work argues that demand-side constraints—that is, factors that affect consumers rather than producers—play a significant role in the prevalence and lack of growth of small firms in developing countries. We specifically focus on a prominent consumer-side barrier: lack of spatial mobility due to high transportation costs.

In our research, we ask the following: can high transport costs for consumers explain the prevalence, lack of growth, and low quality of stores in the retail sector in developing countries? Our main hypothesis is that larger consumer transport costs lead to lower spatial mobility, which limits the degree of competition across stores, leading to the survival of smaller and lower-quality stores.

Studying this hypothesis is challenging because most mom-and-pop shops are informal; therefore, there is no government-collected, high-frequency data on their behavior. To overcome this challenge, we leverage the fact that various private providers have detailed information on these shops. We collaborated with one of the main upstream suppliers of these stores in Mexico to obtain data on the universe of mom-and-pop shops. We obtained a monthly panel of 1.5 million stores, accounting for more than 20 million observations, with information on the stores’ geographic coordinates, the monthly value of their purchases from this provider, their entry and exit patterns, as well as other variables such as their formality status.

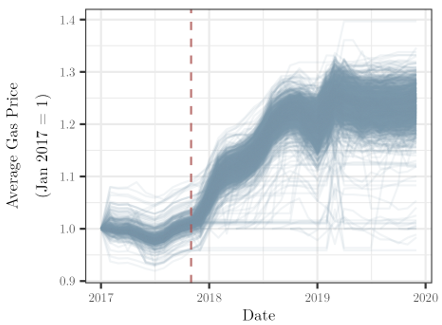

Figure 1: Evolution of Gas Prices |

|

We combine these data with an exogenous shock to consumer transport costs to answer our research question. Our empirical strategy consists of an instrumented difference-in-difference design, which uses variation induced by the liberalization of gasoline prices in Mexico in late 2017. Figure 1 shows the increase in gasoline prices in each municipality of the country after the price liberalization (dashed line). On average, prices increased by 20 percent, with variation across municipalities. Our empirical strategy uses this variation to compare municipalities that experienced a higher versus lower price increase before and after liberalization.

Figure 2 displays our results. Before the price liberalization, there were no significant differences between treated municipalities (where gasoline prices increased more) and control municipalities. However, after the price increase, there was a relative increase in the number of stores by 4.8 percent, a decrease in store size by 3.3 percent, and a decrease in quality by 0.2 standard deviation.

Figure 2: Main Findings: Number of Stores, Sales, and Quality

We explore the mechanisms behind these results using data from the National Household Income and Expenditure Survey and confirm that households experienced reduced spatial mobility by decreasing their gasoline consumption and car ownership. We also find a substitution in consumers’ shopping patterns across store formats: fewer visits to supermarkets and more visits to mom-and-pop shops. We rule out other possible mechanisms such as price changes in the products sold or deteriorating job market opportunities in the formal and informal sectors.

We then estimate a structural spatial model that captures consumers' decisions on where to shop and microentrepreneurs' decisions on whether to open mom-and-pop shops. A key parameter of the model regulates consumers’ sensitivity to transport costs. Estimating this parameter is challenging without data on consumers’ behavior, which are often unavailable in developing countries. Nevertheless, we show that the parameter can be estimated by measuring the effect of a store’s entry on nearby incumbents depending on distance. Intuitively, if consumers are not sensitive to transport costs, the entry of a new firm will affect distant businesses since consumers are willing to travel far to shop at the new store. If consumers are sensitive, the new store’s entry will only affect nearby shops from which the entrant will “steal business.” Using our detailed panel, we show that new stores only affect businesses within 300 meters (3 minutes’ walk), indicating high consumer sensitivity to transport costs (Figure 3). This suggests that retail markets are fragmented, and the degree of spatial competition is highly localized. Thus, supply-side efforts to modernize this sector may have limited impact since the firms cater to localized demand.

Figure 3: Effect of an Entrant on Incumbents’ Sales at Different Distances (measured in meters)

Finally, we use our estimated model to study two counterfactuals of interest. First, we explore how market structure would change if Mexico’s transport costs matched those of the United States. Under this scenario, we estimate a 21 percent reduction in the number of stores relative to the current count. While not sufficient to close the gap between the two countries, this contributes to having fewer, larger stores. The second counterfactual focuses on the impact on social welfare when there are fewer stores. Ex-ante, having fewer stores has an ambiguous effect on social welfare: on the one hand, it reduces the number of varieties to which consumers have access, decreasing consumer surplus; but on the other hand, it allows surviving firms to capture larger market shares, boosting producer surplus. Moreover, fewer stores imply lower total payments for fixed costs incurred. We simulate the outcomes of a government licensing program for shops and find that reducing the number of stores would increase social welfare by 1.4 percent, mainly due to increases in producer surplus by eliminating the cannibalization effect of new stores in the market.

Our study has important implications for both academia and public policy. Incentives for the modernization of the retail sector and microenterprises more broadly depend on the size of the market to which they have access. Public policies focused solely on reducing supply-side barriers will not have the desired effects if businesses have access to small and fragmented markets. Our research suggests that increasing consumers' spatial mobility expands the size of the market to which businesses have access, leading to greater competition among stores and enabling the growth and survival of higher-quality stores.

Join the Conversation