Investment volatility metaphor of people riding arrow-like roller coaster | © shutterstock.com

Investment volatility metaphor of people riding arrow-like roller coaster | © shutterstock.com

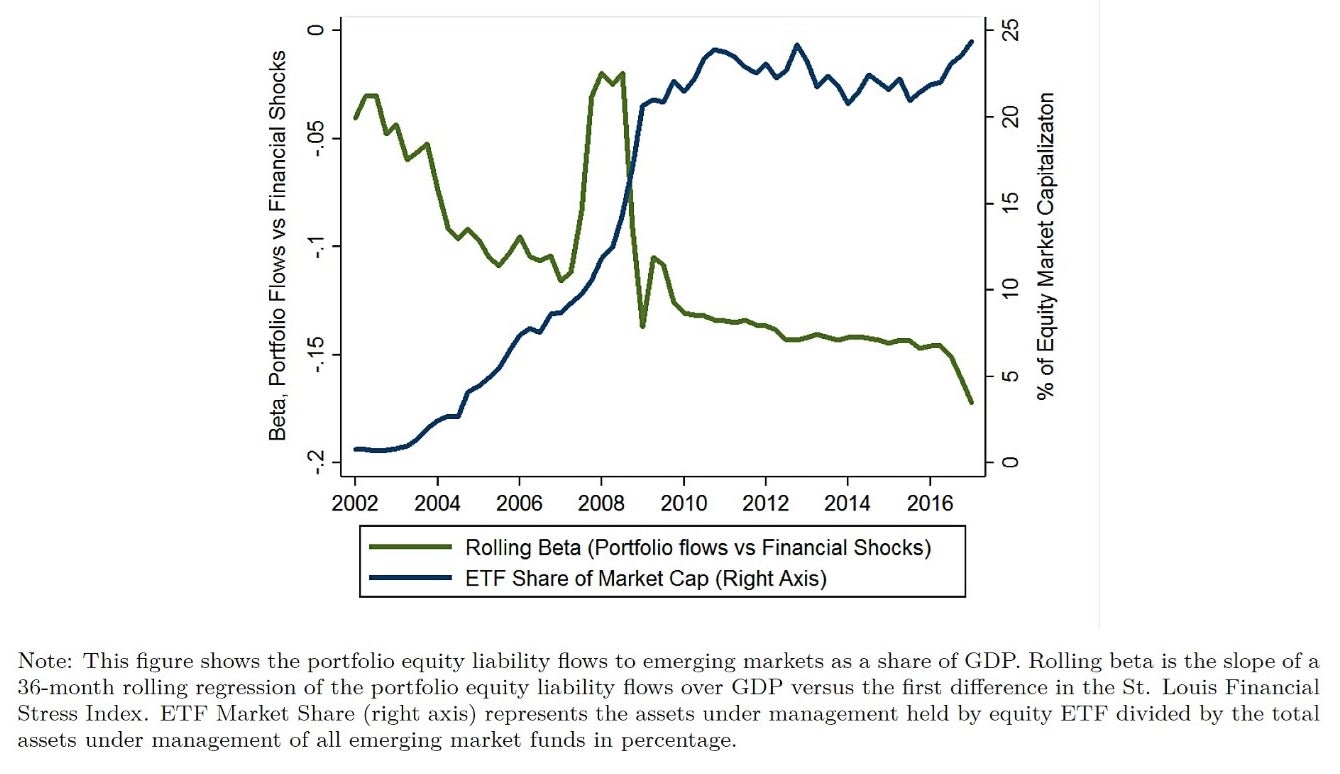

The growth of passively managed and exchange-traded funds (ETFs) has been a notable recent development in fund management. The assets held by ETFs have increased even more rapidly than those of the industry, and now account for more than 20% of the NYSE market capitalization (and about a third of its traded volume).1 This has been especially the case for funds investing in emerging markets (figure 1). In parallel, the exposure of equity inflows to global risk has steadily increased over the past 15 years. More to the core of our argument, these two trends appear to be closely related. Is there a true causal connection between the two?

Figure 1: ETF Market Share and Emerging Markets’ Exposure to Global Financial Shock

In a new paper (Converse et al. 2022), we find evidence that investor flows to ETFs are more responsive to global risk factors and less responsive to local factors such as the fiscal and growth performance, relative to investor flows to traditional mutual funds. Consequently, the larger the share of a country's market capitalization held by ETFs, the greater is the sensitivity of portfolio flows to changes in global financial stress .

To argue this more rigorously, we proceed in two steps. First, we look at monthly fund-level data on investor flows to equity and bond mutual funds and ETFs (sourced from EPFR Global),2 and run a regression of these fund-level flows against one global factor (the St Louis Fed Financial Stress Index, a broad measure of global risk conditions) and one local factor (the median of growth in industrial production across the countries included in each fund’s scope), interacting these two factors with an ETF dummy to capture any differential sensitivity.3 We find that the negative relationship between global risk and investor flows is significantly larger (almost 1.5 times for equity and 1.25 times for bonds) for ETFs, compared to mutual funds investing in emerging markets.

Moreover, we analyze the potential mechanisms behind this excess sensitivity of investor flows to ETFs and show that ETFs with larger sensitivities to global risk factors are typically held more by investors that have a shorter trading horizon and trade more often in response to shocks.

In short, there is enough evidence to conjecture that in countries with a higher degree of ETFication, what is going on abroad may matter relatively more than what is happening at home. This is precisely where we take the second step of our analysis.

From investor behavior to country implications

In our country-level analysis, we estimate, for each country, a global sensitivity parameter β (the coefficient from a regression of (a) portfolio equity inflows from the balance of payments, and (b) stock market returns on our global risk factor), and we compare it with the country´s share of local equities held by ETFs (its period average). Figure 2 shows the result: capital flows are closely driven by global shocks (β is more negative) the larger is the ETF share.

Figure 2: Country Betas and ETF Share of Market Capitalizatio

Examining this link more closely, we find that where ETFs hold a larger share of a country’s equity market capitalization, both portfolio inflows and aggregate stock market prices are more sensitive to global risk.4 A one standard-deviation increase in the share of equity held by ETFs is associated with an exposure to global risk that is 2.5 times higher for portfolio equity inflows. For stock market prices, a similar increase is associated with an exposure to global factors that is almost 1.4 times larger.

Of course, many other variables may cause both a larger exposure to global financial stress and a higher ETF share at the country level. We address these potential concerns in three ways to strengthen our interpretation of the results:

- We include a host of control variables related to financial integration, such as the share of local equities held by traditional mutual funds, and the external liabilities at the country level. We find that only the ETF share is significant when interacted with the global risk factor.

- We use a change in Vanguard’s funds and ETFs from the MSCI index to the FTSE index (due to the lower cost of the latter) to identify changes in ETF and mutual fund shares that are less related to specific country conditions. We show that changes in ETF shares (unlike those in mutual fund shares) due to this exogenous event are indeed related to a higher exposure to global financial stress.

- We link our fund- and country-level estimations and show that the dollar flow sensitivities to ETFs relative to that of mutual funds from both estimations are similar.

Overall, these findings support the intuition that the growth of passive benchmarked instruments contributes to cross-market co-movement and capital flow synchronicity with global factors at the expense of local fundamentals , in line with the “benchmark effect” introduced in Levy-Yeyati and Williams (2012) and Raddatz et al. (2017).

These results, combined with the still growing popularity of ETFs around the world, raise challenges for emerging market policy makers to the extent that they deepen the “dilemma not trilemma” concerns for small, open economies that are open to cross-border flows (Rey 2013). More precisely, in the presence of a global financial cycle that hampers the effectiveness of domestic monetary policy in emerging markets, these restrictions could be further amplified by the penetration of ETFs, strengthening the case for mitigating capital controls or macro-prudential policies.

References

Converse, N, E Levy-Yeyati, and T Williams (2022), “How ETFs Amplify the Global Financial Cycle in Emerging Markets,” forthcoming in Review of Financial Studies.

Levy-Yeyati, E, and T Williams (2012), “Emerging Economies in the 2000s: Real Decoupling and Financial Recoupling,” Journal of International Money and Finance 31(8): 2102–2126.

Raddatz, C, S Schmukler, and T Williams (2017), “International Asset Allocation and Capital Flows: The Benchmark Effect,” Journal of International Economics 108: 413-430.

Rey, H (2013), “Dilemma not Trilemma: The Global Financial Cycle and Monetary Policy Independence,” Federal Reserve Bank of Kansas City Economic Policy Symposium.

1 Passive management of mutual or exchange-traded funds (ETFs) refers to the case in which the fund's portfolio mirrors a market benchmark, typically an index or combination of indexes such as the S&P500 or the EMBIG, as opposed to active management that attempts to beat the benchmark through idiosyncratic investment strategies.

2 The period is January 1997 to August 2017 for equities, and from January 2002 to August 2017 for bonds. EPFR data provides good representative coverage of the fund universe: as of mid-2017, they accounted for roughly 66% of total worldwide mutual fund and ETF assets.

3 The results are robust to the use of alternative global and local risk factors.

4 More specifically, we estimated a regression of gross equity liability flows from the balance of payments or the MSCI country returns on our global risk factor and an interaction of the global risk factor with the lagged share of local equities held by ETFs.

Join the Conversation